ASX: ASX LIMITED – ASX Elliott Wave Technical Analysis

Introduction

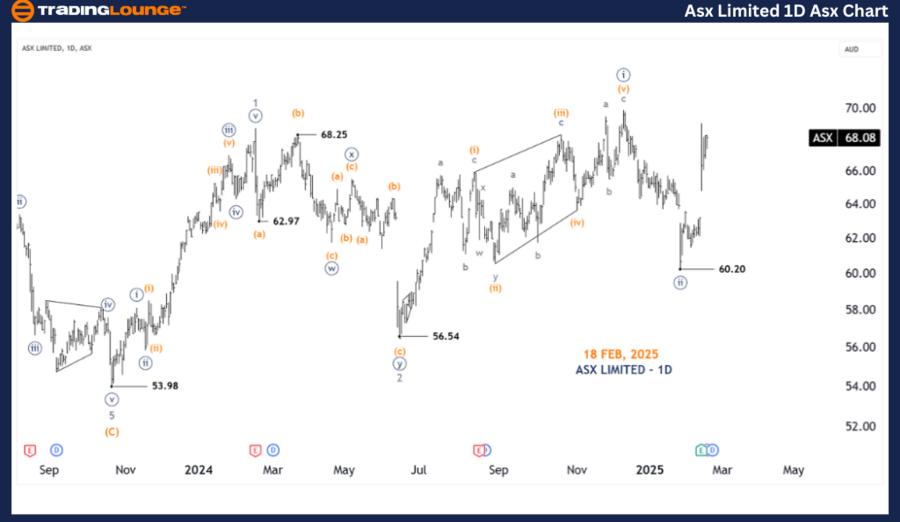

Welcome to today's Elliott Wave analysis on the Australian Stock Exchange (ASX) and ASX LIMITED (ASX: ASX).

Our latest insights indicate strong upside potential within the third wave of the third wave, a scenario that suggests significant growth opportunities. This technical analysis outlines potential trend perspectives and key confirmation points to track market movements effectively.

ASX: ASX LIMITED – ASX Elliott Wave Technical Analysis (1-Day Chart)

1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - Navy of Wave 3 - Grey

Details:

Recent Elliott Wave observations suggest that Wave 3 - Grey is unfolding as an extended wave, with Wave ((iii)) - Navy progressing higher. This aligns with the third wave of the third wave, which historically tends to be the strongest and most dynamic phase in an impulse sequence.

- Key Implication: Significant upside potential remains intact.

- Invalidation Point: 60.20

ASX: ASX LIMITED – ASX Elliott Wave Technical Analysis (4-Hour Chart)

4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave (iv) - Orange of Wave ((iii)) - Navy

Details:

Upon analyzing the 4-hour chart, we see that since the 60.20 level, Wave ((iii)) - Navy has been trending upward. The structure consists of subwaves (i) - Orange to (iv) - Orange, with Wave (iv) - Orange currently in progress and requiring more time for completion.

There is a potential scenario where Wave (iv) - Orange develops into a sideways consolidation pattern, such as a Triangle or Flat correction, before resuming its bullish momentum with Wave (v) - Orange.

- Invalidation Point: 63.59

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Northern Star Resources Ltd (NST) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis delivers a structured market forecast for ASX LIMITED (ASX: ASX), providing short-term trading insights and highlighting key price action zones.

We have identified critical validation and invalidation levels, enhancing the confidence in our Elliott Wave count. Traders and investors can utilize these insights to refine their trading strategies, aligning with objective and professional market perspectives.

By incorporating technical indicators, wave structure, and confirmation points, this analysis presents a data-driven approach to market trends, helping investors make informed decisions.