ADANI PORTS and SEZ – ADANIPORTS (1D Chart) Elliott Wave Technical Analysis

ADANIPORTS Elliott Wave Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Impulse within larger degree correction

Position: Minute Wave ((iii)) Navy

Details:

- Minute Wave ((iii)) is progressing lower against the 1630 resistance level.

- Alternatively, Minor Wave 4 appears complete near the 1000 mark, indicating the potential for a higher push.

- Invalidation Point: 1630

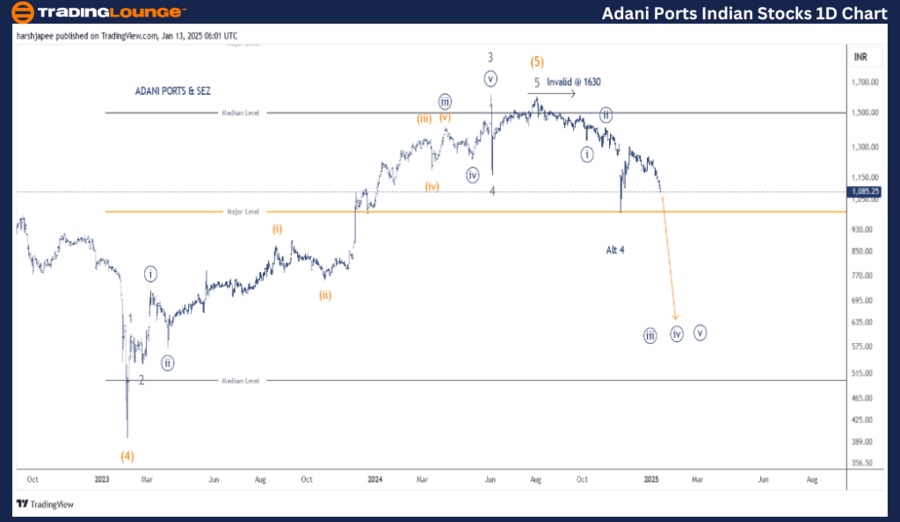

ADANI PORTS & SEZ Daily Chart Technical Analysis and Potential Elliott Wave Counts

ADANI PORTS & SEZ daily chart highlights a potential trend reversal below the 1630 high, marking the end of Intermediate Wave (5) Orange. The stock is progressing through Minute Wave ((iii)), with the possibility of targeting levels well below the 1000 mark.

- Intermediate Wave (4) Orange concluded near 395 in February 2023.

- The subsequent rally subdivided into five waves, with Wave 5 ending as a truncation near 1610.

- Minor Wave 3 extended to 1620 in June 2024, followed by a sharp correction in Minor Wave 4 around 1165.

- Minor Wave 5 truncated near 1610, after which the stock turned bearish.

For bearish momentum to remain dominant, prices should stay below the 1610-1630 range.

ADANI PORTS and SEZ – ADANIPORTS (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Impulse within larger degree correction

Position: Minute Wave ((iii)) Navy

Details:

- Minute Wave ((iii)) is progressing against the 1630 level.

- Alternatively, Minor Wave 4 seems complete near the 1000 level, hinting at the potential for an upward move.

- Invalidation Point: 1630

ADANI PORTS & SEZ 4H Chart Technical Analysis and Potential Elliott Wave Counts

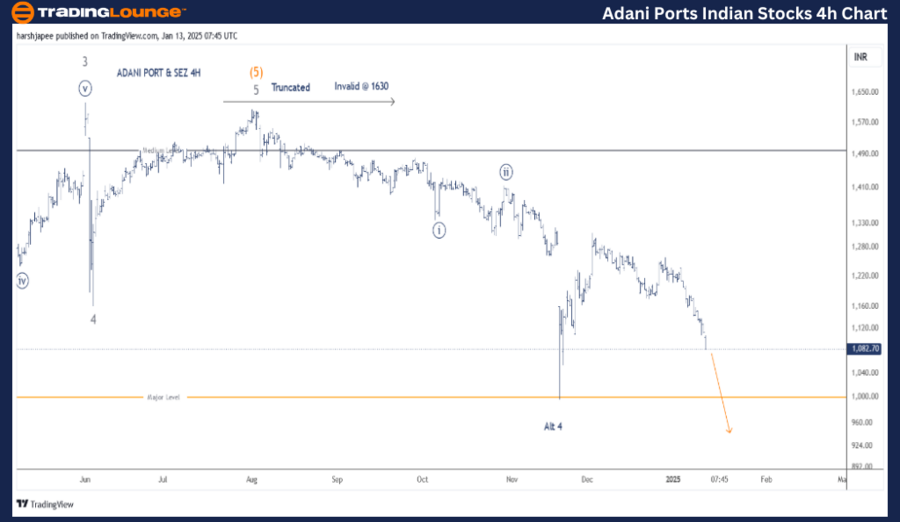

The 4H chart for ADANI PORTS & SEZ reflects the sub-waves after the Minor Wave 4 Grey correction, which ended near 1165 in June 2024. Minor Wave 5 ended as a truncation close to the 1610 mark, leading to a subsequent decline.

- Minute Wave ((i)) terminated near 1340, followed by an expanded flat Wave ((ii)) around 1420.

- The stock is currently in an extended Minute Wave ((iii)), which is showing signs of unfolding lower.

- A decisive break below the 1000 level would confirm the bearish extension and accelerate the downward move.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BHARAT Electronics Ltd. (BEL) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

ADANI PORTS & SEZ appears to be carving out Minute Wave ((iii)) of a corrective structure within a larger trend. Prices are trending lower with strong resistance in the 1610-1630 range. A significant move below the 1000 mark would reinforce bearish sentiment.