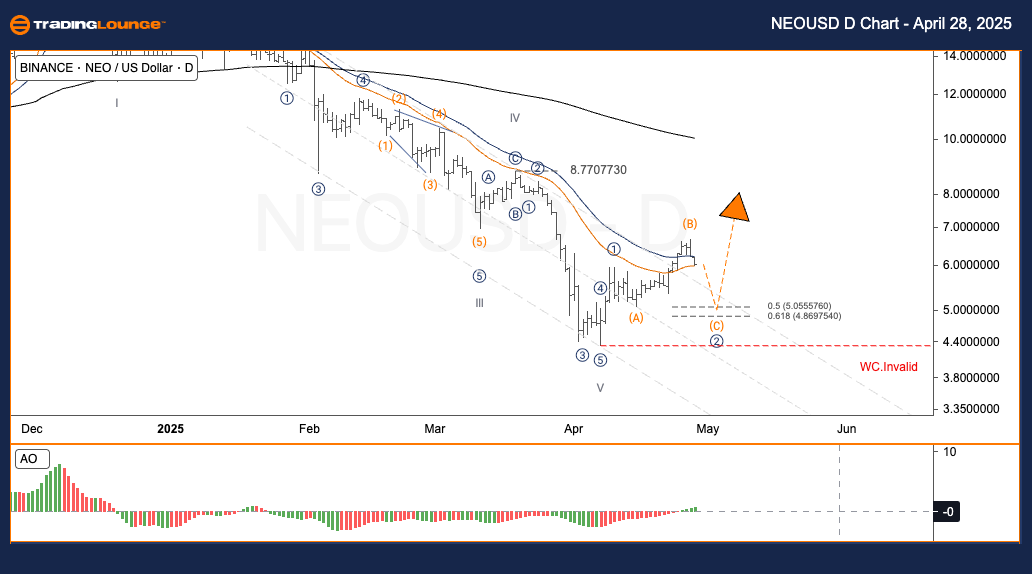

NEOUSD Elliott Wave Analysis – TradingLounge Daily Chart

NEO/ U.S. Dollar (NEOUSD) Daily Chart Analysis

NEOUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave ((2))

Direction for Next Higher Degrees: —

Wave Cancel Invalid Level: —

NEO/ U.S. Dollar (NEOUSD) Trading Strategy

The NEOUSD price action has completed its major downtrend near $4.20 and initiated a bullish recovery, establishing wave (1). Currently, NEOUSD is consolidating within wave (2), positioning for a potential strong rally into wave (3), in line with the Elliott Wave motive pattern.

Trading Strategies

Strategy

Short-Term Traders (Swing Trade)

✅ If NEOUSD declines into the $5.05–$4.88 support zone and a bullish reversal signal emerges → This offers a strong opportunity to ride the beginning of wave (3) to the upside.

Risk Management

If NEOUSD breaks below $4.20 → Reassess the Elliott Wave structure and update the trading plan.

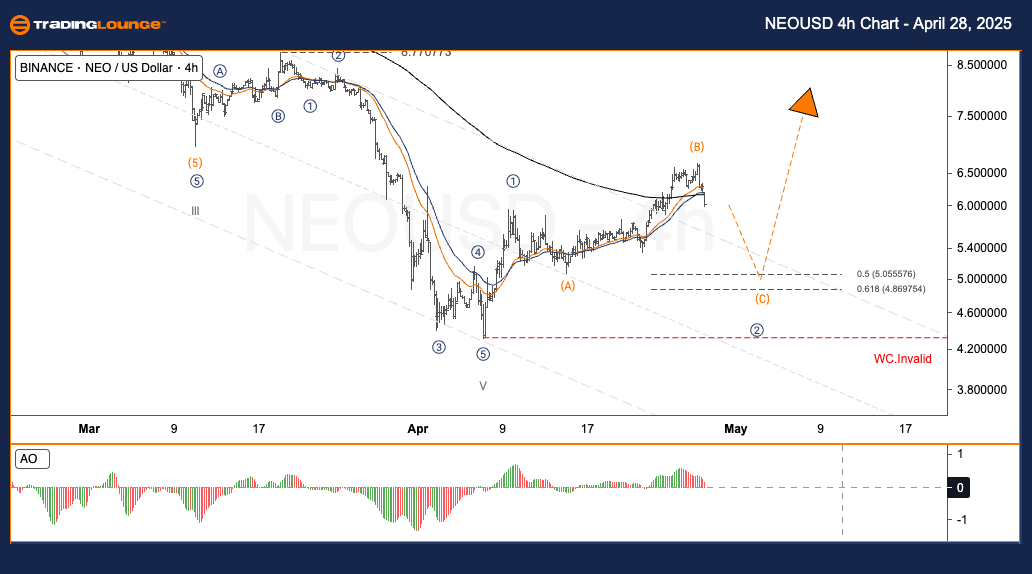

NEOUSD Elliott Wave Analysis – TradingLounge H4 Chart

NEO/ U.S. Dollar (NEOUSD) 4-Hour Chart Analysis

NEOUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave ((2))

Direction for Next Higher Degrees: —

Wave Cancel Invalid Level: —

NEO/ U.S. Dollar (NEOUSD) Trading Strategy

NEOUSD completed its significant bearish move near $4.20 and successfully formed wave (1). Now, the cryptocurrency is trading sideways within the wave (2) structure, preparing for a bullish breakout into wave (3), consistent with Elliott Wave trend-following strategies.

Trading Strategies

Strategy

Short-Term Traders (Swing Trade)

✅ If NEOUSD retraces into the $5.05–$4.88 area and a reversal pattern is confirmed → A high-probability setup to capture the impulsive move of wave (3) higher.

Risk Management

If NEOUSD falls below $4.20 → Immediate review and adjustment of the Elliott Wave analysis are required.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ETHUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support