Welcome to our latest Elliott Wave analysis for Caterpillar Inc. (CAT). This analysis delves into CAT's price movements through the lens of the Elliott Wave Theory, aiming to uncover potential trading opportunities based on current trends and market structures. We will examine both the daily and 4-hour charts to provide a thorough perspective on CAT's market behaviour.

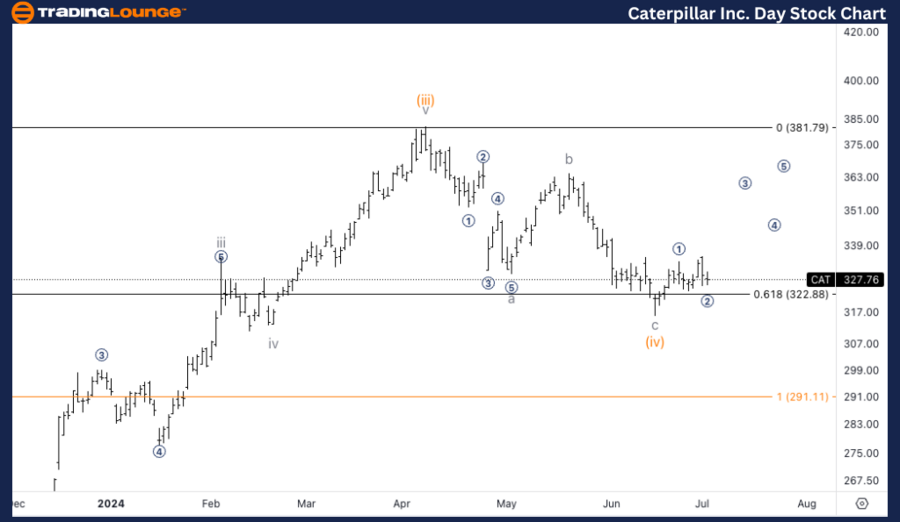

CAT Elliott Wave Analysis Trading Lounge Daily Chart

Caterpillar Inc., (CAT) Daily Chart Analysis

CAT Stock Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minute wave (v)

DIRECTION: Upside in wave (v)

DETAILS: We are looking at Minuette wave (iv) reacting to the 0.618 retracement of wave (iv) versus wave (ii). Looking for a bottom in place to then resume the upside trend in wave (v).

CAT Elliott Wave Technical Analysis – Daily Chart

In our Elliott Wave analysis of Caterpillar Inc. (CAT), we observe an impulsive trend pattern with a motive structure. CAT is currently positioned in minute wave (v), indicating an ongoing upward trend. The recent price action shows that Minuette wave (iv) has reacted off the 0.618 retracement level of wave (iv) versus wave (ii), suggesting a potential bottom. This reaction provides a signal that CAT might resume its uptrend into minute wave (v), continuing the impulsive sequence.

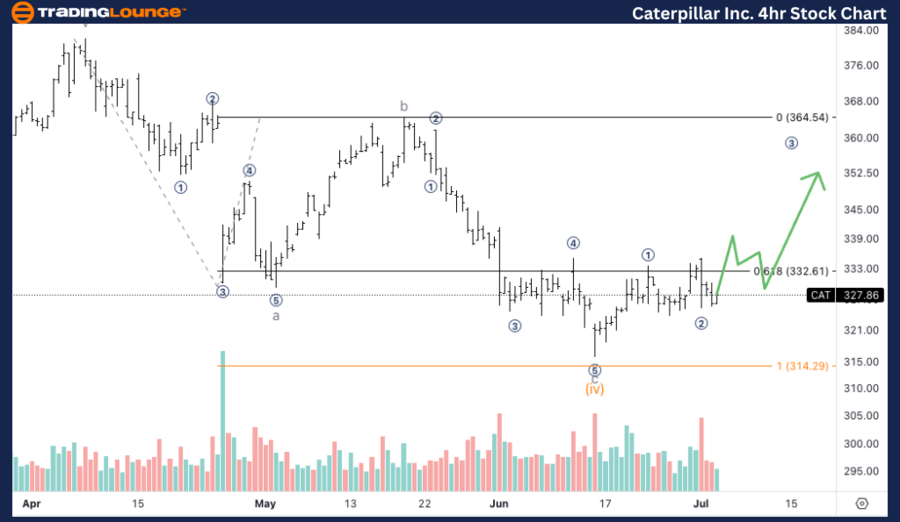

CAT Elliott Wave Analysis Trading Lounge 4Hr Chart

Caterpillar Inc., (CAT) 4Hr Chart Analysis

CAT Stock Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Sub-minuette i of (v)

DIRECTION: Five waves into wave i

DETAILS: Looking for a micro wave 1-2 in place, expecting further upside into micro wave 3 looking to take off from Minor Group 1 at $330.

CAT Elliott Wave Technical Analysis – 4Hr Chart

In our Elliott Wave analysis of Caterpillar Inc. (CAT), we observe an impulsive trend pattern with a motive structure. CAT is currently positioned in minute wave (v), indicating an ongoing upward trend. The recent price action shows that Minuette wave (iv) has reacted off the 0.618 retracement level of wave (iv) versus wave (ii), suggesting a potential bottom. This reaction provides a signal that CAT might resume its uptrend into minute wave (v), continuing the impulsive sequence.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Apple Inc. (AAPL) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support