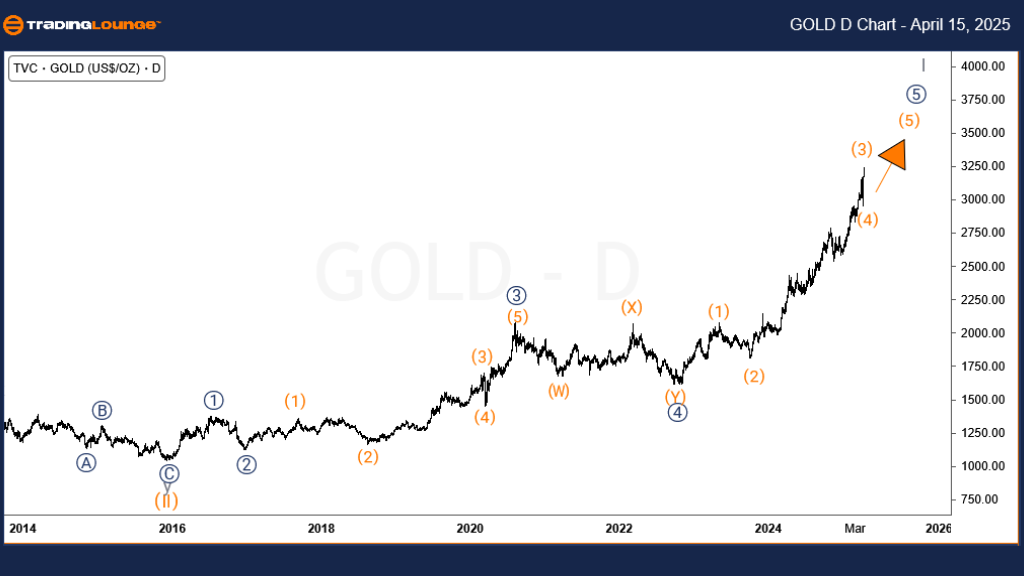

Gold Elliott Wave Analysis – Bullish Momentum to Continue Toward $3200–$3500

Gold prices are hovering near fresh record highs as ongoing global uncertainty—particularly trade tensions between the U.S. and key partners—continues to drive demand for the safe-haven asset. From an Elliott Wave analysis perspective, this sustained rally was forecasted to resume its long-term bullish trend following the completion of a 2-year corrective phase in October 2022. Current projections place the next major upside targets between $3200 and $3500.

Gold Daily Chart Analysis – Elliott Wave Bull Market Structure

Gold remains in a powerful long-term uptrend. The current bullish wave structure follows a significant 2-year corrective pullback from the September 2011 peak, which previously marked the all-time high. After breaking above that high in July 2020, gold has consistently printed new highs on the monthly, weekly, and daily timeframes.

According to Elliott Wave theory, the supercycle wave (II) ended in December 2015, following wave (I)’s peak in September 2011. Since then, wave (III) has advanced sharply. Currently, wave ((5)) of I of (III) is unfolding. The daily chart indicates that wave (4) of ((5)) of I has completed, and wave (5) of ((5)) is underway. However, this final wave of the sequence has yet to conclude, suggesting further upside before a major correction in wave II sets in.

Gold 4-Hour Chart Analysis – Final Impulse Before Pullback

The 4-hour chart highlights the development of wave ((5)), which began from the April 2024 low. This impulse wave structure is now in its terminal phase and could either represent the end of wave (5) of ((5)) of I or the completion of wave 1 of a larger wave (5).

Regardless of the exact structure, the wave count implies that a short-term corrective pullback may soon emerge. Traders are advised to remain patient, monitor for completed pullbacks, and look for buying opportunities aligned with the broader bullish trend.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: Wheat Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support