Wheat Commodity Elliott Wave Technical Analysis

Wheat prices remain under strong bearish influence, with short- to medium-term projections aiming for the $500 support zone. Since March 2022, wheat futures have been trending lower, forming a prolonged downtrend. According to Elliott Wave wheat analysis, a corrective rebound could be on the horizon. However, before this potential recovery, prices may break through the $510 level and push lower toward $500 or beyond.

Wheat Elliott Wave Analysis – Daily Chart

The daily wheat chart highlights a nearing conclusion to the bearish trend that began in March 2022. This decline has unfolded through a classic 5-wave impulse structure. The current movement, identified as wave (V), appears to be shaping an ending diagonal—typically a signal that sellers may begin to lose strength. Presently, wheat price action is within wave V of (V), possibly marking the last leg of the downtrend. Inside wave V, sub-waves ((A)) and ((B)) have completed, while wave ((C)) is actively forming, likely approaching its mid-phase. This setup strengthens the case for a possible short-term reversal in the wheat price forecast.

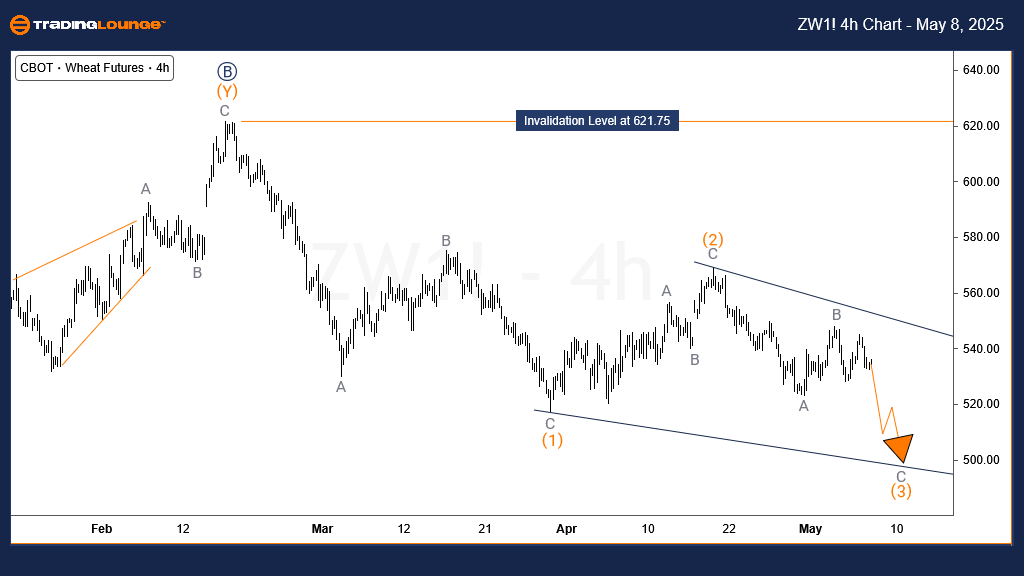

Wheat Elliott Wave Analysis – H4 Chart

On the 4-hour timeframe, wheat technical analysis shows wave ((C)) of V may be constructing an ending diagonal, completing a broader 5-3-5 zigzag corrective structure since the May 2024 swing high. Confirmation of this diagonal in wave ((C)) is key for determining short-term trend direction. Should wave (3) of ((C)) finalize its move lower, prices could soon test the $500 level. While short-term traders may continue to find selling opportunities during intraday bounces, long-term traders should be cautious. A shift from the prolonged bearish trend could develop if this diagonal structure completes, hinting at an upcoming reversal in the wheat trading signals.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Cocoa Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support