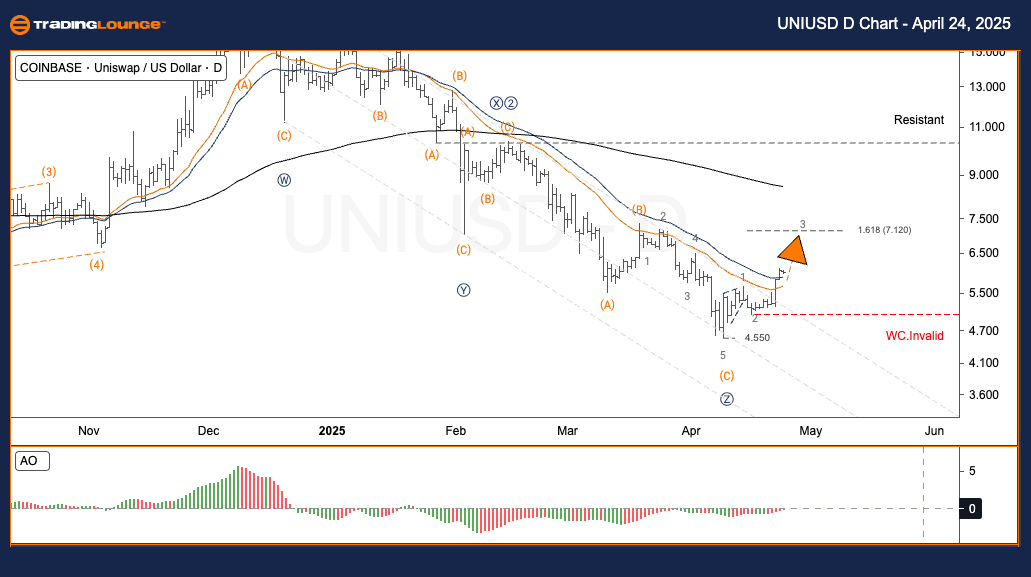

UNIUSD Elliott Wave Analysis – TradingLounge Daily Chart

UNI/USD (UNIUSD) Daily Chart Analysis

UNIUSD Elliott Wave Technical Analysis

Function: Trend following

Mode: Motive

Structure: Impulse

Current Position: Wave 3

Next Directional Bias: Higher-degree bullish wave

Invalidation Level: N/A

UNI/USD Daily Trading Strategy – Elliott Wave Outlook

UNI/USD has ended a multi-month corrective phase and is now transitioning into a strong bullish trend, supported by a clear Elliott Wave 1-2 pattern completion. Currently, Wave 3 is unfolding with increasing momentum. The low near 4.550 likely marks the end of a major Zigzag correction, laying the groundwork for a sustained upward impulse.

Trading Strategies

Approach – For Swing Traders (Short-Term):

Enter positions during consolidation phases using price action setups within the defined range.

Risk Management Tip:

A sustained move below the $5.00 support level would suggest the corrective structure may not be fully complete, signaling caution.

UNIUSD Elliott Wave Analysis – TradingLounge H4 Chart

UNI/USD (UNIUSD) H4 Chart Analysis

UNIUSD Elliott Wave Technical Analysis

Function: Trend following

Mode: Motive

Structure: Impulse

Current Position: Wave 3

Next Directional Bias: Higher-degree bullish wave

Invalidation Level: N/A

UNI/USD H4 Trading Strategy – Elliott Wave Forecast

On the H4 chart, UNI/USD is gaining bullish traction after concluding a prolonged correction. The 1-2 wave sequence appears complete, giving rise to a powerful Wave 3 move. The 4.550 level likely marked the end of the Zigzag correction, with bullish price structure now becoming more evident.

Trading Strategies

Approach – For Swing Traders (Short-Term):

Monitor for consolidation and bullish setups within the price range to initiate entries.

Risk Control Consideration:

A drop below the $5.00 level may signal the return of bearish pressure, invalidating short-term bullish scenarios.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: XRPUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support