ETN Elliott Wave Analysis: Current Trend Overview

This analysis delves into the trend structure of Eaton Corp PLC (ETN), applying the Elliott Wave Theory on both daily and 1-hour charts. The breakdown below provides insight into ETN's positioning and likely price trajectory.

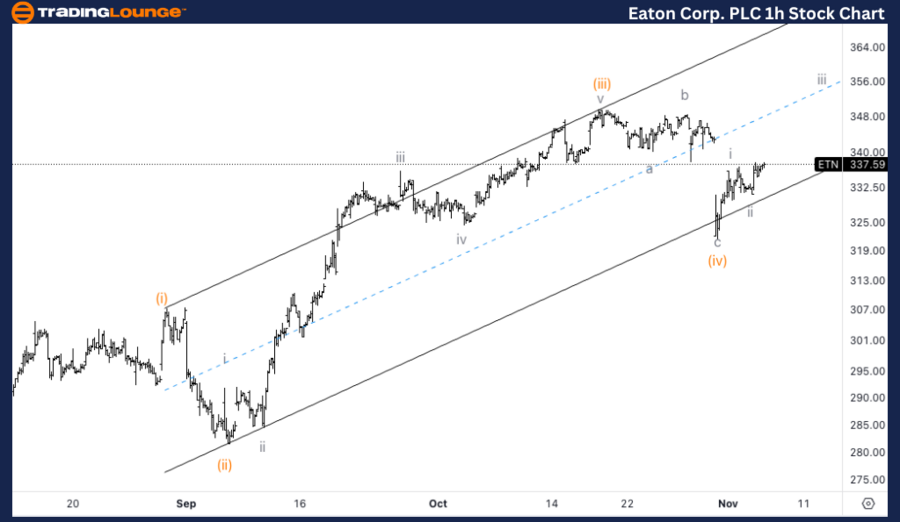

ETN Elliott Wave Analysis - Daily Chart Overview

Eaton Corp PLC (ETN) - Daily Chart Analysis

ETN Elliott Wave Technical Analysis

Trend Function: Uptrend

Wave Mode: Impulsive

Structure: Motive Wave

Position: Minor

Current Direction: Ascending within wave (v) of 5

We anticipate one additional upward move in wave (v) of {v} of 5, marking the potential end of a larger upward cycle. The projected resistance level, MG2, around $380, may signal a point of reversal or consolidation.

Detailed Daily Chart Analysis for ETN

The daily analysis reveals that Eaton Corp (ETN) is approaching the final phase of Minor wave 5, now progressing in wave (v) of {v}. This implies that at least one more upswing is expected before completing the overall uptrend. The resistance level at MG2, near $380, could serve as a potential top before a more significant corrective phase begins.

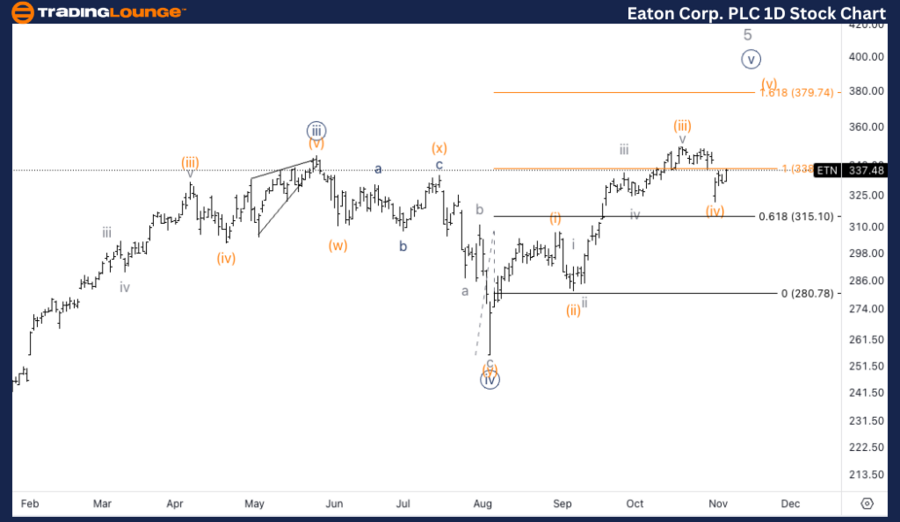

ETN Elliott Wave Analysis - 1-Hour Chart Overview

Eaton Corp PLC (ETN) - 1H Chart Analysis

ETN Elliott Wave Technical Summary

Trend Function: Uptrend

Wave Mode: Impulsive

Structure: Motive Wave

Position: Wave iii of (v)

Current Direction: Ascending in wave (v)

A three-wave corrective pattern in wave (iv) has found support at the upper boundary of the parallel trend channel. With ETN trading above the MG1 level, the next upside target appears to be $350 as wave (v) extends further.

Detailed 1-Hour Chart Analysis for ETN

The 1-hour analysis shows ETN completing wave iii of (v), with the price currently moving through wave (iv). This wave has formed a three-wave correction pattern, finding support along a parallel trend line. Should the price maintain its position above Trading Level MG1, the subsequent target on the upside is $350, as wave (v) seeks to advance further.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Netflix Inc. (NFLX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support