ASX: Northern Star Resources Ltd (NST) Elliott Wave Technical Analysis

Introduction

Welcome to today’s Elliott Wave analysis of ASX: Northern Star Resources Ltd (NST). This technical breakdown examines the current wave structure, identifying potential price movements and trend shifts within the Australian Stock Exchange (ASX).

Our analysis highlights an upside potential for ASX:NST, but first, we anticipate a pullback with wave ((ii))-navy before a higher move in wave ((iii))-navy. This update includes critical price levels to help traders determine trend confirmations and invalidations.

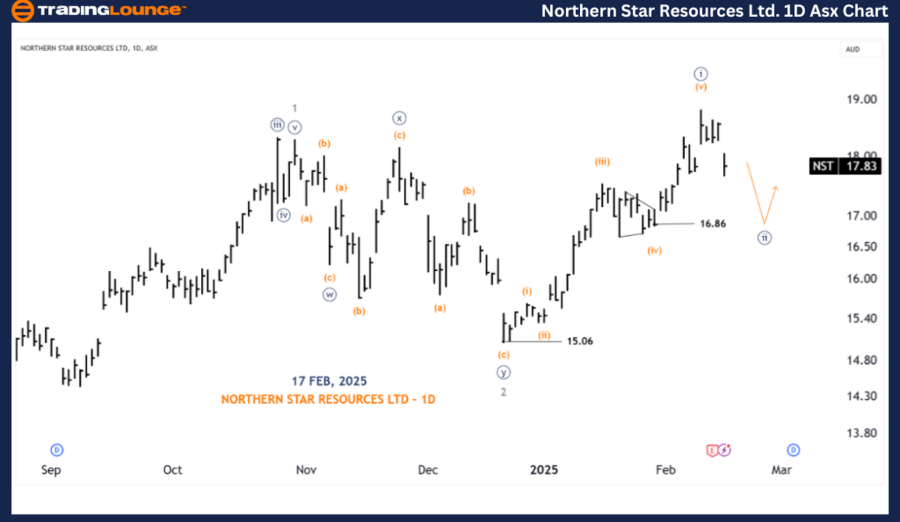

ASX: Northern Star Resources Ltd (NST) Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Market Structure Overview

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((ii))-navy

Analysis

- Wave ((i))-navy recently completed a five-wave impulse formation.

- Wave ((ii))-navy is developing downward, with a target near the 16.86 support level.

- Once wave ((ii))-navy completes, a strong bullish trend in wave ((iii))-navy is expected.

Key Price Levels

- Support Target: 16.86

- Invalidation Point: 15.06 (A break below would invalidate this wave count)

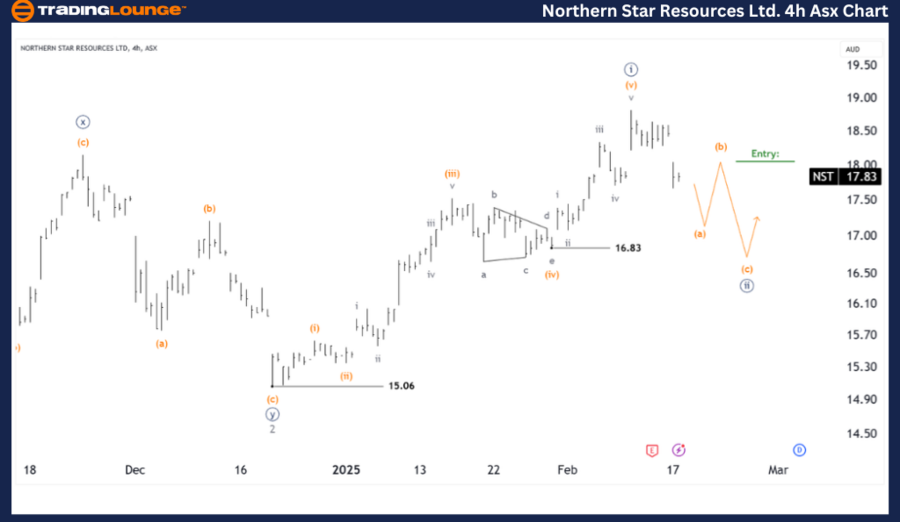

ASX: Northern Star Resources Ltd (NST) Elliott Wave Technical Analysis – 4-Hour Chart

Market Structure Overview

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave (a)-orange of Wave ((ii))-navy

Analysis

- Wave ((ii))-navy has not yet reached its target at 16.83, suggesting further short-term downside.

- The market may continue declining in an ABC correction pattern before reversing.

- A strategic entry opportunity could arise once Wave (b)-orange is completed, presenting a high-quality long trade setup.

Key Price Levels

- Support Target: 16.83

- Invalidation Point: 15.06

- Key Level: Completion of Wave (b)-orange

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis of ASX: Northern Star Resources Ltd (NST) provides insights into potential price movements and trading opportunities. By pinpointing key price levels, we enhance the accuracy of our forecast and strengthen trading strategies.

Traders should monitor the completion of Wave (ii)-navy as it may signal the next bullish wave (iii)-navy. Our objective approach ensures a professional outlook, helping traders make informed market decisions.