TradingLounge WTI Crudeoil Commodity Elliott Wave Analysis

WTI Crudeoil Elliott Wave Technical Analysis

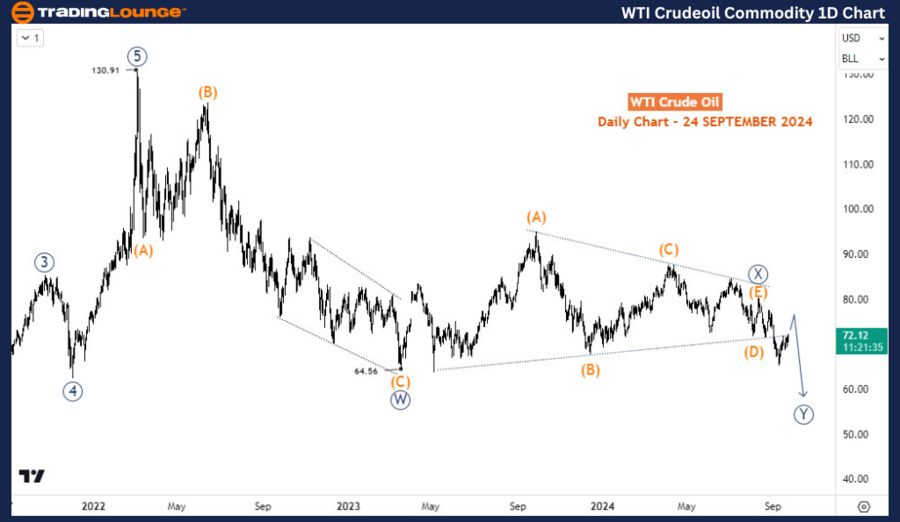

As we near the end of September 2024, WTI oil prices are experiencing a retracement following the sell-off that began in late June. While this retracement might continue, the overall long-term bearish cycle is expected to push prices below the lows of May 2023, with the potential to revisit levels last seen in mid-2021.

From a broader perspective, WTI is in a bearish corrective phase. After rebounding from the COVID-19 downturn in April 2020, WTI prices surged for 23 months, culminating in an impulse wave peak in March 2022, when prices exceeded $130. Since then, WTI has entered a bearish phase, which we now classify as a corrective cycle.

WTI Crudeoil Commodity Daily Chart Analysis

A closer look at the daily chart reveals that the corrective cycle since March 2022 is developing into a double zigzag pattern. After completing a zigzag at $64.50 in March 2023, prices have moved sideways for over 17 months, indicating the possibility of a larger double zigzag formation that could drive prices below $50 in the upcoming months.

The first leg of this pattern completed a zigzag structure, labeled wave W (circled) in the primary degree. The second leg formed a triangle structure, identified as wave X (circled). In early September, prices broke out of the triangle, signaling the start of the third leg—wave Y (circled). The current bounce appears to be a minor correction within the larger wave Y (circled) decline.

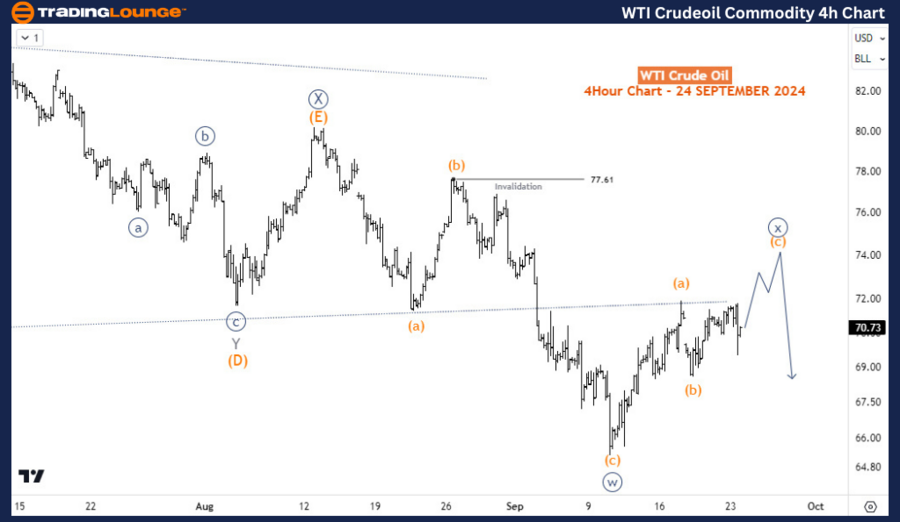

WTI Crudeoil Commodity 4-hour Chart Analysis

On the H4 chart, wave Y (circled) began after the high on August 13, 2024, at $80.16, where wave X (circled) concluded with a triangle pattern. The ongoing bounce could extend toward the $74-$76 range to complete wave x (circled) of W, a sub-wave of Y (circled). As long as this bounce remains below $80.16, the long-term outlook for WTI continues to favor further downside movement.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Coffee Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support