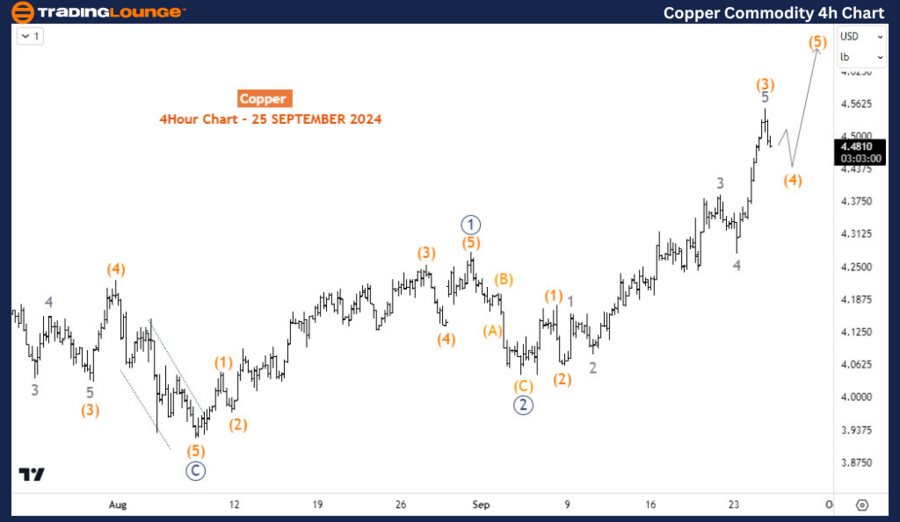

Copper Commodity Elliott Wave Technical Analysis

Copper has seen a significant rise since its August 7th low, posting gains of over 14%. The commodity is positioned for more upward movement, with the possibility of reaching the 4.7 resistance level before a potential pullback.

Copper Commodity Long-Term Bullish Trend in Copper

Copper has been in a long-term uptrend since March 2020. During this time, a diagonal pattern appears to be forming, with waves (I), (II), and (III) of the supercycle degree completing in March 2022, July 2022, and May 2024, respectively. Afterward, wave (IV) began in May 2024 and found support in August 2024. Two scenarios could play out for wave (IV). Either it has concluded as a zigzag formation, or it may extend into a double zigzag if the current rally fails to exceed the May 2024 high.

If the ongoing bounce from August 2024 develops as an impulsive wave, this would signal the completion of wave (IV) and the start of wave (V). On the other hand, if this bounce forms as a corrective pattern, wave (IV) could extend further downward. The critical level to monitor is 4.62. A break above this level would confirm the continuation of the bullish wave (V). If the rally falls short of breaking 4.62, the probability of further downside increases, favoring an extended wave (IV). However, the overall trend remains bullish until a clear reversal signals otherwise.

Copper Commodity Key Levels on the H4 Chart

On the H4 timeframe, Copper is experiencing a dip in wave (4) of the primary degree wave 3 (circled). This pullback is expected to find support between the 4.43 and 4.36 levels. Once support is confirmed, wave (5) should drive Copper higher, targeting the 4.62 to 4.7 range.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WTI Crudeoil Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Copper continues to maintain its long-term bullish trend, with the current rally determining whether wave (IV) has concluded or if another downward leg is necessary. Traders should closely watch for a break above 4.62, as this would confirm the next major upside movement.