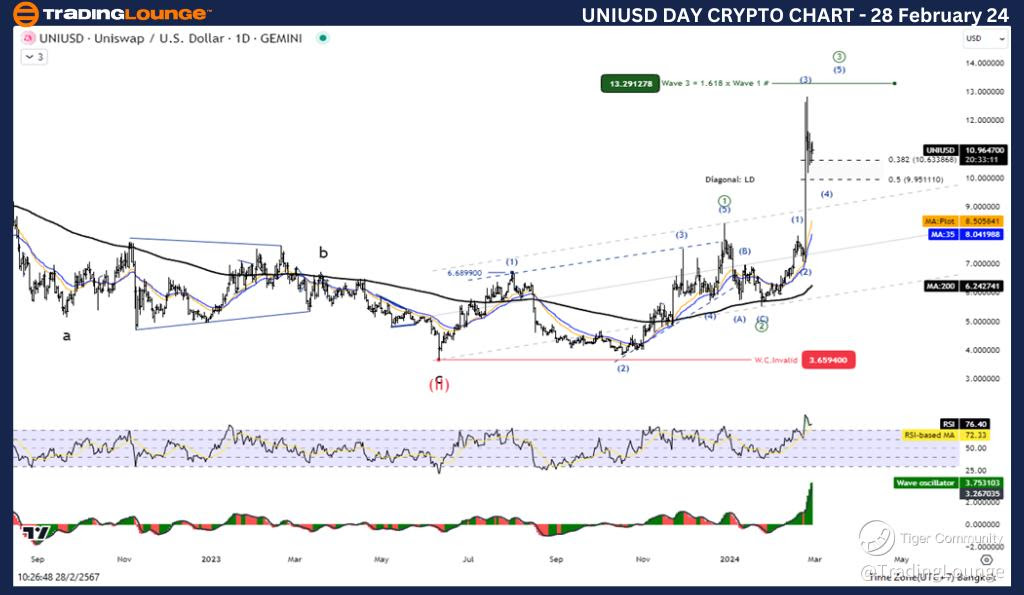

Uniswap/U.S. dollar (UNIUSD) Elliott Wave Analysis TradingLounge, 28 February 24

When analyzing Uniswap/ U.S. dollar (UNIUSD) through Elliott Wave Theory, we observe a promising trajectory for traders. As of 28 February 24, the Elliott Wave Analysis TradingLounge provides crucial insights into UNIUSD's market behavior.

UNIUSD Elliott Wave Technical Analysis

Uniswap/U.S. dollar(UNIUSD) Daily Chart Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave ((3))

Direction Next higher Degrees: Wave I of Impulse

Wave Cancel invalid Level: 4.50

UNIUSD Trading Strategy: UNIUSD exhibits an impulse wave ((3)), often extending its momentum. Anticipated movement suggests a potential test of the 13.291 level, indicating a prevailing uptrend. Consequently, there's a likelihood for further upward movement.

UNIUSD Technical Indicators: Price action remains above the MA200, signaling an Uptrend. Additionally, Wave Oscillators reflect bullish Momentum.

UNIUSD Elliott Wave Analysis TradingLounge, 28 February 24,

Uniswap/ U.S. dollar(UNIUSD) 4Hr Chart Analysis

UNIUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave ((3))

Direction Next higher Degrees: Wave I of Impulse

Wave Cancel invalid Level: 4.50

Uniswap/ U.S. dollar(UNIUSD) Trading Strategy: Similar to the daily chart analysis, the 4-hour chart reaffirms the presence of an impulse wave ((3)), hinting at potential upward movement. The 13.291 level remains a significant target, reinforcing the prevailing uptrend sentiment.

Uniswap/ U.S. dollar(UNIUSD) Technical Indicators: Consistent with the daily chart, UNIUSD's price action maintains its position above the MA200, indicating an Uptrend. Additionally, Wave Oscillators continue to exhibit bullish Momentum.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Bitcoin/USD Dollar (BTCUSD)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

In Conclusion:

Uniswap/ U.S. dollar (UNIUSD) exhibits a promising outlook based on Elliott Wave Technical Analysis. With clear indications of an impulse wave ((3)) and bullish momentum, traders may find opportunities to capitalize on the anticipated uptrend. However, risk management strategies should be employed, and market developments closely monitored for informed decision-making.

By staying informed on Elliott Wave patterns and technical indicators, traders can navigate UNIUSD's market dynamics effectively, potentially maximizing profitability while minimizing risks.