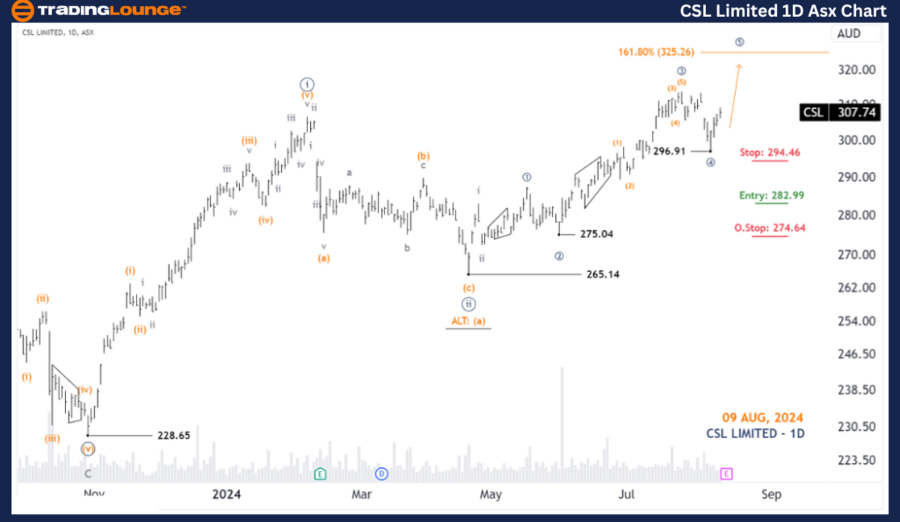

ASX: CSL LIMITED – Elliott Wave Technical Analysis (1D Chart)

Greetings! In this Elliott Wave analysis, we update the technical outlook for CSL Limited (ASX: CSL) on the Australian Stock Exchange (ASX). The current pattern suggests that CSL may be advancing within wave ((iii))-navy.

ASX: CSL LIMITED Elliott Wave Technical Analysis

ASX: CSL LIMITED – 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave ((5))-navy of Wave iii-grey of Wave ((iii))-navy

Details: Wave ((4))-navy has recently concluded, and Wave ((5))-navy is now unfolding, suggesting a continued upward movement. The prior long trade remains strong and effective.

Invalidation Point: 296.91

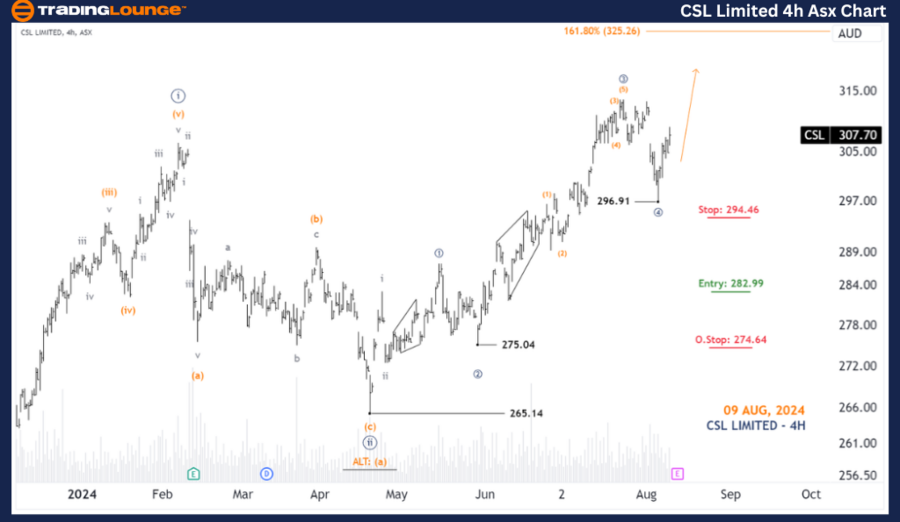

ASX: CSL LIMITED – Elliott Wave Technical Analysis (4-Hour Chart)

ASX: CSL LIMITED – 4-Hour Chart Analysis

Function: Major Trend (Minuette Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((5))-navy of Wave iii-gray of Wave ((iii))-navy

Details: Similar to the daily chart, Wave ((4))-navy has completed, and Wave ((5))-navy is progressing, likely driving the price towards the target range of 320.00 - 325.26. The price must stay above 296.91 to sustain this bullish outlook.

Invalidation Point: 296.91

Conclusion

Our analysis of CSL Limited (ASX: CSL) focuses on providing insights into current market trends, helping traders make informed decisions. We offer key price points that validate or invalidate our wave count, enhancing confidence in our forecast. This approach aims to deliver an objective and professional view of market movements.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX LIMITED Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support