DAX (Germany) Elliott Wave Analysis – Trading Lounge Day Chart

DAX (Germany) Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Micro navy blue wave 3

Position: Gray wave 3

Direction Next Lower Degrees: Micro navy blue wave 4

Invalidation Level: 20,526.33

Details:

The DAX Germany daily chart confirms a strong bullish trend, characterized by an impulsive wave structure. The market is currently in micro navy blue wave 3, forming part of the broader gray wave 3 structure. This setup indicates continued upward momentum, with strong buying pressure fueling price gains.

The completion of micro navy blue wave 2 has established a solid base for micro navy blue wave 3 to advance. This phase represents an expansionary movement, defined by bullish strength and higher price action. The overall trend remains positive, with further upward potential as this wave continues developing.

The next focus is micro navy blue wave 4, expected to emerge after micro navy blue wave 3 concludes. This suggests that a corrective phase could occur before the primary uptrend resumes. However, the larger market trend remains bullish, with higher price targets in sight.

The key invalidation level for this Elliott Wave structure is 20,526.33. A price decline below this threshold would require a reassessment of the bullish wave count. As long as the market holds above this support level, the bullish outlook remains intact, favoring further price gains.

Summary:

- The DAX Germany daily chart confirms a bullish Elliott Wave structure, with micro navy blue wave 3 driving continued upward momentum.

- Key invalidation level: 20,526.33 – maintaining prices above this level keeps the bullish scenario intact.

- Next wave in focus: Micro navy blue wave 4, which may introduce a temporary corrective phase before the uptrend resumes.

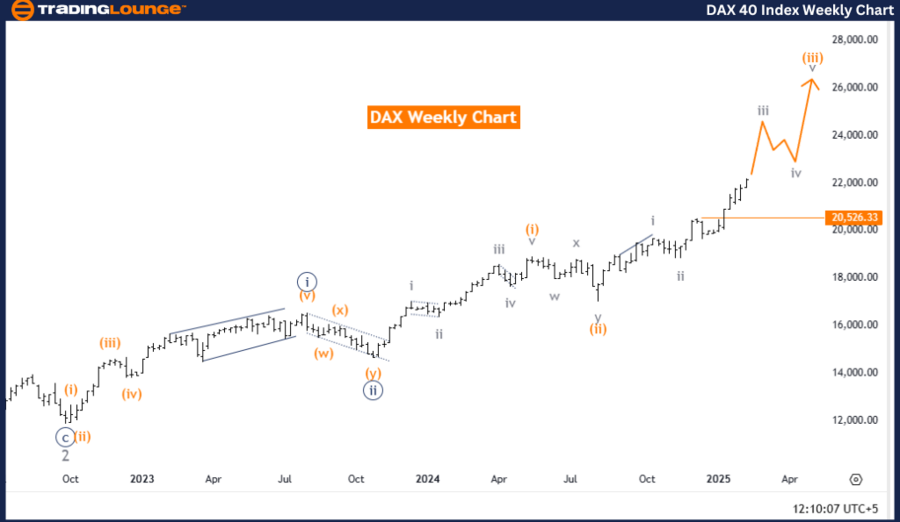

DAX (Germany) Elliott Wave Analysis – Trading Lounge Weekly Chart

DAX (Germany) Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Gray wave 3

Position: Orange wave 3

Direction Next Lower Degrees: Gray wave 4

Invalidation Level: 20,526.33

Details:

The DAX Germany weekly chart confirms a bullish Elliott Wave structure, with the market currently positioned in gray wave 3, following the completion of gray wave 2. This structure indicates strong upward momentum, signaling that the index is in a growth phase with sustained buying interest.

The current wave structure positions the market in orange wave 3, which is part of the larger gray wave 3 formation. This signals an expansion phase, where the market is experiencing consistent price gains within a sustained uptrend. As long as this Elliott Wave pattern remains intact, further price appreciation is expected.

The next lower degree wave in focus is gray wave 4, anticipated to emerge after the completion of gray wave 3. This suggests that a corrective movement may occur before the bullish rally resumes. However, the dominant trend remains upward, with higher price levels projected.

The key invalidation level for this wave count is 20,526.33. If the index drops below this level, a reassessment of the wave structure will be necessary. However, as long as the price holds above this threshold, the bullish outlook remains valid, supporting further upside potential.

Summary:

- The DAX Germany weekly chart remains bullish, with gray wave 3 confirming strong market strength.

- Key invalidation level: 20,526.33, ensuring that the bullish Elliott Wave count remains intact.

- Next wave in focus: Gray wave 4, which may introduce a temporary corrective movement before the uptrend continues.

This analysis highlights a continuation of the bullish momentum in the DAX Germany index, with higher price targets expected, barring any break below the invalidation level.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Swiss Market Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support