Wheat Elliott Wave Analysis

Wheat Extends Bearish Momentum, Nearing Critical Multi-Year Support Levels

Wheat continued its broader downtrend in February, reinforcing the long-term bearish structure that has persisted since March 2022. The price action remains under pressure, increasing the likelihood of a break below the July 2024 low and testing price territory not seen since 2020.

Despite ongoing weakness, the downward momentum could be nearing completion, with Elliott Wave patterns suggesting an approaching end to the bearish cycle. This scenario opens the door for a corrective rally to unfold in the near future.

Once the downward sequence concludes, wheat prices are expected to initiate a multi-month bullish retracement, recovering part of the extended downtrend.

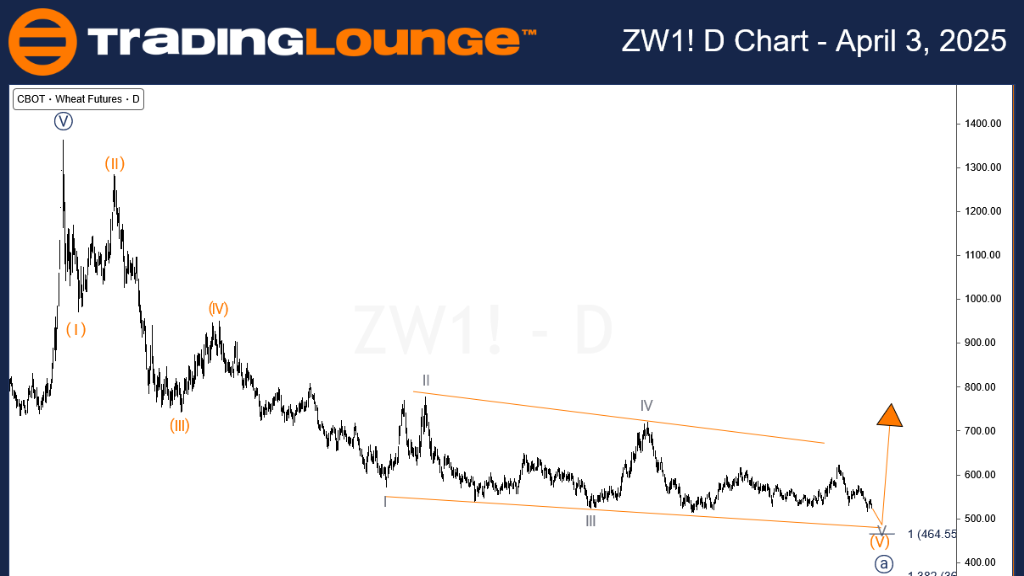

Daily Chart Analysis: Ending Diagonal Structure Approaching Final Phase

In the daily chart analysis, wheat’s decline since March 2022 has followed a clear impulsive pattern, where wave ((A)) has evolved through a five-wave move. The final component, wave (V), is forming an ending diagonal—often indicative of a terminal price structure and a possible trend reversal.

Wave V of (V), which started in May 2024, now appears to be in its final phase. As is typical in diagonal patterns, a final drop is likely before the broader correction begins. The $500 support level represents a key price zone to watch for a potential low.

If price action confirms structural support around this area, traders can look for signs of a trend reversal and a significant corrective bounce to follow.

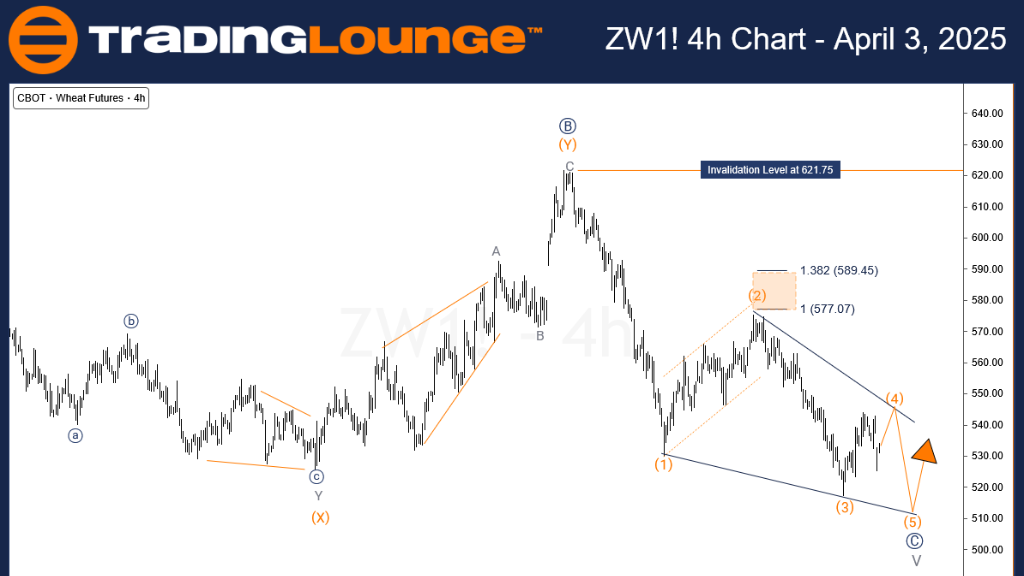

H4 Chart Analysis: Completion of Final Wave V Underway

In the H4 timeframe, wave V of (V) of ((A)) is advancing within an ending diagonal formation. At present, wave (4) of ((C)) of V is unfolding, possibly needing one more short-term push higher before wave (5) drives the market lower. A successful diagonal completion would likely push wheat prices below $500 before any meaningful corrective movement begins.

If, however, the wave structure fails to hold and bearish momentum accelerates, a deeper move under $500 could unfold before bulls step in. Traders should wait for clear structural confirmation before entering long positions or adjusting trade setups.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: Corn Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support