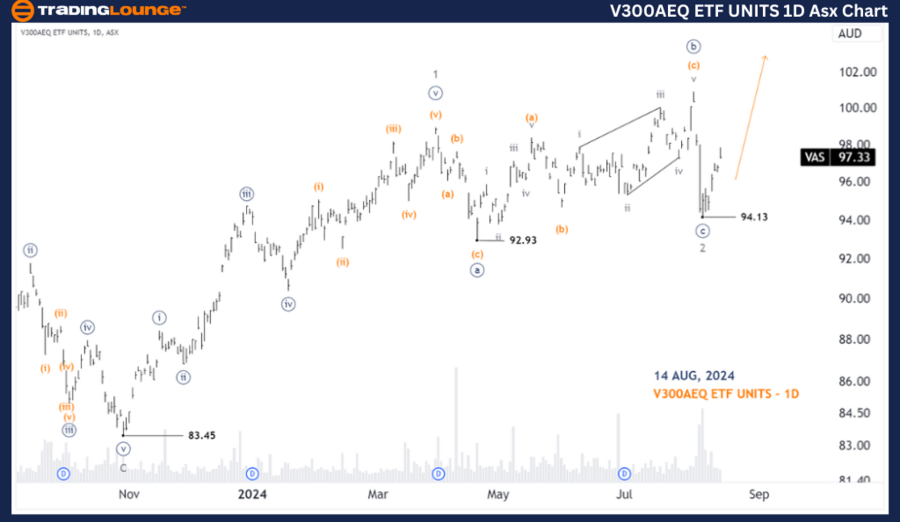

ASX: V300AEQ ETF UNITS – VAS Elliott Wave Technical Analysis (1D Chart)

Greetings, today's Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) with V300AEQ ETF UNITS – VAS. Our analysis suggests that VAS may begin advancing with a 3-grey wave.

ASX: V300AEQ ETF UNITS – VAS Elliott Wave Technical Analysis

ASX: V300AEQ ETF UNITS – VAS 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave 3-grey

Details: Wave 2-grey concluded at the 94.13 low in an Expanded Flat. Wave 3-grey could potentially drive the price higher, with an initial target near 110.00.

Invalidation point: 94.13

ASX: V300AEQ ETF UNITS – VAS Elliott Wave Technical Analysis (4-Hour Chart)

ASX: V300AEQ ETF UNITS – VAS Stock Technical Analysis

ASX: V300AEQ ETF UNITS – VAS 4-Hour Chart Analysis

Function: Counter trend (Minute degree, navy)

Mode: Corrective

Structure: Flat

Position: Wave (iii)-orange of Wave ((i))-navy

Details: Since the 94.13 low, the 3-grey wave is forming, further breaking down into the ((i))-navy wave. The ((i))-navy wave itself is subdividing into five waves. The trend is expected to continue upward until it fulfills its structure. Afterward, the ((ii))-navy wave may initiate a slight decline. A Long Trade Setup will be considered once the ((ii))-navy wave completes, targeting the ((iii))-navy wave that follows.

Invalidation point: 94.13

Conclusion

Our analysis and short-term forecast for ASX: V300AEQ ETF UNITS – VAS aim to provide insights into the current market trends, helping traders capitalize on them effectively. We highlight specific price points that serve as validation or invalidation signals for our wave count, enhancing the reliability of our outlook. By integrating these factors, we offer a professional and objective perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: REA GROUP LTD – REA Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support