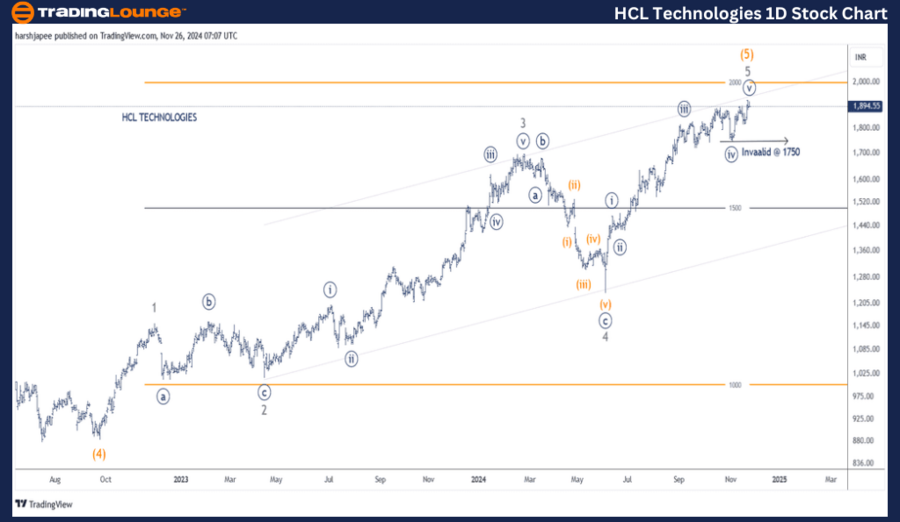

HCL TECHNOLOGIES – HCLTECH Elliott Wave Analysis (1D Chart)

HCL TECHNOLOGIES Day Chart Analysis

HCLTECH Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Navy

Details: Minute Wave ((v)) is progressing higher within Minor Wave 5 of Intermediate Wave (5) Orange, targeting levels above 1750.

Invalidation Point: 1750

HCL TECHNOLOGIES Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart for HCL Technologies suggests the larger-degree uptrend could be nearing its completion, currently at the 1930 mark. Intermediate Wave (5) Orange appears either complete or approaching completion. A break below 1750 would indicate a possible trend reversal.

- Earlier, the stock dropped to 885 lows during Intermediate Wave (4) in September 2022, mirroring the bottoming patterns seen across global tech stocks during that period.

- Since that low, a clear five-wave rally has formed, with the stock peaking at 1930.

- Minor Wave 3 showed an extension, while Minor Wave 4 unfolded as a Flat (3-3-5) pattern.

If the current structure remains valid, a downward movement could be on the horizon. The 1750 level for Minute Wave ((iv)) is critical for bulls to maintain control.

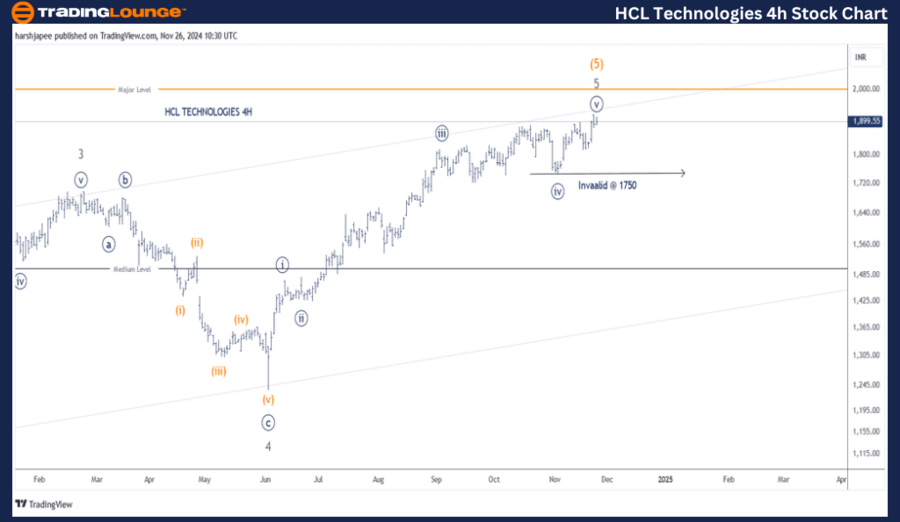

HCL TECHNOLOGIES – HCLTECH (4H Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Navy

Details: Minute Wave ((v)) continues to rise within Minor Wave 5 of Intermediate Wave (5) Orange.

Invalidation Point: 1750

HCL TECHNOLOGIES 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4-hour chart for HCL Technologies offers a detailed view of the subwaves following the completion of Minor Wave 3, which peaked around 1695 in February 2024. Minor Wave 4 subsequently unfolded as a Flat (3-3-5) structure, ending near the 1240 level.

- Minor Wave 5 has since taken shape as an impulse, driving the price to break past 1930, with Minute Wave ((v)) still progressing.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AXIS BANK LTD – AXISBANK Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

HCL Technologies is advancing higher within Minute Wave ((v)) of Minor Wave 5, maintaining bullish momentum as long as the price stays above the 1750 invalidation level.