NVDA Elliott Wave Analysis Trading Lounge Daily Chart,21 February 24

Welcome to our NVDA Elliott Wave Analysis Trading Lounge, your go-to source for comprehensive insights into NVIDIA Corp. (NVDA) using Elliott Wave Technical Analysis. As of the Daily Chart on 21st February 2024, we delve into significant trends guiding the market.

NVDA Elliott Wave Technical Analysis – Daily Chart

In terms of wave dynamics, we identify a dominant impulse function with a motive structure. The current position is in Minor wave 5 of (1), indicating a pullback in wave {iv} of 5. There's a possibility of a larger top being imminent in wave (5), potentially leading to a larger pullback. Additionally, an upside target at TL8 around $800 is plausible.

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minor wave 5 of (1).

DIRECTION: Pullback in wave {iv} of 5.

DETAILS: As explained on the chart we could be having a larger top soon to be in place in wave (5) instead of 5 and that could mean a larger pullback would be due. In addition, we could see an upside target at TL8 at 800$.

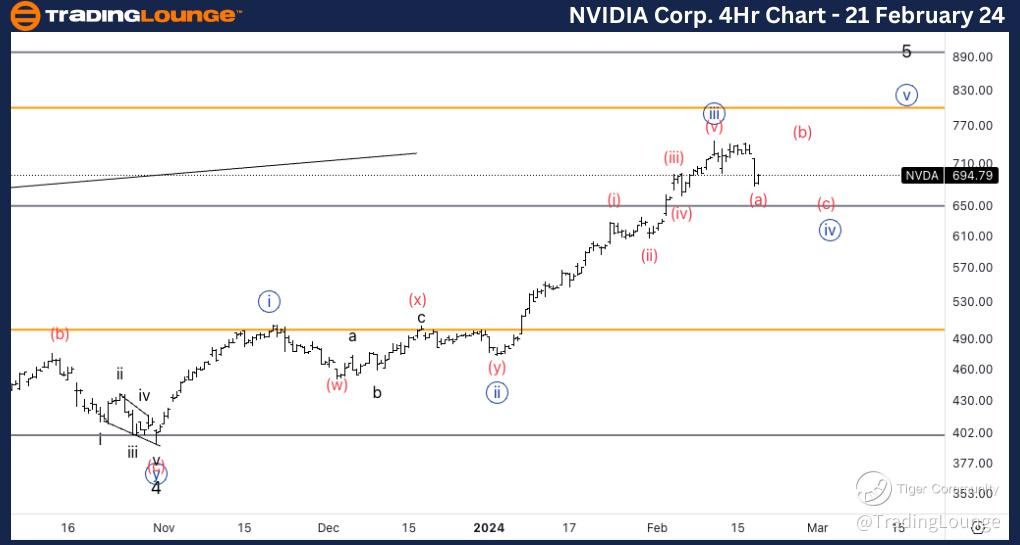

NVDA Elliott Wave Analysis Trading Lounge 4Hr Chart, 21 February 24

NVDA Elliott Wave Technical Analysis – 4Hr Chart

Here, the wave function shifts to a counter-trend mode with a corrective structure, specifically a flat pattern. The present position is in Wave (a) of {iv}, signifying the completion of a three-wave move in wave {iv}. We anticipate a three-wave move into wave {iv}, with Medium Level support around $650.

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave (a) of {iv}

DIRECTION: Completion of a three-wave move in wave {iv}.

DETAILS: Looking for a three-wave move into wave {iv} as of now we would have a much smaller wave {iv} compared to its wave {ii}. We could see Medium Level 650$ act as support.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Microsoft Inc.(MSFT)