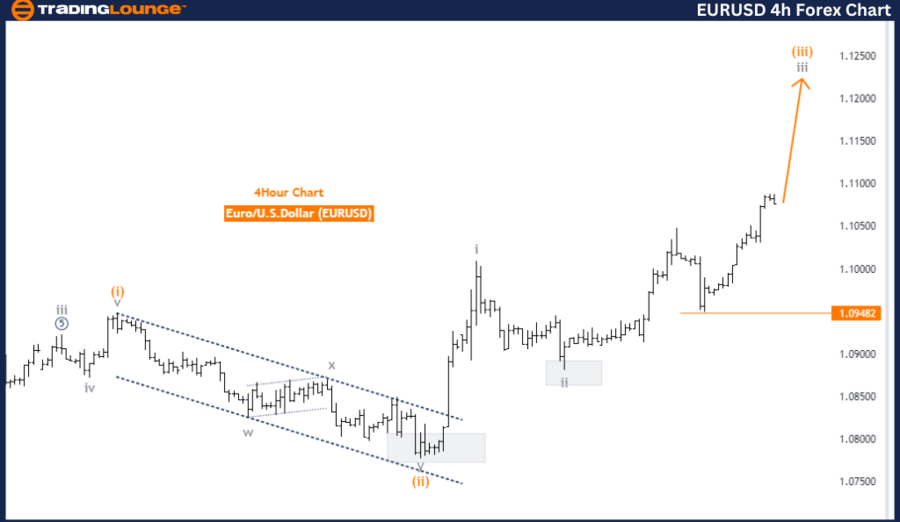

EURUSD Elliott Wave Analysis - Trading Lounge Day Chart

Euro/U.S. Dollar (EURUSD) Day Chart Analysis

EURUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction Next Lower Degrees: Orange Wave 4

Details: Orange Wave 2 appears completed, with Orange Wave 3 now unfolding.

Wave Cancel Invalid Level: 1.09482

The EURUSD daily chart, analyzed through Elliott Wave theory, reveals a strong bullish trend. The key pattern identified is Orange Wave 3, an impulsive wave signaling a significant upward movement. This wave is part of a larger structure within Navy Blue Wave 3, reinforcing the strong bullish momentum.

Before Orange Wave 3 began, Orange Wave 2 was in play, typically acting as a corrective wave. Wave 2 generally represents a retracement or temporary decline following Wave 1’s rise. The completion of Orange Wave 2 suggests that the market has resumed its upward trend, leading to the current development of Orange Wave 3.

With Orange Wave 2 complete, Orange Wave 3 is expected to continue pushing the market higher. After Orange Wave 3 concludes, the market will likely enter Orange Wave 4, indicating the next corrective phase.

A critical element in this analysis is the wave cancel invalid level, set at 1.09482. A drop below this level would invalidate the current Elliott Wave count, potentially signaling a shift in market direction or requiring a reevaluation of the wave structure.

Summary: The EURUSD daily chart shows a strong impulsive upward trend, with Orange Wave 3 in progress after Orange Wave 2's completion. The market is expected to continue its upward movement, with 1.09482 as a crucial level to watch for potential changes in the Elliott Wave analysis.

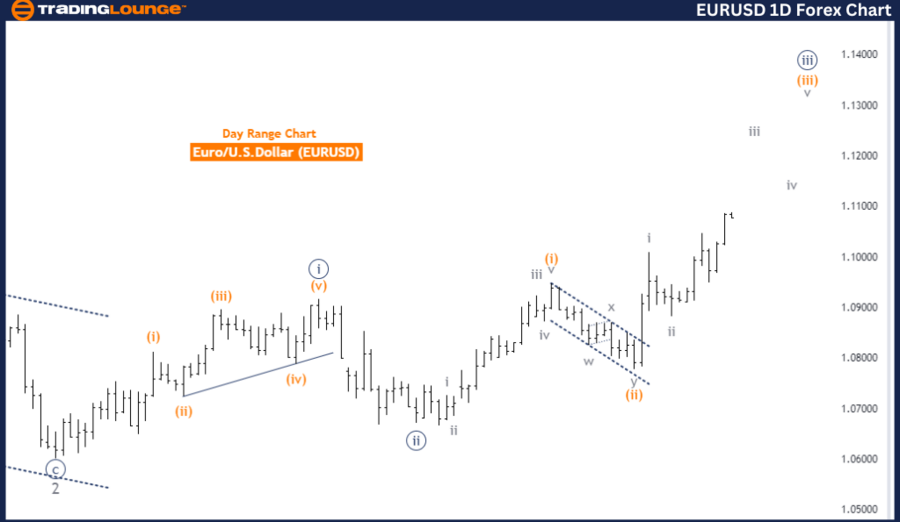

EURUSD Elliott Wave Analysis - Trading Lounge 4-Hour Chart

Euro/U.S. Dollar (EURUSD) 4-Hour Chart Analysis

EURUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 3

Direction Next Lower Degrees: Gray Wave 4

Details: Gray Wave 2 appears completed, with Gray Wave 3 now unfolding.

Wave Cancel Invalid Level: 1.09482

The EURUSD 4-hour chart, analyzed using Elliott Wave theory, indicates a strong upward trend. The primary structure identified is Gray Wave 3, an impulsive wave that signifies a sustained upward movement. This wave is part of a larger structure within Orange Wave 3, reinforcing the market’s bullish momentum.

Before Gray Wave 3, Gray Wave 2 completed its corrective phase. In Elliott Wave theory, Wave 2 typically indicates a retracement following the initial advance of Wave 1. The completion of Gray Wave 2 suggests that the market has resumed its upward trajectory with Gray Wave 3 now unfolding.

Gray Wave 3 is expected to continue driving the market higher. After Gray Wave 3 concludes, the market is likely to transition into Gray Wave 4, marking the next corrective phase.

The wave cancel invalid level, set at 1.09482, is crucial in this analysis. A breach below this level would invalidate the current wave count, potentially indicating a change in market direction or necessitating a reassessment of the wave structure.

Summary: The EURUSD 4-hour chart shows an impulsive upward trend, with Gray Wave 3 unfolding after Gray Wave 2's completion. The market is expected to continue its upward momentum, with 1.09482 as a key level to monitor for any potential changes in the wave analysis.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NZDUSD Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support