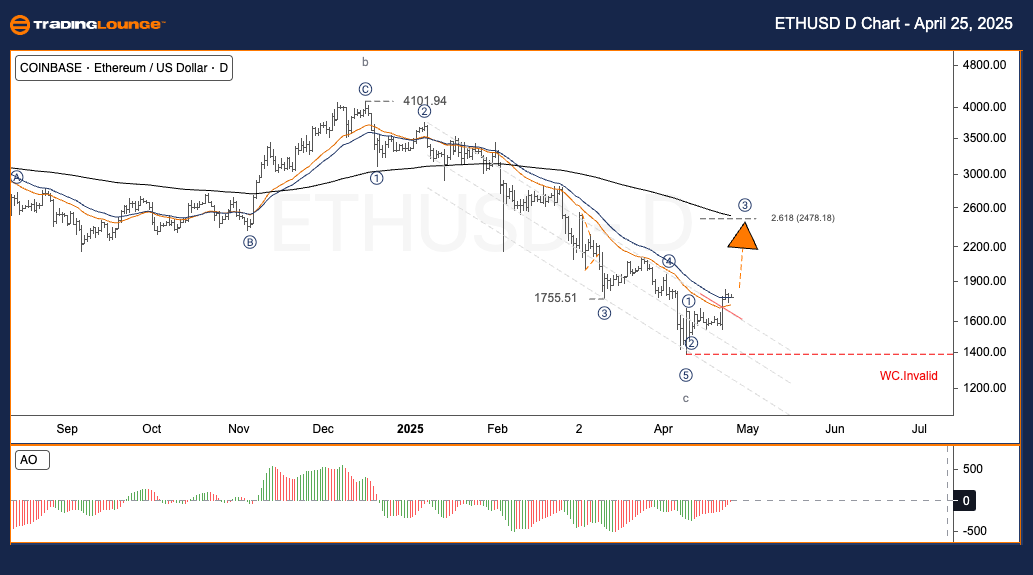

Ethereum/U.S. Dollar (ETHUSD) Elliott Wave Analysis – TradingLounge Daily Chart

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Next Higher Degree Direction: Upward

Wave Cancel Invalid Level: $1,380

Ethereum (ETH) Price Forecast & Elliott Wave Strategy – Daily Chart

Ethereum has completed its recent W–X–Y corrective phase as of March, with a confirmed low at $1,380. A new impulsive uptrend is forming, suggesting the start of wave (3) in a motive sequence. The current Elliott Wave analysis projects a bullish outlook, with a possible Fibonacci extension target near $2,478.18, representing the 261.8% level.

ETHUSD Swing Trading Plan (Daily Chart):

Entry Strategy: Watch for a minor pullback followed by bullish confirmation signals to initiate long positions.

Risk Management: Keep stops below the $1,380 invalidation level to manage downside risk.

Ethereum/U.S. Dollar (ETHUSD) Elliott Wave Analysis – TradingLounge H4 Chart

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Next Higher Degree Direction: Upward

Wave Cancel Invalid Level: $1,380

Ethereum (ETH) Intraday Forecast & Trading Strategy – H4 Chart

Ethereum’s H4 chart aligns with the larger bullish trend, continuing its progression from the March low at $1,380. The Elliott Wave pattern indicates a developing wave (3), supported by a clear impulse structure. If momentum sustains, ETH could aim for the Fibonacci extension at $2,478.18.

ETHUSD Swing Trading Plan (H4 Chart):

Entry Strategy: Monitor intraday retracements and wait for bullish setups to confirm continuation.

Risk Management: Use the $1,380 level as a critical invalidation zone for protective stops.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: UNIUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support