Welcome to Our Latest Elliott Wave Analysis for Palo Alto Networks Inc. (PANW)

This report presents an in-depth analysis of PANW's price movements using Elliott Wave Theory. The goal is to help traders identify potential trading opportunities based on the current trend and wave structure of the stock. We will review both the daily and 1-hour charts to provide a well-rounded view of PANW’s market behavior.

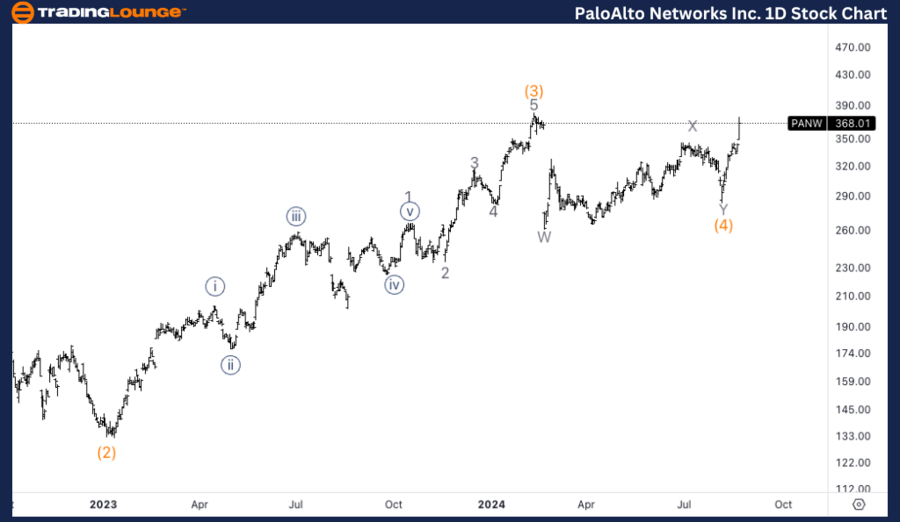

PANW Elliott Wave Analysis: Trading Lounge Daily Chart

Palo Alto Networks Inc. (PANW) Daily Chart Analysis

PANW Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Intermediate (5)

Direction: Upside into wave (5)

Details: We anticipate an upward movement into wave (5) as PANW appears to have reached a bottom in wave (4). The stock is now expected to move towards the Medium Level at $400.

PANW seems to be advancing into the final wave (5) of the current impulsive cycle after bottoming in wave (4). The upward momentum is likely to persist, targeting the Medium Level at $400. The recent price actions align with the outlook for continued gains as the stock progresses towards completing wave (5).

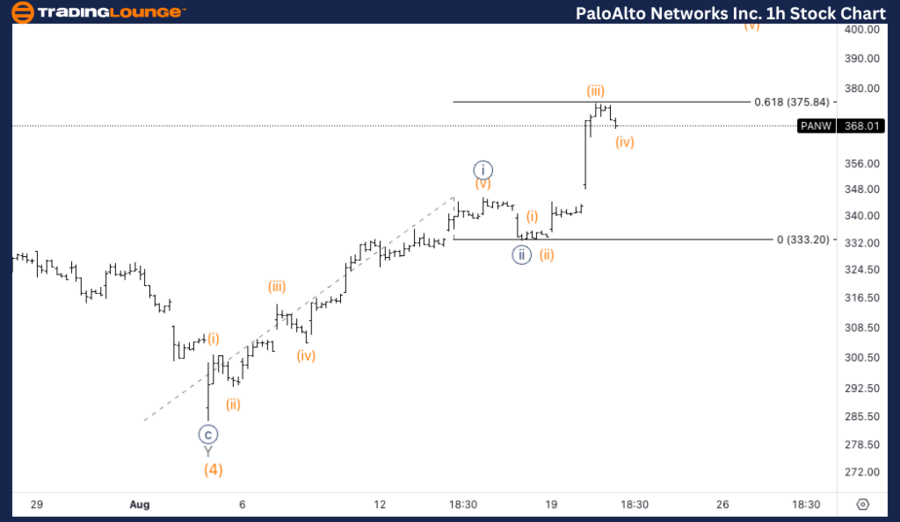

PANW Elliott Wave Analysis: Trading Lounge 1H Chart

Palo Alto Networks Inc. (PANW) 1H Chart Analysis

PANW Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 1

Direction: Upside in wave {iii}

Details: We are looking for continued upside in wave {iii} after observing the highest RSI reading at the $375 top. This high RSI level suggests that it could be the third wave of a third, typically the most extended and powerful in an Elliott Wave sequence.

PANW Stock Technical Analysis – 1H Chart

PANW is currently moving higher within wave {iii} of 1, with the highest RSI reading near the $375 level. This RSI peak indicates that this move may be part of a third wave, often the strongest in the Elliott Wave sequence, reinforcing expectations for further upside as wave {iii} develops.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Texas Instruments Inc. (TXN) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support