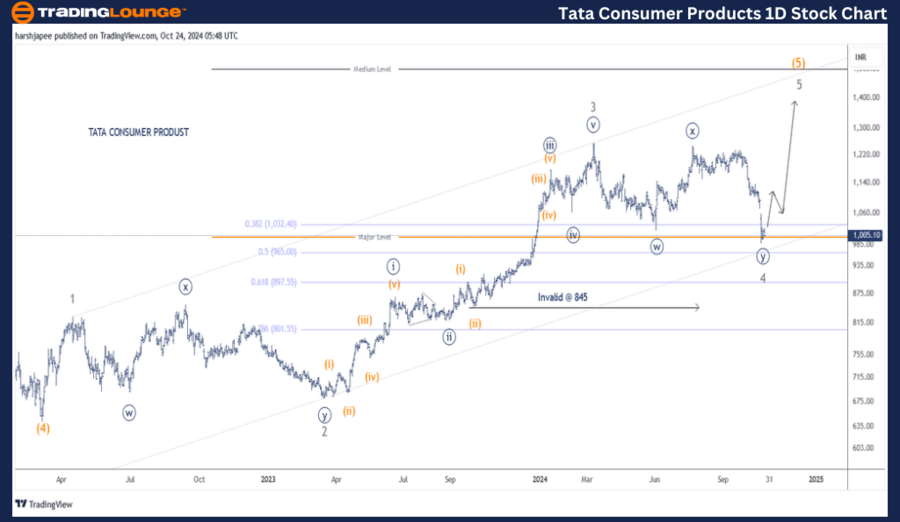

TATA Consumer Product Stock – TradingLounge (1D Chart)

TATA Consumer Product – TATACONSUM Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4

Details: Minor Wave 4 may have developed as a combination, potentially concluding near the 1000 level. If this holds true, Minor Wave 5 is likely to begin soon.

Invalidation Point: 845

Elliott Wave Analyst: Harsh Japee

TATA Consumer Product - Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart of TATA Consumer Product indicates a continued upward momentum as Intermediate Wave (5) Orange evolves. The stock appears poised to surpass the 1255 level as Minor Wave 5 Grey initiates from a point below 1000.

Intermediate Wave (4) Orange concluded near the 640 mark in March 2022. From that point, Minor Waves 1 through 4 have either completed or are close to completion. It’s important to note that the wave counts have been revised since the last update, with Minor Wave 4 now categorized as a combination.

Moreover, the Fibonacci 0.50 retracement and channel support validate the possibility of Wave 4 ending near the 1000 level. If this assumption is correct, Wave 5 Grey should continue its ascent, with a target of breaking above the 1255 mark.

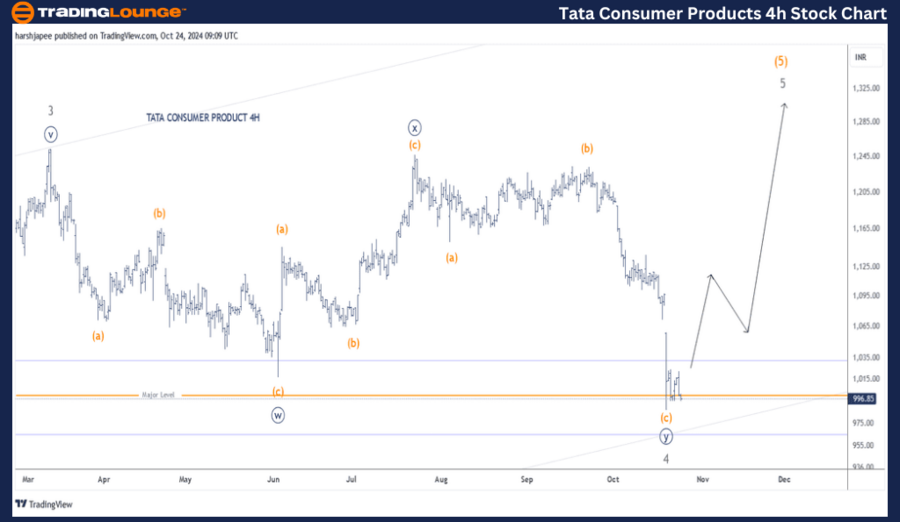

TATA Consumer Product Stock – TradingLounge (4H Chart)

TATA CONSUMER PRODUCT – TATACONSUM (4H Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4

Details: Minor Wave 4 may have unfolded as a combination, ending near the 1000 level. A Minute ((w)) - ((x)) - ((y)) structure has been identified, confirming a 3-3-3 pattern. If correct, Minor Wave 5 should soon begin its upward move.

Invalidation Point: 845

TATA Consumer Product - 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4H chart of TATA Consumer Product outlines the sub-waves between Minor Waves 3 and 4 Grey. This structure is identified as a 3-3-3 pattern, labeled Minute Waves ((w)) - ((x)) - ((y)), between the 1255 and 990 levels. If this pattern holds, the stock is expected to rise from its current levels as Minor Wave 5 starts to form.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Reliance Industries Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

TATA Consumer Product seems to have completed Minor Wave 4 around the 1000 level as a combination. If this is accurate, Minor Wave 5 Grey should be in progress, pushing the stock higher.