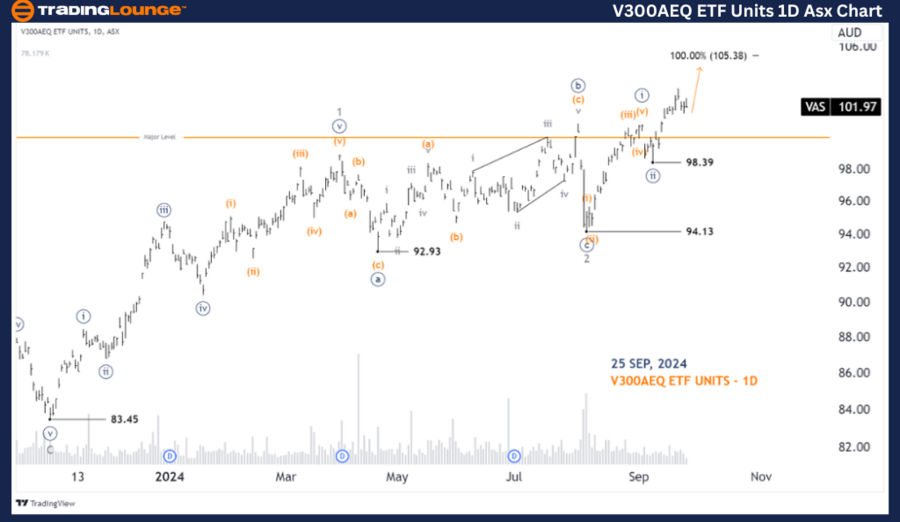

Vanguard Australian Shares Index ETF – TradingLounge (1D Chart)

Greetings! Today's Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) with V300AEQ ETF UNITS – VAS. According to our analysis, VAS may have completed wave 2-grey, and wave 3-grey is currently unfolding, pushing the price higher.

ASX: V300AEQ ETF UNITS – VAS 1D Chart (Semilog Scale) Analysis

VAS Elliott Wave Technical Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 3-grey

Details: From the low of 94.13, wave 3-grey is progressing higher. Within this wave, wave ((iii))-navy is forming, which is expected to continue pushing upwards, aiming for the next target at 105.50 and potentially higher. The price must stay above 98.39 to keep this view valid.

Invalidation point: 98.39

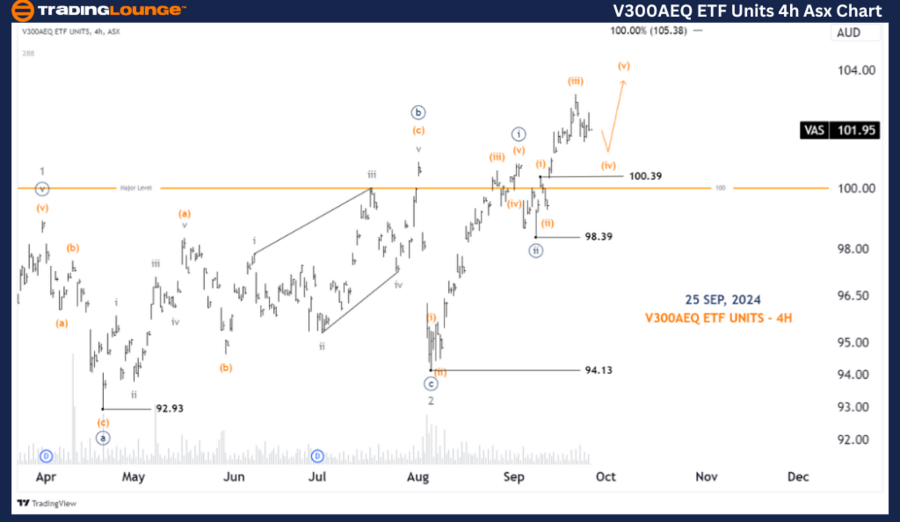

ASX: V300AEQ ETF UNITS – VAS 4-Hour Chart Analysis

Vanguard Australian Shares Index ETF (VAS)

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((iii))-navy

Details: From the low of 98.39, wave ((iii))-navy continues to push higher, further subdividing into wave (iii)-orange. This wave is expected to push slightly higher before wave (iv)-orange unfolds, pushing lower. Ultimately, wave (v)-orange will complete the move, continuing the upward trend. The price must remain above 100.39 to maintain this bullish outlook.

Invalidation point: 100.39

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Brambles Limited - BXB Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our updated Elliott Wave analysis provides a comprehensive overview of the current market trends for ASX: V300AEQ ETF UNITS – VAS. By focusing on key price points, we aim to offer traders a clear understanding of potential validation or invalidation levels. This approach helps increase confidence in our wave count and supports a more informed trading strategy. Combining technical insights with these critical levels, we strive to offer the most objective and professional perspective on market movements.