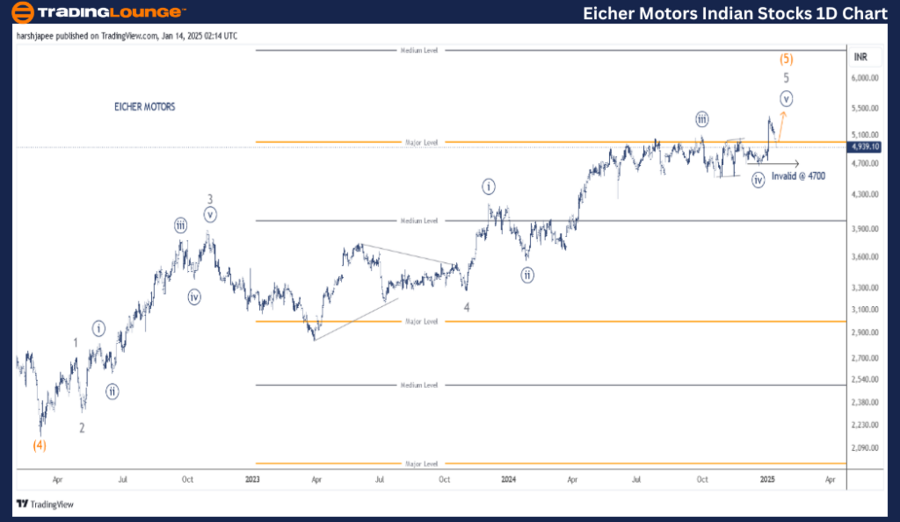

EICHER MOTORS – EICHERMOT Elliott Wave Technical Analysis (1D Chart)

EICHERMOT Elliott Wave Analysis

Larger Degree Trend: Higher (Intermediate Degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Minute Wave ((v)) Navy

Analysis Details:

The wave counts have been revised following a price action breakout above the 5300 zone. The stock appears to be unfolding Minute Wave ((v)) of Minor Wave 5, which lies within Intermediate Wave (5) Orange.

EICHER MOTORS Daily Chart: Technical Analysis and Potential Elliott Wave Counts

The daily chart indicates a strong upward trend, progressing toward a potential termination above the 5400 mark. However, if the stock declines below 4800 and then 4700, it could signal that Wave 5 of (5) concluded near the 5390-5400 zone.

- Intermediate Wave (4) ended around 2160 levels in March 2022.

- The subsequent rally unfolded a five-wave progression toward the 5390 level.

At this stage, the stock may be approaching a significant peak or might have already reached it around 5400 levels.

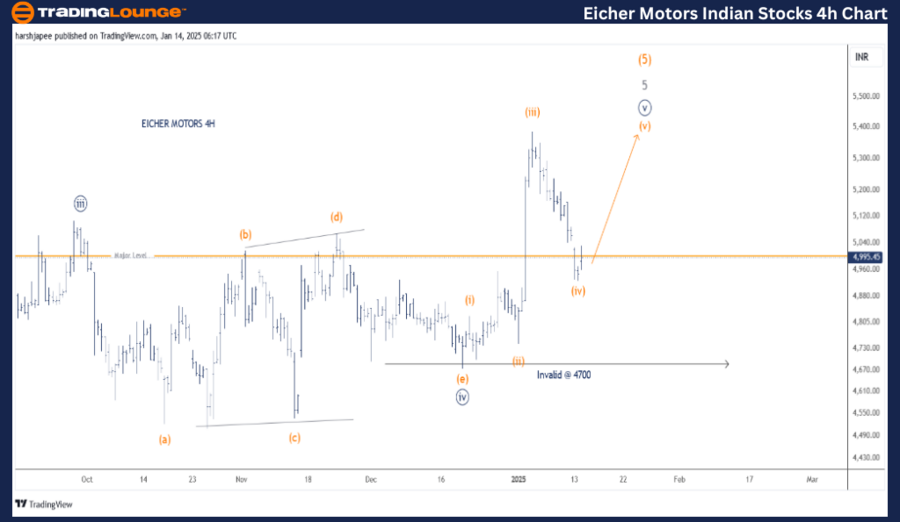

EICHER MOTORS – EICHERMOT Elliott Wave Technical Analysis (4H Chart)

Larger Degree Trend: Higher (Intermediate Degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Minute Wave ((v)) Navy

Analysis Details:

The wave counts were adjusted as the price crossed the 5300 zone, suggesting that the stock is forming Minute Wave ((v)) of Minor Wave 5 within Intermediate Wave (5) Orange. Minute Wave ((iv)) unfolded as a triangle, and Minute Wave ((v)) appears to be progressing as an impulse.

EICHER MOTORS 4H Chart: Technical Analysis and Potential Elliott Wave Counts

The 4H chart highlights sub-waves of Minor Wave 5 within Intermediate Wave (5):

- Minute Wave ((iii)) terminated around 5100 levels.

- Minute Wave ((iv)) unfolded as a potential triangle, likely terminating around 4700.

If this count holds, Minute Wave ((v)) could continue progressing upward, unfolding as an impulse. Prices should remain above the 4830-4840 zone to maintain the impulse structure. A drop below this level would confirm that the stock has already reached a peak near the 5390-5400 zone.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ADANI PORTS and SEZ – ADANIPORTS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

EICHER MOTORS is advancing within Minute Wave ((v)) of Minor Wave 5 of Intermediate Wave (5), with 4700 as the key invalidation point for this wave count.