Welcome to Our Latest Elliott Wave Analysis for Advanced Micro Devices Inc. (AMD)

This report delves into AMD's price action using Elliott Wave Theory, offering traders valuable insights into potential market opportunities. We'll analyze both the daily and 1-hour charts to provide a comprehensive view of AMD's current market behavior.

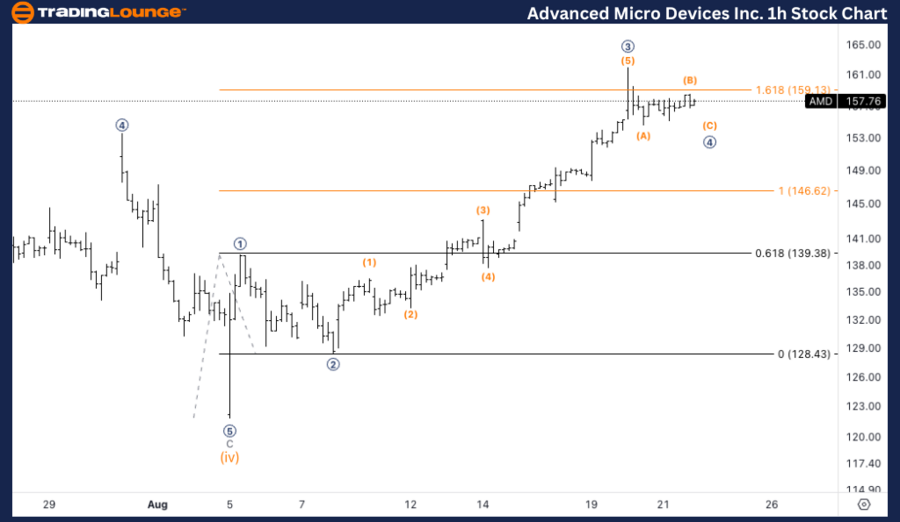

AMD Elliott Wave Analysis - Daily Chart

Advanced Micro Devices Inc. (AMD) Daily Chart Analysis

AMD Elliott Wave Technical Analysis

- Function: Trend

- Mode: Impulsive

- Structure: Motive

- Position: Wave (v)

- Direction: Upside in wave (v)

Details: We are observing a three-wave move, potentially forming minuette wave (iv), with consistent support above $150.

AMD Stock Forecast – Daily Chart Overview

AMD appears to be advancing into wave (v), the final wave of the current impulsive sequence. Recent price movements indicate a three-wave correction likely forming minuette wave (iv). Crucially, AMD has consistently found support around the $150 level, reinforcing the possibility of continued upward momentum. The market structure suggests that wave (v) could extend further, with a potential target of $180 as this wave develops.

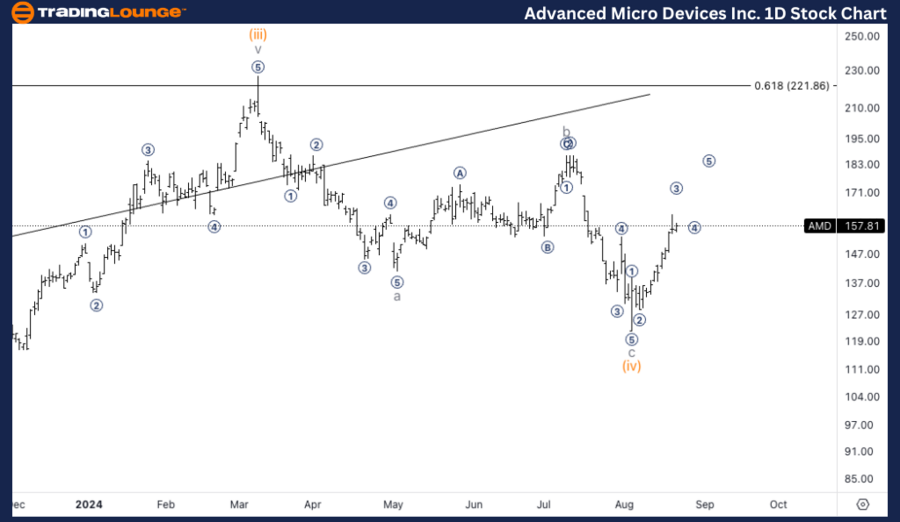

AMD Elliott Wave Analysis - 1H Chart

Advanced Micro Devices Inc. (AMD) 1H Chart Analysis

AMD Elliott Wave Technical Analysis

- Function: Trend

- Mode: Impulsive

- Structure: Motive

- Position: Microwave 4 of i

- Direction: Upside into microwave 5

Details: We are monitoring the completion of micro wave 4, with the price reaching the 1.618 Fibonacci extension of wave 3 vs. 1 at $159. We anticipate a potential top in microwave 5 around $180.

Advanced Micro Devices Stock Analysis – 1H Chart Overview

AMD is nearing the completion of micro wave 4, having reached the 1.618 Fibonacci extension of wave 3 vs. 1 at $159. This level serves as significant resistance, yet the current wave structure suggests that microwave 5 could drive the price towards $180, the expected peak for this microwave sequence.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Palo Alto Networks Inc. Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support