Silver Elliott Wave Technical Analysis

Silver surpassed the August 26, 2024 high, continuing its recovery that began on August 6. The commodity is likely to challenge the May 20 high, setting up a fresh yearly high. 2024 has been a dynamic year, with Silver rising from around $24, achieving nearly a 40% gain since January. The strategy of buying dips remains the most effective approach for traders.

Silver (XAGUSD) Commodity Daily Chart Analysis

Silver initiated an impulse wave sequence on January 22, or at least a long-term 2-swing bounce. Wave A or 1 (circled) was completed at $32.5 on May 20, 2024, after the completion of an impulse wave structure. Following that, a pullback in a double zigzag structure completed wave B or 2 (circled) at $26.5 on August 6, 2024. From the $26.5 level, wave C or 3 (circled) began, which is expected to evolve into a 5-wave structure. Waves (1) and (2) were completed in late August and early September, respectively. Currently, the price is in wave (3), which is projected to extend to around $34 (a new 2024 high) or higher, before the next pullback in wave (4). The long-term target range is $37 to $42. Given this potential, traders should consider buying during the pullbacks.

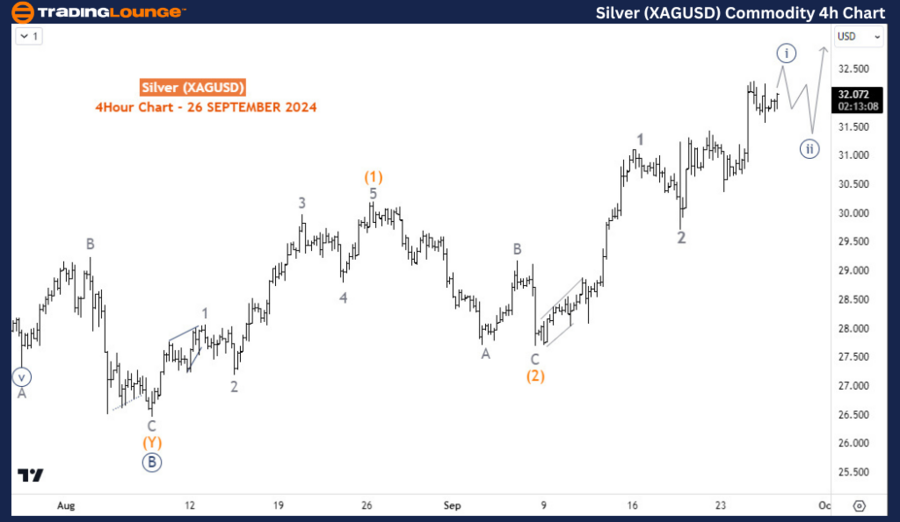

Silver (XAGUSD) Commodity 4-Hour Chart Analysis

The H4 chart reveals the sub-waves of wave (3). Waves 1 and 2 of (3) have been completed, and the price is now advancing in wave 3. At a lower degree, the commodity appears to be in an impulse structure for wave i (circled) of 3, which is likely to experience a pullback in wave ii (circled) before continuing its upward trend. Traders should look for fresh buying opportunities during waves ii & iv (circled) of 3 and also during the wave 4 pullback in both the short and medium term.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Copper Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support