WTI Crude Oil Elliott Wave Analysis – Bearish Outlook Below $72

WTI Elliott Wave Forecast

WTI crude oil is currently undergoing an Elliott Wave corrective phase after a steep decline that pushed prices below $60 for the first time since April 2021. Despite a short-term recovery, the upside is expected to remain capped under $72. A further decline toward $50 is anticipated, continuing the bearish cycle that began in March 2022.

WTI Daily Elliott Wave Chart Analysis

Since March 2022, WTI has been in a sustained downtrend, following a completed 5-wave impulse that emerged during the post-Covid recovery. In line with Elliott Wave Theory, a corrective 3-wave structure typically follows such a motive phase. This current corrective move is unfolding as a double zigzag pattern, with a projected termination zone near $46, as indicated on the daily chart.

This setup suggests that while WTI may experience interim rallies, the broader trend remains bearish until a bullish impulse wave breaks above $87. The wave ((X))—a primary degree retracement within the larger cycle wave w of supercycle (y)—bottomed below $81 in January 2025. The market is now progressing into wave ((Y)) of w, continuing the correction.

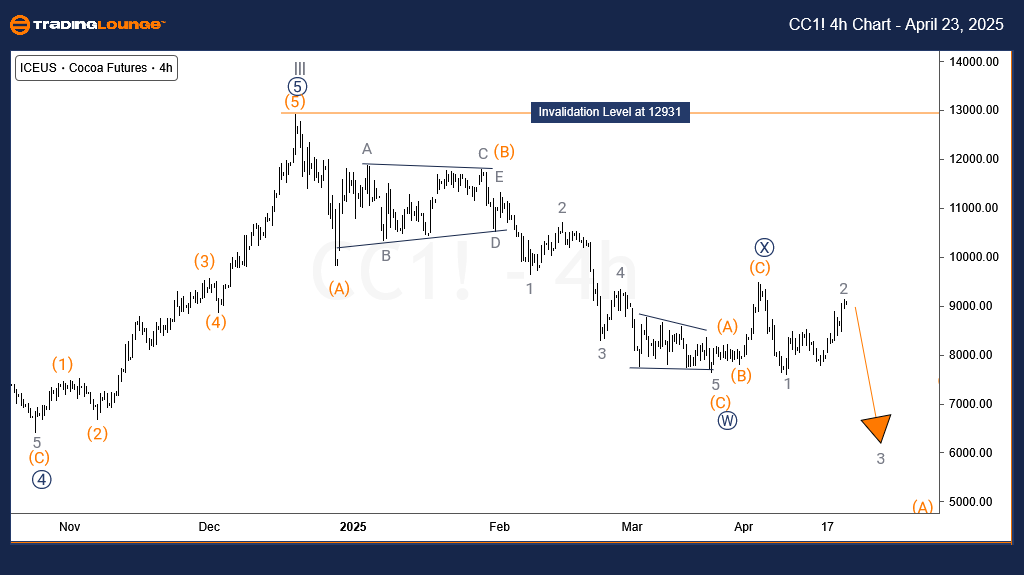

WTI 4-Hour Elliott Wave Chart Analysis

On the 4-hour chart, the decline from the April 2025 high marks wave A (minor degree) of (Y) (intermediate degree) of ((Y)) (primary degree). The current upward movement represents wave B, which retraces the previous drop.

As long as WTI remains below the $72 resistance level, wave C is expected to resume the downtrend, potentially targeting the $50 area. Wave B has already reached a key Fibonacci retracement zone, limiting further upside potential. Therefore, the medium-term WTI Elliott Wave outlook stays bearish.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: Gold Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support