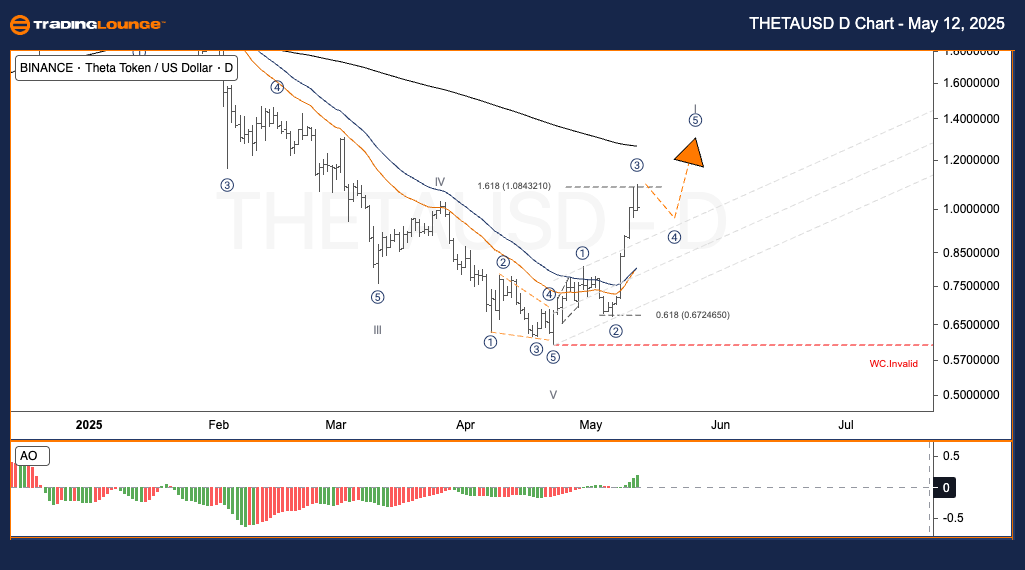

Theta Token / U.S. Dollar (THETAUSD) Elliott Wave Analysis – TradingLounge Daily Chart

THETAUSD Elliott Wave Technical Analysis

Function: Trend-following

Mode: Motive

Structure: Impulse

Wave Position: Wave 3

Next Higher Degree Direction: Not specified

Wave Cancel Invalid Level: Not defined

Theta Token (THETAUSD) Daily Elliott Wave Trading Strategy

As of early April, THETAUSD established key support around $0.67, aligning with the Fibonacci 61.8% retracement. The market then surged higher in wave (3). Recently, THETAUSD broke above the 1.618 Fibonacci extension of wave (1) at $1.084, implying wave (3) is approaching its peak. A corrective move in wave (4) could follow, potentially paving the way for wave (5) to drive the price further. Medium-term projections point above $1.20.

Trading Strategies

✅ Short-term swing traders:

Monitor for the wave (4) correction to finalize, then prepare for a long position in wave (5).

🟥 Critical Alert:

A price drop beneath the red support zone (wave count invalid level) would invalidate the current wave structure.

Theta Token / U.S. Dollar (THETAUSD) Elliott Wave Analysis – TradingLounge H4 Chart

THETAUSD Elliott Wave Technical Analysis

Function: Trend-following

Mode: Motive

Structure: Impulse

Wave Position: Wave 3

Next Higher Degree Direction: Not specified

Wave Cancel Invalid Level: Not defined

Theta Token (THETAUSD) 4-Hour Elliott Wave Trading Strategy

Mirroring the daily timeframe, THETAUSD on the H4 chart continues its strong uptrend from the $0.67 support base. After breaking above the 1.618 Fibonacci extension at $1.084, it indicates that wave (3) is near its endpoint. A temporary pullback in wave (4) may offer a new buying opportunity as the asset gears up for wave (5). Targets remain above $1.20 in the short to mid-term.

Trading Strategies

✅ Short-term swing traders:

Watch closely for wave (4) to complete. This phase could offer a strategic entry for wave (5).

🟥 Warning:

A break below the red invalidation level will negate the wave count and require a reevaluation.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DOTUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support