ASX: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis – TradingLounge

Greetings,

This Elliott Wave technical update centers on Newmont Corporation (ASX: NEM), listed on the Australian Stock Exchange.

Our wave analysis indicates strong long-term bullish potential for ASX:NEM shares.

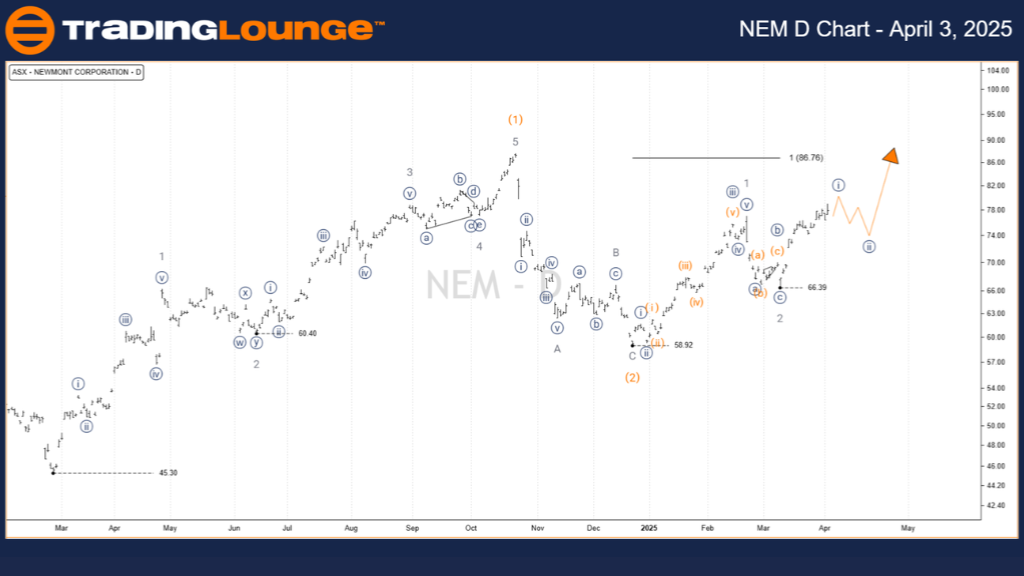

ASX: NEWMONT CORPORATION – NEM 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3-grey of Wave (3)-orange

Analysis Summary:

Wave (2)-orange concluded near the support level of 58.92. The market is now advancing into wave (3)-orange, suggesting higher price momentum. Within this structure, wave 1-grey has finalized, and wave 2-grey appears to have ended as well. The focus now shifts to wave 3-grey, which is targeting a potential move towards the $100.00 resistance zone.

Invalidation Point: 66.39

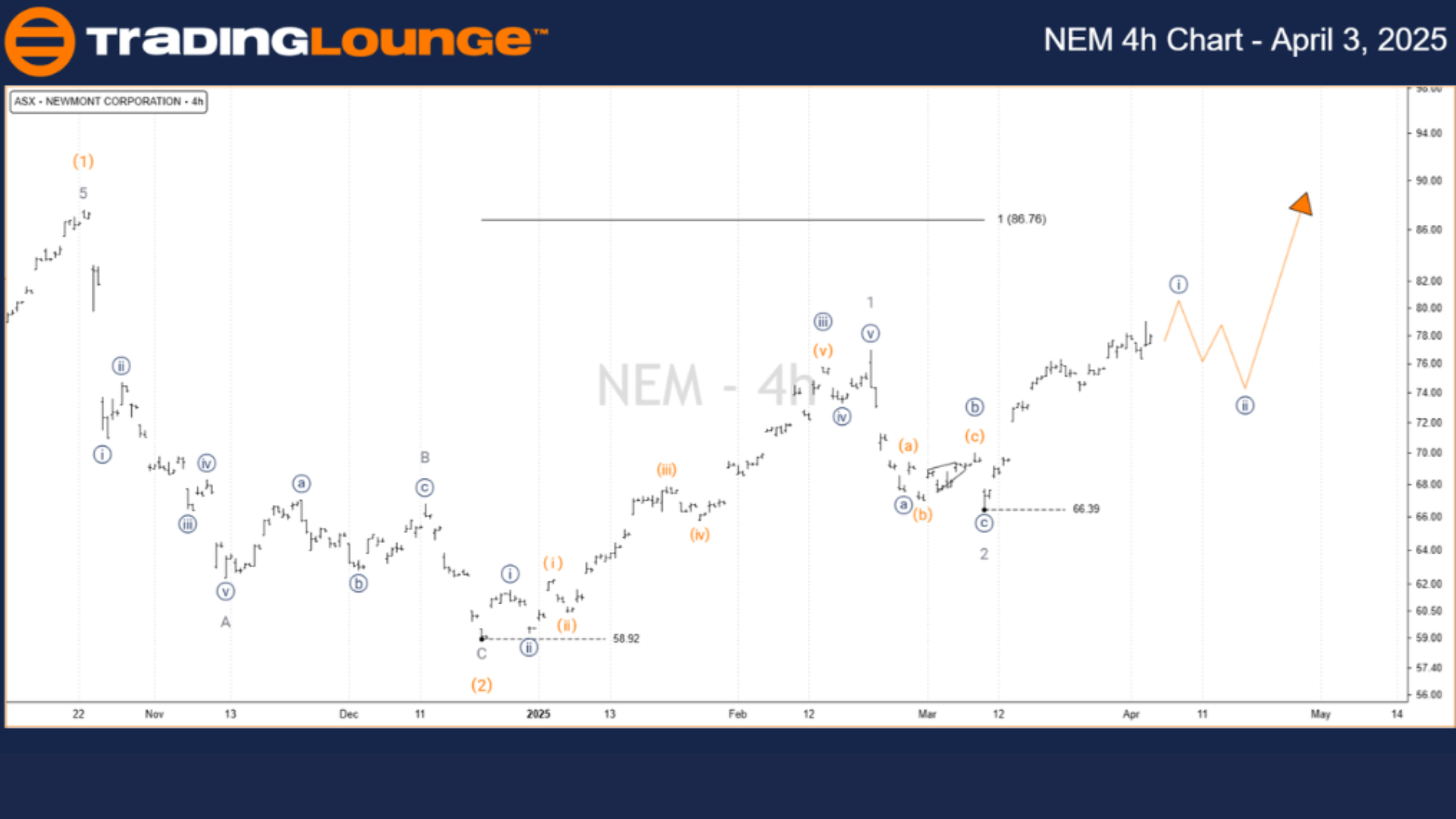

ASX: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

Function: Major Trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((i))-navy of Wave 3-grey

Detailed View:

Starting from 66.39, wave ((i))-navy is nearly complete. The next expectation is a corrective wave ((ii))-navy, likely unfolding in an ABC pattern. Afterward, wave ((iii))-navy is forecast to continue the upward movement in alignment with the larger trend.

Invalidation Point: 66.39

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NAB Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave technical forecast outlines a structured and data-driven approach to analyzing Newmont Corporation (ASX: NEM). By defining key price levels for validation or invalidation, the analysis supports informed trading strategies. The current wave count points to an evolving bullish phase, helping traders recognize potential opportunities in the ongoing trend.