Cocoa Commodity Elliott Wave Technical Analysis

After reaching an all-time high of 11,722 in April 2024, Cocoa prices have entered a corrective phase, remaining in a consolidation period. Since May 2024, Cocoa has traded primarily below the 10,000 mark, indicating that the ongoing bearish correction could extend further. The current corrective cycle is expected to continue below the August 2024 low, potentially dropping toward the 5,000 level or lower before resuming the long-term bullish trend.

Cocoa Commodity Daily Chart Analysis

On the daily chart, a double zigzag corrective pattern is emerging from the April high. The first leg of the correction, wave W, ended on August 8th, with the current upward movement representing wave X. Once wave X completes, wave Y is anticipated to follow, which could push prices down toward the 5,000 level or even lower. Unless Cocoa prices see a significant rebound near the 11,000 level, the downside scenario remains the most likely, suggesting the correction is not yet complete.

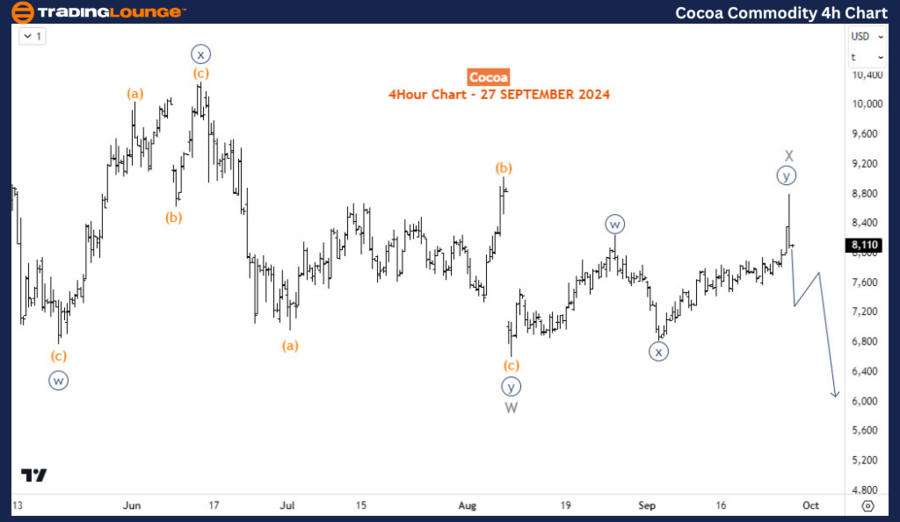

Cocoa Commodity H4 Chart Analysis

In the H4 chart, wave X appears to have completed its own double zigzag pattern. As prices approach the wave x (circled) low at 6,850, the probability of wave Y commencing increases. A break below this level would likely confirm the start of wave Y, followed by a breach of the 6,600 level, where wave W previously ended.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver (XAGUSD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Cocoa's corrective phase seems far from over, with the potential for further declines toward 5,000 or below. The market remains in a larger bearish cycle that started after the April 2024 peak. While a strong rebound could alter the outlook, the price action indicates the corrective structure will likely continue. A break below 6,850 would be a key signal confirming the start of wave Y, accelerating the move toward completing this corrective phase.