Cocoa Commodity Elliott Wave Technical Analysis

After reaching a record high in December 2024, cocoa prices have been undergoing a corrective decline against the October 2024 low. The pullback completed a 5-wave structure lower from the 12931 record high and is now retracing the decline with higher prices. Based on Elliott Wave analysis, another 5-wave decline is anticipated following the current bounce, unless cocoa prices manage to surpass the previous record high.

Cocoa Elliott Wave Analysis - Daily Chart

Cocoa maintains a strong long-term bullish trend starting from the December 2000 low. From the $707 low in December 2000, cocoa prices completed a 5-wave impulsive structure, peaking at $3775 in February 2011. A corrective second wave followed, ending in April 2017 at $1756. The third wave began in April 2017 and remains in progress, unfolding as an impulse wave pattern. So far, we can identify a 3-swing rally from the December 2000 bullish cycle, suggesting the potential development of either a 3-wave or a 5-wave cycle. Given the origin from an all-time low, probabilities favor a full 5-wave impulsive sequence. Therefore, cocoa prices are currently advancing within the ongoing third wave, yet to complete.

Further analysis suggests that cocoa is in the third sub-wave of the ongoing third wave. The daily Elliott Wave chart shows that the recent record high marks the end of wave III of (III) of ((III)). The subsequent pullback could evolve into a more complex double correction. Accordingly, the April 2025 low signifies the completion of an impulse structure for wave ((A)) of IV, with the current rebound representing wave ((B)) within the wave IV correction.

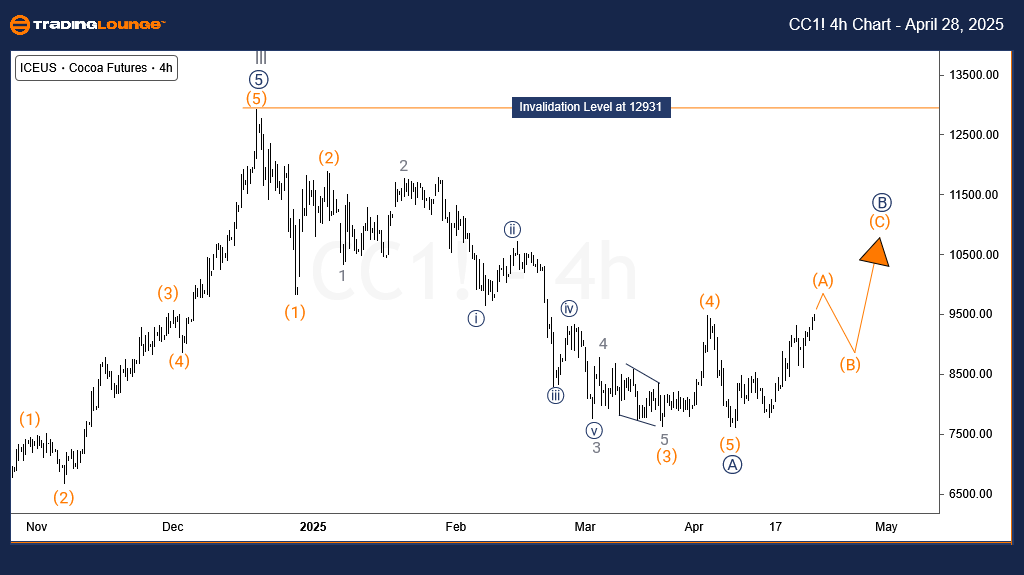

Cocoa Elliott Wave Analysis - H4 Chart

The 4-hour chart shows a bullish impulse structure developing from the April 2025 low for wave (A) of ((B)). As wave ((B)) extends higher, cocoa prices are expected to stay below the 12931 record high before sellers initiate wave ((C)) downward, completing the larger wave IV pullback. The long-term bullish trend is expected to resume after wave IV finishes. However, if the ongoing rally breaks above 12931, it would confirm that wave IV has already concluded at the April 2025 low, opening the path for further bullish extension in cocoa prices.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: WTI Crude Oil Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support