FTNT Elliott Wave Analysis: Assessing Fortinet Inc.’s Trend Structure

In this Elliott Wave analysis, we evaluate the trend structure of Fortinet Inc. (FTNT) using daily and 1-hour charts to pinpoint the current wave position and potential price movements.

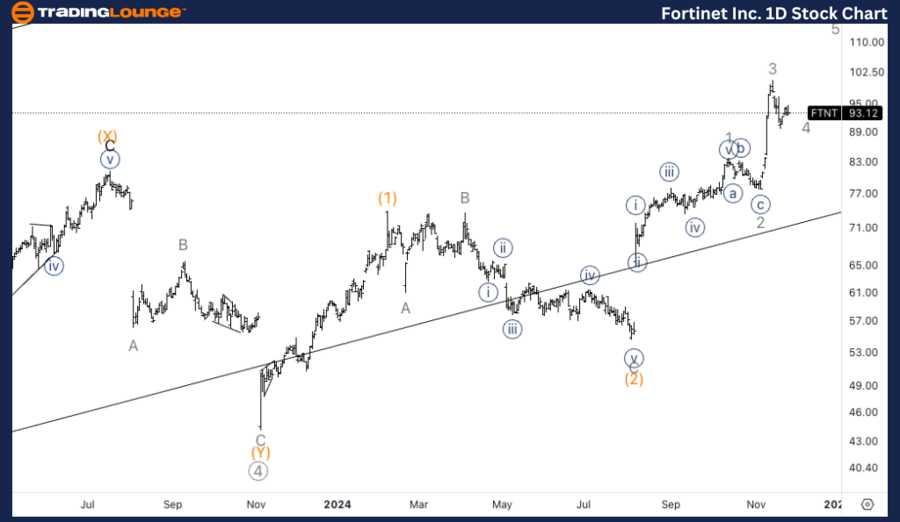

Fortinet Inc. (FTNT) Elliott Wave Analysis and Daily Chart Analysis

FTNT Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (3)

Direction: Upside within wave (3)

Details: Fortinet is advancing in Intermediate wave (3), with the price surpassing TradingLevel1 at $100. The equality of wave (3) compared to wave (1) was achieved at $91. The next target is the 1.618 extension of wave (1), projected at $125, highlighting further upside potential as the wave unfolds.

FTNT Elliott Wave Analysis: Daily Chart Highlights

Fortinet Inc. (FTNT) is currently in Intermediate wave (3), characterized by a strong impulsive trend. The stock recently crossed TradingLevel1 at $100, and wave (3) has already equaled the length of wave (1) at $91. The focus now shifts to the 1.618 Fibonacci extension, suggesting a target of $125. This indicates that Fortinet could experience additional gains as this wave progresses.

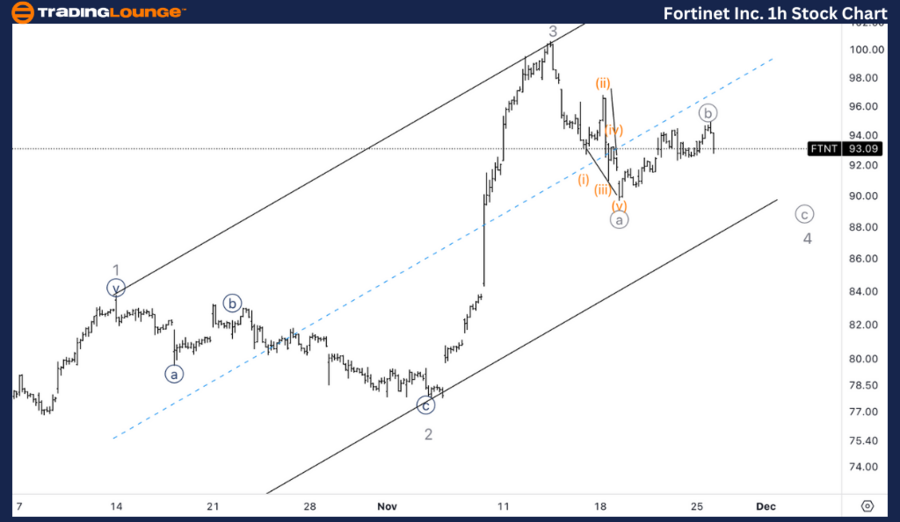

Fortinet Inc. (FTNT) 1-Hour Chart Analysis

FTNT Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 4 of (3)

Direction: Bottom in wave 4

Details: The 1-hour chart shows Fortinet correcting in wave 4 of (3), following the recent rally. A leading diagonal appears to have formed in wave {a} of 4, indicating that the correction phase may be near completion. An alternate count suggests that the structure could represent wave {ii} of 3, which would imply a stronger upside if confirmed. Traders should watch for a wave 4 bottom, as this could set the stage for a continuation of the upward trend.

FTNT Elliott Wave Analysis: 1-Hour Chart Highlights

The short-term wave structure in Fortinet (FTNT) indicates wave 4 of (3) correction is in progress. The formation of a leading diagonal in wave {a} of 4 supports the expectation of a near-term bounce. Alternatively, if the current structure is wave {ii} of 3, it implies a steeper bullish trajectory. Either scenario points to a continuation of the uptrend once the correction concludes.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Tesla Inc Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support