Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis – Trading Lounge Daily Chart

EURUSD Elliott Wave Technical Analysis

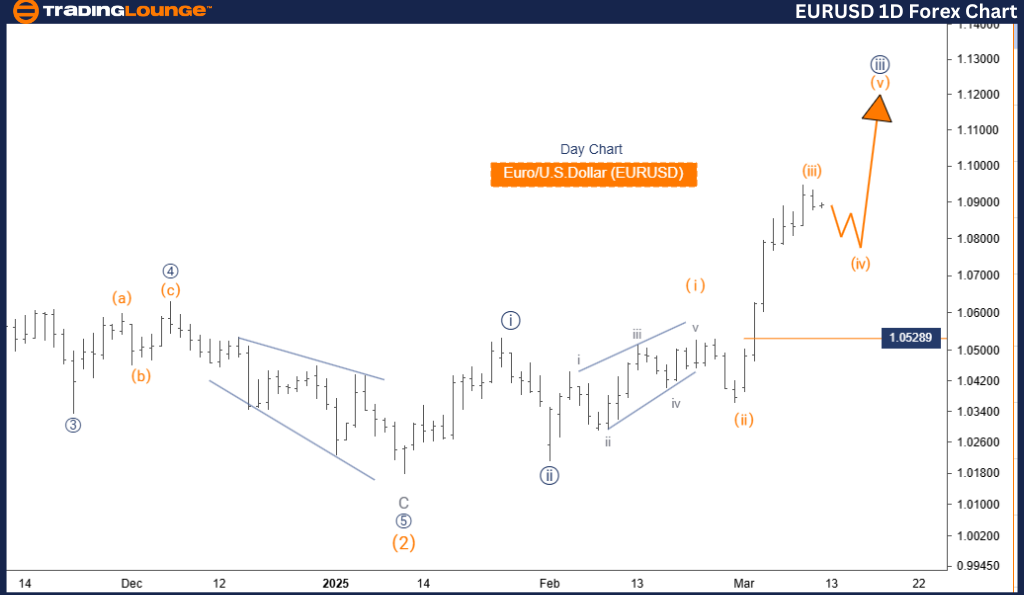

Function: Counter-Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 3

Next Higher Degree Wave: Orange Wave 5

Details: Orange Wave 3 appears completed, with Orange Wave 4 now active.

Wave Invalidation Level: 1.05289

The EURUSD Elliott Wave Analysis on the daily chart provides a structured outlook on the Euro/U.S. Dollar currency pair, evaluating its ongoing trend and potential market direction. The current analysis suggests that EURUSD is in a counter-trend phase, indicating a corrective wave pattern rather than a dominant directional move.

The key wave structure under observation is Orange Wave 4, which forms part of a larger corrective sequence within Navy Blue Wave 3. According to the analysis, Orange Wave 3 has likely concluded, and the market is transitioning into Orange Wave 4. This wave is expected to exhibit sideways price action or retracement before the next impulse wave (Orange Wave 5) emerges.

Key Price Levels to Watch

Orange Wave 5 is projected to follow after Orange Wave 4 completes its corrective structure.

The invalidation level is set at 1.05289—if the price moves beyond this threshold, the current Elliott Wave count becomes invalid, signaling a potential change in market dynamics.

Trading Strategy Insights

Traders should focus on the evolution of Orange Wave 4 and prepare for a possible shift into Orange Wave 5.

The 1.05289 invalidation level must be closely monitored to confirm or reassess the Elliott Wave structure.

Understanding the ongoing corrective phase is crucial for identifying potential entry and exit points within the larger trend cycle.

This analysis provides a comprehensive roadmap for traders, helping them anticipate future price movements and navigate the current corrective environment effectively.

Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 3

Next Higher Degree Wave: Orange Wave 5

Details: Orange Wave 3 appears completed, with Orange Wave 4 now active.

Wave Invalidation Level: 1.05289

The EURUSD Elliott Wave Analysis for the 4-hour chart offers a closer look at the short-term market structure of the Euro/U.S. Dollar currency pair. The analysis confirms that EURUSD is in a corrective counter-trend phase, with Orange Wave 4 now in progress after the completion of Orange Wave 3.

This wave structure is positioned within Navy Blue Wave 3, reinforcing its placement in the larger Elliott Wave cycle. As a corrective wave, Orange Wave 4 is expected to bring sideways consolidation or retracement, potentially setting the stage for the next impulse move (Orange Wave 5).

Key Price Levels and Market Outlook

Orange Wave 5 is the next major wave to monitor once Orange Wave 4 concludes.

The invalidation level remains at 1.05289, meaning if the price exceeds this level, the current Elliott Wave structure would be invalidated, signaling a possible shift in market conditions.

Trading Strategy Considerations

Traders should track Orange Wave 4 closely, as it presents potential trade opportunities within the corrective structure.

Monitoring the 1.05289 invalidation level is essential for maintaining an accurate wave count and trade positioning.

Understanding the corrective phase will help traders align their risk management strategies and entry/exit decisions in anticipation of the next bullish or bearish breakout.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

Previous: USDCHF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support