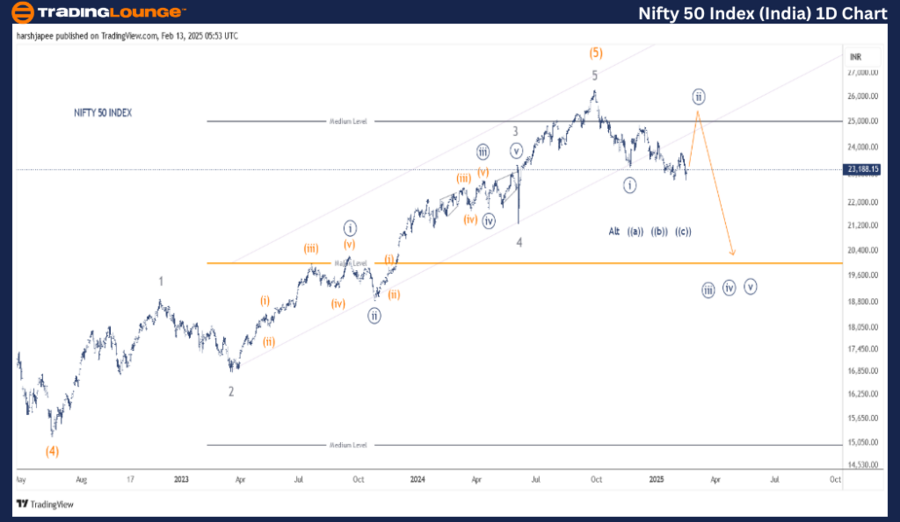

NIFTY 50 INDEX – NIFTY (1D Chart) Elliott Wave Technical Analysis

NIFTY Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Impulse within a larger degree corrective wave

Position: Minute Wave ((ii))

Technical Details:

- Minute Wave ((ii)) appears to be advancing towards the 25,000 level before resuming its downward trajectory.

- The correction is developing as an expanded flat pattern.

- Alternatively, the entire structure from the 26,300 peak might be evolving as a correction at Minute degree.

Invalidation Point: 26,400

NIFTY 50 INDEX Daily Chart Technical Analysis and Elliott Wave Outlook

The NIFTY 50 daily chart suggests that a major peak was formed around 26,300 in September 2024. A highly probable Elliott Wave count indicates that the index has completed Minute Wave ((i)) around 23,267 and is currently unfolding a potential expanded flat corrective wave towards the 25,000-25,100 range.

Previously, the index established Intermediate Wave (4) Orange around the 15,200 lows. Following this, a five-wave impulse structure at Minor degree (labeled 1 through 5) drove prices beyond 26,300, marking the termination of Wave (5).

Since then, bears have maintained control, and a deep corrective phase appears to be developing against the 26,300 peak.

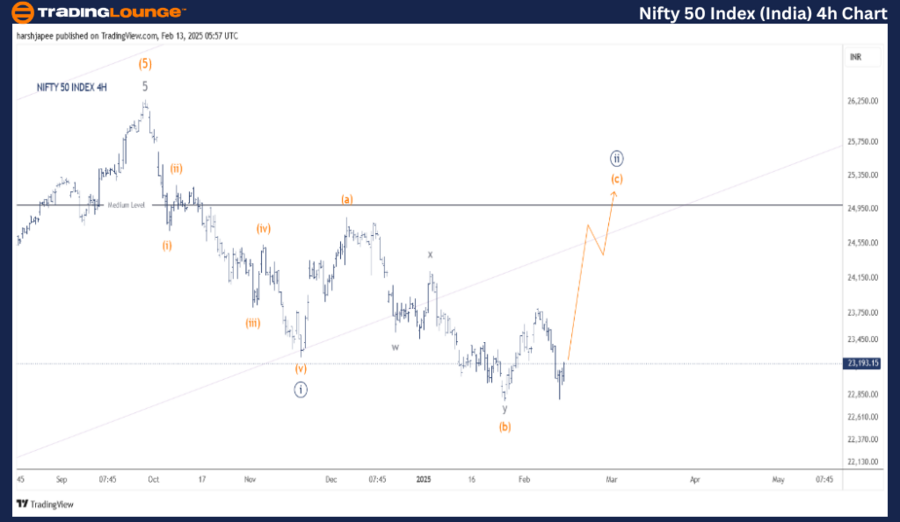

NIFTY 50 INDEX – NIFTY (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Impulse within a larger degree

Position: Minute Wave ((ii))

Technical Details:

- Minute Wave ((ii)) seems to be advancing towards 25,000 before the downtrend resumes.

- The expanded flat correction is labeled as Minuette (a)-(b)-(c) on the 4-hour chart.

- Alternatively, if the entire structure from the 26,300 high is a correction at Minute degree, it may unfold as a ((a))-((b))-((c)) structure.

- Under the alternate count, the index may dip below 22,700 before reversing higher.

Invalidation Point: 26,400

NIFTY 50 INDEX 4H Chart Technical Analysis and Potential Elliott Wave Counts

The NIFTY 50 4H chart highlights potential Elliott Wave counts following the formation of the 26,280-26,300 high on September 27, 2024. The initial decline to 23,267 appears to have subdivided into five waves, marking the completion of Minute Wave ((i)).

Following this, the market structure could be evolving as a potential expanded flat correction ((a)-(b)-(c)), with an expected target of 25,000-25,100 in the near term.

- Wave (a) and Wave (b) appear to have developed around 24,800-24,900 and 22,700-22,800, respectively.

- If this scenario holds, Wave (c) Orange could be unfolding as a potential impulse wave, retracing against the 22,700-22,800 support range.

- Alternatively, if the entire structure from 26,300 is a corrective ((a))-((b))-((c)) pattern, this may be part of a larger degree correction.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: DAX (Germany) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

The NIFTY 50 INDEX is currently advancing towards the 25,000-25,100 zone within Minuette Wave (c) Orange, aiming to complete Minute Wave ((ii)) before the potential downtrend resumes.