PG Elliott Wave Analysis Trading Lounge Daily Chart, 9 February 24

The Procter & Gamble Company, (PG) TradingLounge Daily Chart

PG Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Minor wave 1 of (3).

DIRECTION: Acceleration in wave (3).

DETAILS: Looking for upside resumption as we have found support on Medium Level 150$ and we are now trading above the previous resistance we have broken it with increasing volume suggesting the move is trend-establishing, rather than corrective.

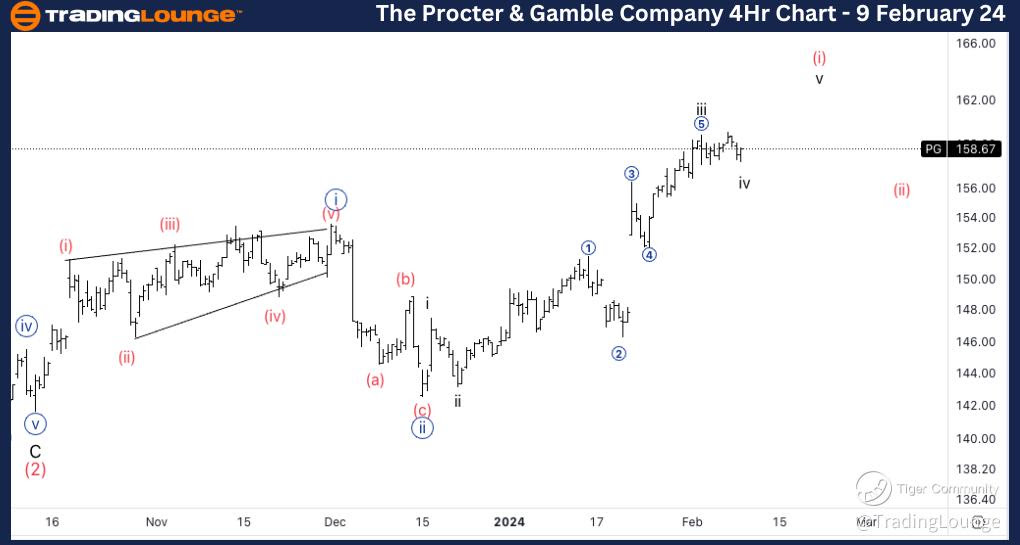

PG Elliott Wave Analysis Trading Lounge 4Hr Chart, 9 February 24

The Procter & Gamble Company, (PG) 4Hr Chart

PG Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (i) of {iii}.

DIRECTION: Upside into wave v of (i).

DETAILS: Looking for a continuation higher on the intraday as every pullback to the downside seems to be a three-wave move and therefore corrective in nature. Looking for a top soon in what could be either wave (i) of {iii} or else wave {iii}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Visa Inc. (V)

Welcome to our PG Elliott Wave Analysis Trading Lounge, your trusted source for comprehensive insights into The Procter & Gamble Company (PG) through Elliott Wave Technical Analysis. As of the Daily Chart on 9th February 2024, we uncover pivotal trends guiding the market.

*PG Elliott Wave Technical Analysis – Daily Chart*

In terms of wave dynamics, we discern a dominant impulse function with a motive structure. The current position is in Minor wave 1 of (3), indicating acceleration in wave (3). Our focus is on the resumption of upside momentum, particularly as we find support at the Medium Level of $150. Notably, trading above previous resistance with increasing volume suggests a trend-establishing move rather than a corrective one.

*PG Elliott Wave Technical Analysis – 4Hr Chart*

Here, the wave function remains impulsive with a motive structure. The present position is in Wave (i) of {iii}, signaling an upside movement into wave v of (i). We anticipate continued upward momentum intraday, especially as pullbacks to the downside manifest as three-wave moves, indicative of corrective nature. We remain vigilant for a potential top, which could signify either wave (i) of {iii} or wave {iii}.