Corn Elliott Wave Analysis

Corn May Resume Bearish Trend Below 504.5

Corn is likely to continue its bearish trajectory from the April 2022 peak, following a corrective rebound from the August 2024 low. As long as the price remains under the critical resistance level of 504.5, the downward bias is expected to dominate in the short term.

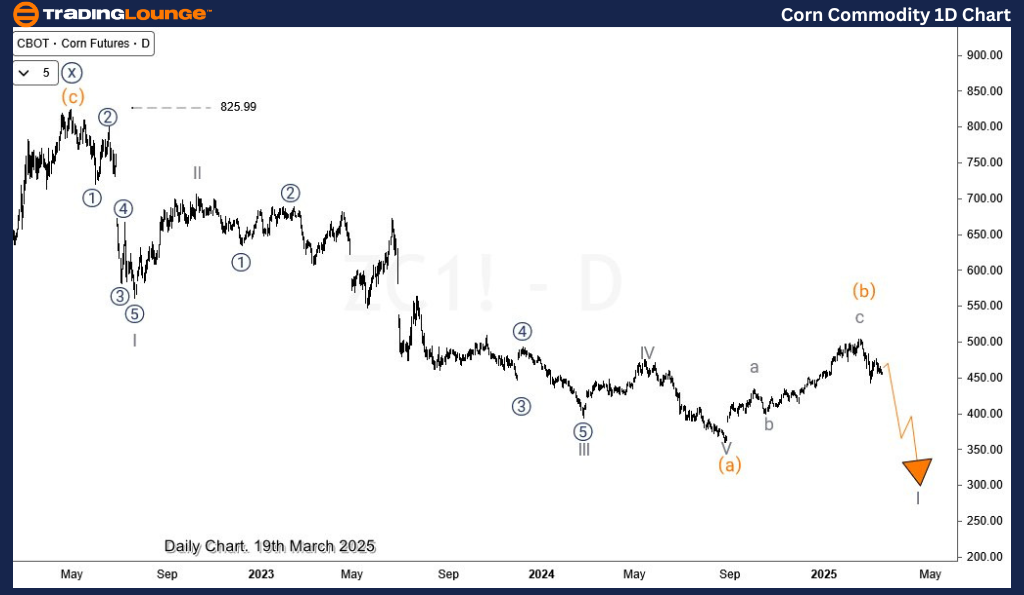

Corn Daily Chart Analysis

On the daily chart, Corn has been in a persistent downtrend since reaching a high of $826 in April 2022, plunging to $359 in August 2024. This decline followed a five-wave bearish impulse, which we can identify as wave (a) of the supercycle degree.

A corrective wave (b) then retraced part of the losses, pushing prices toward $504. If this correction has concluded, Corn is now set to begin wave (c) of the supercycle degree, which could drive prices down toward $220 in the coming months.

However, an alternate scenario remains where wave (b) could extend further in a double correction before the bearish momentum resumes.

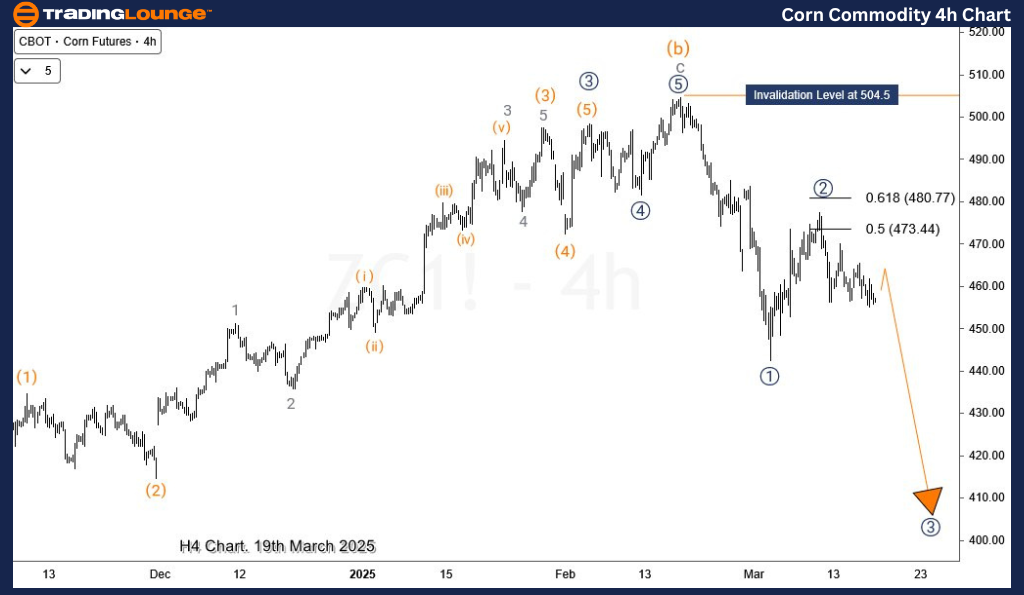

Corn H4 Chart Analysis

On the H4 timeframe, the internal structure of wave I of (c) is forming. The first bearish leg, labeled wave ((1)), concluded on March 4, 2025. A subsequent corrective rally as wave ((2)) has reached the key Fibonacci retracement zone.

As long as wave ((1))'s low holds, there is still potential for wave ((2)) to extend higher toward $477 before the downtrend resumes. If Corn breaks below wave ((1))'s low, further downside movement is expected, targeting the 417-394 zone in the short term.

This analysis follows the Elliott Wave framework, highlighting potential price movements based on wave structures. Keep an eye on key resistance at 504.5 and Fibonacci retracement levels to confirm the next market direction.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: Coffee Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support