Corn Elliott Wave Analysis

Corn futures remain under pressure, trading below the critical 504 resistance level after finalizing a significant bullish correction that began in August 2024. Current Elliott Wave patterns suggest a potential continuation lower toward the $400 price area. If bearish momentum continues, prices could break beneath the August 2024 low of $360 in a possible impulsive move.

Corn Long-Term and Daily Chart Analysis

Since April 2022, corn prices have followed a long-term bearish trend, breaking key support levels after short-term rallies. A corrective rebound began from the August 2024 low. However, unless this rebound evolves into a complex double correction, the technical outlook supports another leg lower. This could result in a breakdown below the August 2024 low, extending the broader downtrend that started in April 2022.

According to Elliott Wave Theory, corn completed a 5-wave bearish sequence from April 2022, identified as wave (a) of the supercycle. The current recovery represents wave (b) of the same supercycle. After forming a 3-swing corrective structure, corn has turned lower again. The latest decline from February 2025 could conclude a minor 3-swing retracement before rallying higher to complete wave (b), or alternatively, initiate a stronger impulsive sell-off targeting sub-$360 levels for wave (c) of the supercycle.

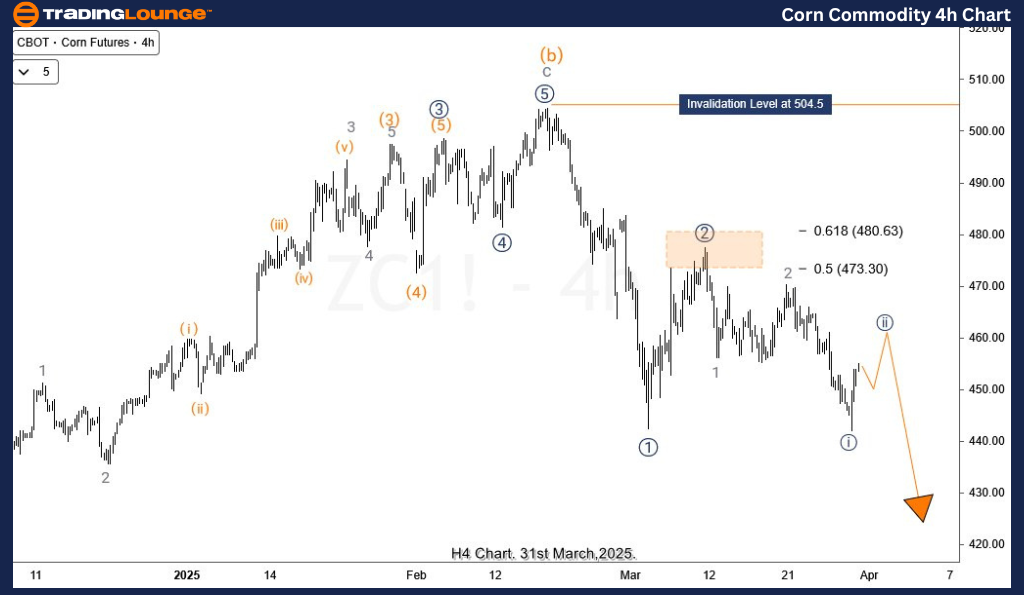

Corn H4 Chart Analysis

The 4-hour chart highlights completed waves ((1)) and ((2)) of the primary degree. The next wave, ((3)), is expected to push prices lower. Notably, a full impulsive wave structure has not yet materialized, leaving room for further downside. Until a defined 5-wave impulse appears, technical traders will monitor for at least a completed 3-swing decline, aiming toward the $420–$400 zone.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: Coffee Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support