Wheat Elliott Wave Analysis – Trading Lounge

Wheat is approaching the terminal phase of its extended bearish trend, which started after the price peaked above $1360 in March 2022. Since that high, a well-defined Elliott Wave impulse pattern has unfolded and is now nearing its end. A bullish reversal or corrective bounce may soon begin, signaling the potential start of a multi-month recovery phase.

Wheat Daily Chart Analysis

The daily chart outlines a continuous bearish impulse structure stemming from the March 2022 high. Waves (I) through (IV) were completed by October 2022. Following that, wave (V) has been developing as a diagonal pattern, extending for more than two and a half years. This suggests wave (V) may be nearing completion, prompting long-term bearish positions to be reconsidered or closed, as a trend reversal may be imminent.

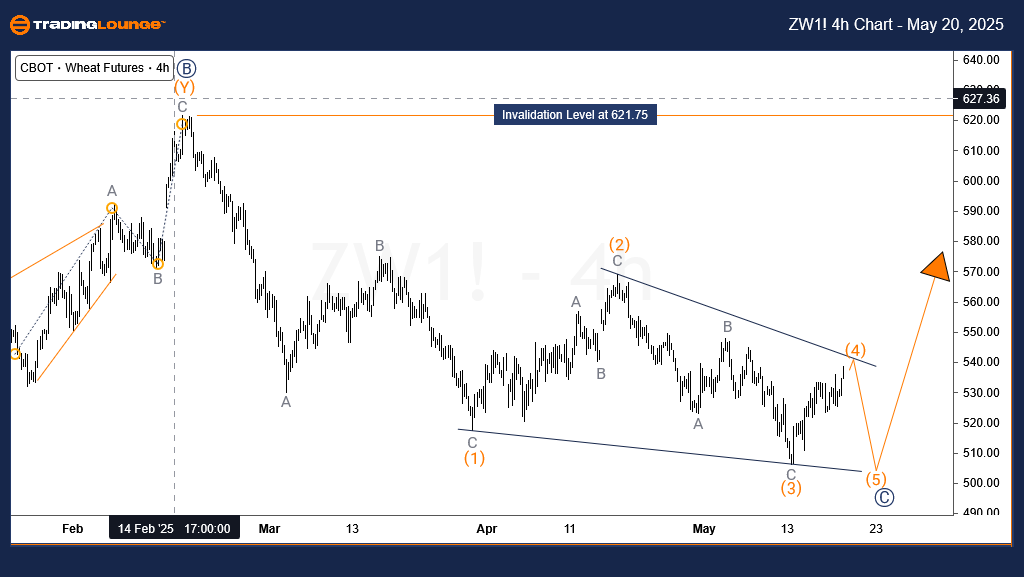

Wheat H4 Chart Analysis

On the 4-hour chart, focus remains on wave V within the broader diagonal formation of wave (V). Wave V has followed a three-part Elliott Wave sequence. Wave ((A)), an impulsive move, developed between May and July 2024. Subsequently, wave ((B)) formed a double zigzag correction from July 2024 to February 2025. Currently, wave ((C)) is unfolding as a diagonal and is in sub-wave (4) of ((C)). One final decline, potentially targeting the $500 level or slightly under, is anticipated to complete wave ((C)) of V. This move would mark the conclusion of the bearish cycle initiated in March 2022 and could pave the way for a sustained upward correction over the coming months.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Silver Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support