Introduction to Elliott Wave Analysis for ASX: Northern Star Resources Ltd – NST

Welcome to today’s Elliott Wave analysis of Northern Star Resources Ltd (ASX:NST). Our focus is to provide a detailed look into the bullish trend emerging for ASX:NST and guide traders on effective strategies to capitalize on this upward momentum.

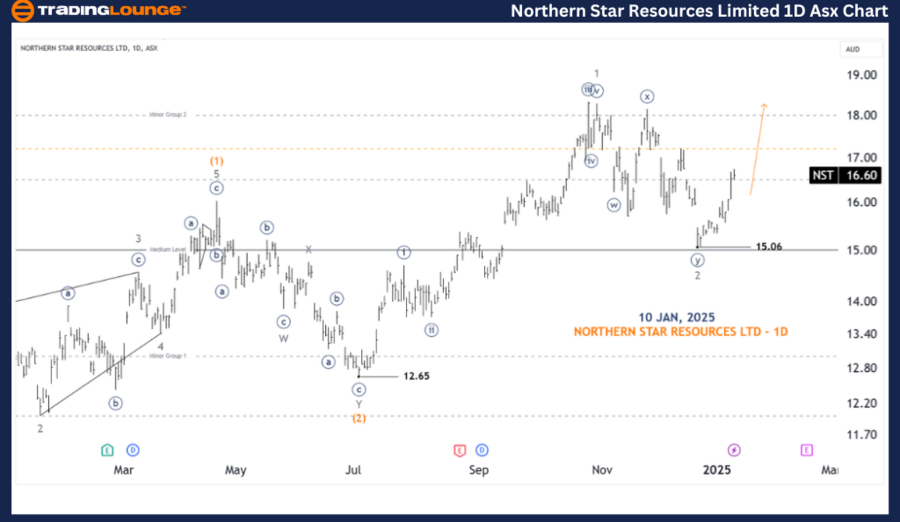

ASX: Northern Star Resources Ltd – NST 1D Chart Analysis (Semilog Scale)

Major Trend: Intermediate Degree (Orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave 3-grey of Wave (3)-orange

Analysis Details:

- The price action confirms that Wave 2-grey concluded as a Double Zigzag, labeled as ((w))((x))((y))-navy, bottoming at 15.06.

- The subsequent upward move signals the progression of Wave 3-grey, targeting the next milestone at 20.00.

Key Levels:

- Invalidation Point: 15.06

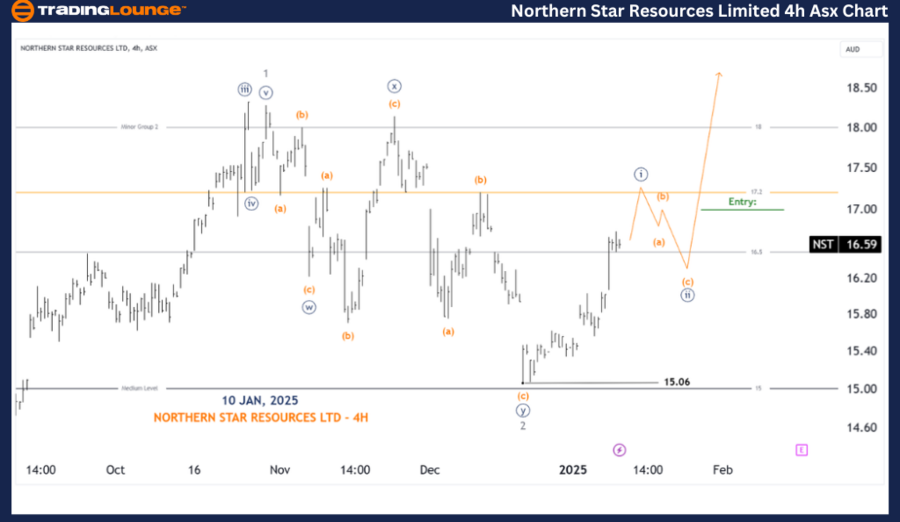

ASX: Northern Star Resources Ltd – NST 4-Hour Chart Analysis

Major Trend: Minute Degree (Navy)

- Mode: Motive

- Structure: Impulse

- Position: Wave ((i))-navy of Wave 3-grey

Analysis Details:

- A closer look at Wave 3-grey indicates that Wave ((i))-navy is nearing completion.

- After this, a pullback in Wave ((ii))-navy is expected.

- The optimal long trade setup arises when the price breaks above the endpoint of Wave (b)-orange within Wave ((ii))-navy. This ensures a safe entry point for bullish momentum.

Key Levels:

- Invalidation Point: 15.06

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: COCHLEAR LIMITED - COH Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis highlights the upward potential of Northern Star Resources Ltd (ASX:NST). By providing precise validation and invalidation levels, we aim to strengthen traders’ confidence in the current wave structure and trend forecast. Following our methodology can help you align your trading strategy with these critical market insights.

For long opportunities, the safest entry point lies above the key price level of Wave (b)-orange. By leveraging this strategic approach, traders can better position themselves to benefit from the bullish trend.