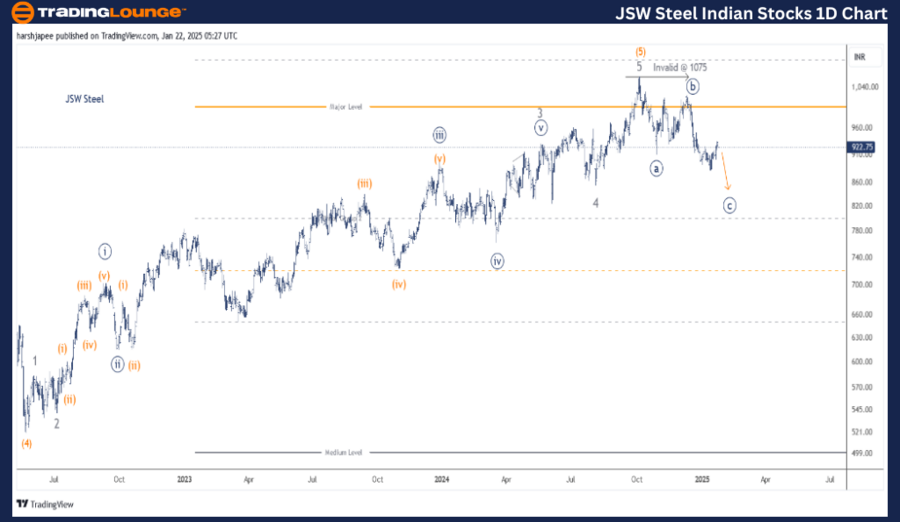

JSW STEEL Stock Elliott Wave Analysis - TradingLounge Day Chart

JSW STEEL Indian Stock (1D Chart) Analysis

JSW STEEL – JSWSTEEL Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree Grey)

Mode: Corrective

Structure: Flat

Position: Minute Wave ((c)) Navy

Details: Minute Wave ((c)) is currently moving lower, facing resistance at 1075, with potential termination around the 850-860 zone.

Invalidation point: 1075

JSW STEEL Daily Chart Technical Analysis and Elliott Wave Projection

The JSW STEEL daily chart signals a major top formation near 1075, identified as Minor Wave 5 within Intermediate Wave (5) Orange. Following this peak, a corrective drop at the Minuette degree is nearing completion or already concluded around the 840-850 zone.

In May 2022, JSW STEEL concluded Intermediate Wave (4) Orange around 520, leading to a five-wave rally at the Minor degree, labeled as 1 through 5, pushing the price to the 1075 high in October 2024. Observing the chart, a broader degree flat pattern could be evolving at the Minor degree level, with the 1075 mark acting as a critical resistance level.

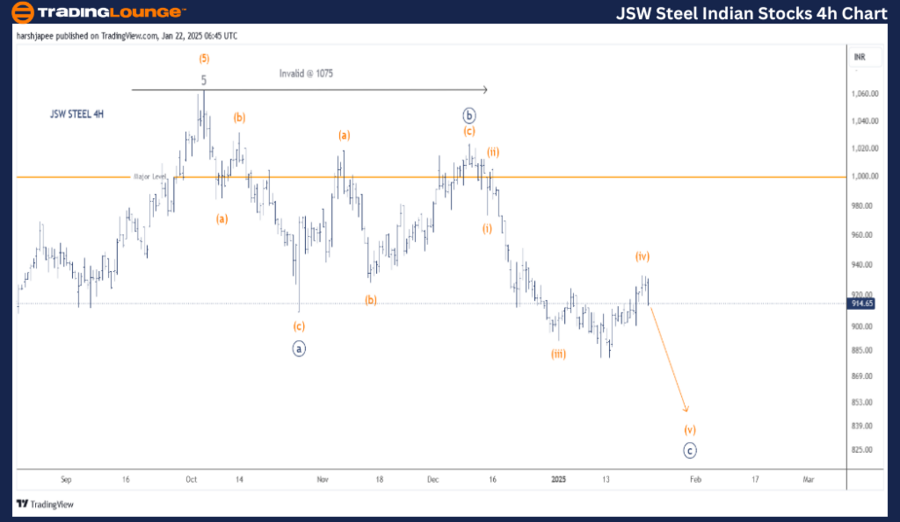

JSW STEEL Stock Elliott Wave Analysis - TradingLounge 4h Chart

JSW STEEL – JSWSTEEL (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree Grey)

Mode: Corrective

Structure: Flat

Position: Minute Wave ((c)) Navy

Details:

Minute Wave ((c)) is currently declining, holding resistance at 1075. The sub-waves indicate an impulsive movement and might have ended Minuette Wave (iv) Orange around 930, with a potential termination expected within the 850-860 range.

Invalidation point: 1075

JSW STEEL 4H Chart Technical Analysis and Elliott Wave Scenarios

The JSW STEEL 4-hour chart highlights sub-wave action following the 1075 high, marking the termination of Minor Wave 5 of (5). The sequence Minuette (a)-(b)-(c) concluded Wave ((a)) around 910, with Minute Wave ((b)) pushing back to 1020, subdividing into three distinct waves at the Minuette degree.

Currently, Minute Wave ((c)) continues to decline impulsively, with a possible target in the 850-860 zone, before bullish momentum might return. The 854 level, which marks the previous Wave 4 termination, could provide significant support.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASIAN PAINTS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

JSW STEEL is in a downward phase within Minute Wave ((c)), targeting the 850-860 zone, with the 1075 mark serving as the key invalidation point.