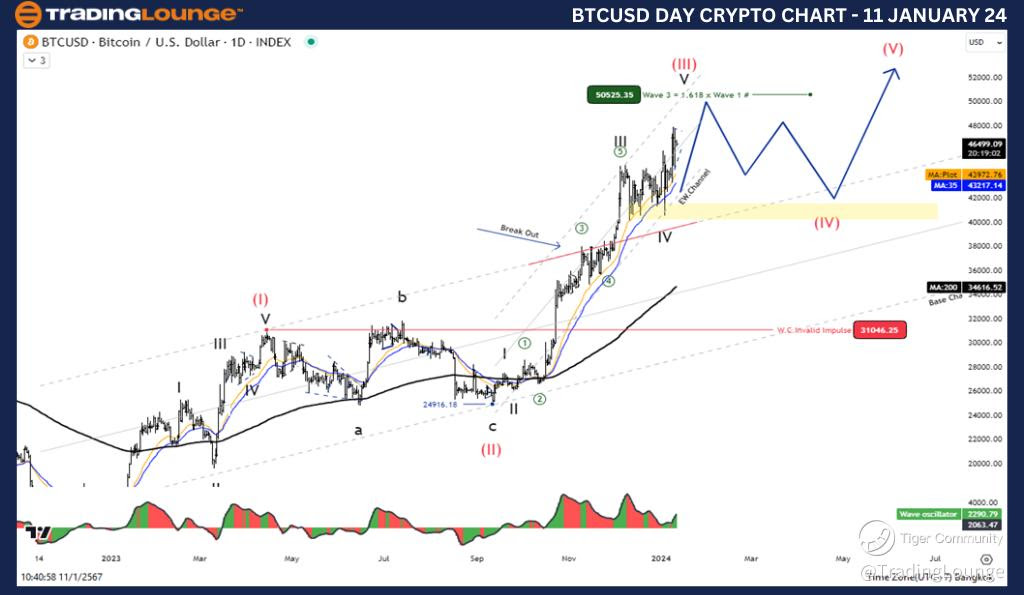

Elliott Wave Analysis TradingLounge Daily Chart, 11 January 24,

Bitcoin / U.S. dollar(BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave (III)

Direction Next higher Degrees: wave ((I))

Wave Cancel invalid level: 31046.25

Details: Wave (III) is equal to 161.8% of Wave (I) at 50525.35

Bitcoin / U.S. dollar(BTCUSD)Trading Strategy: Bitcoin 1 is still in an uptrend. And there is a chance to test the level 50525.35, but even so, it is an increase in wave 5, which is the last wave in a sequence of five waves. that warns before corrections or trend changes Be careful of corrections.

Bitcoin / U.S. dollar(BTCUSD)Technical Indicators: The price is Above the MA200 indicating an uptrend, Wave Oscillators a bullish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source : Tradinglounge.com get trial here!

Elliott Wave Analysis TradingLounge 4H Chart, 11 January 24,

Bitcoin / U.S. dollar(BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave (III)

Direction Next higher Degrees: wave ((I))

Wave Cancel invalid level: 31046.25

Details: Wave (III) is equal to 161.8% of Wave (I) at 50525.35

Bitcoin / U.S. dollar(BTCUSD)Trading Strategy: Bitcoin 1 is still in an uptrend. And there is a chance to test the level 50525.35, but even so, it is an increase in wave 5, which is the last wave in a sequence of five waves. that warns before corrections or trend changes Be careful of corrections

Bitcoin / U.S. dollar(BTCUSD)Technical Indicators: The price is Above the MA200 indicating an uptrend, Wave Oscillators a bullish Momentum.