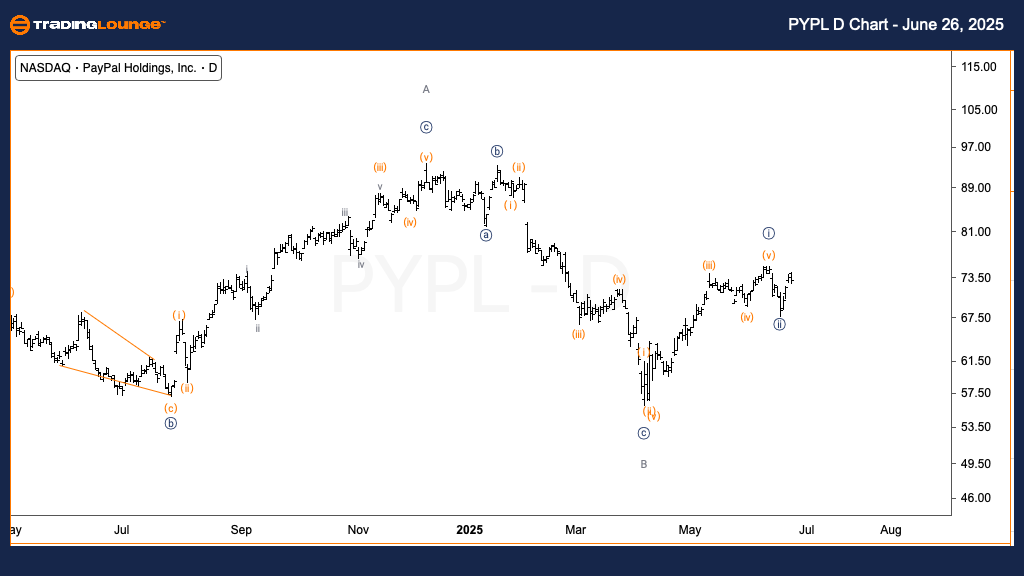

PayPal Holdings Inc. (PYPL) Elliott Wave Forecast – Trading Lounge Daily Chart

PayPal Holdings Inc. (PYPL) Daily Chart Forecast

PayPal Holdings Inc. (PYPL) Elliott WaveTechnical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave C of (B)

Direction: Upside in Wave C

Details: The current Elliott Wave structure for PayPal (PYPL) suggests ongoing bullish momentum in Wave C. Pullbacks are unfolding in clear three-wave corrections, characteristic of continuation patterns within larger corrective phases, rather than indicating trend reversals. This supports a positive short-term outlook for the stock.

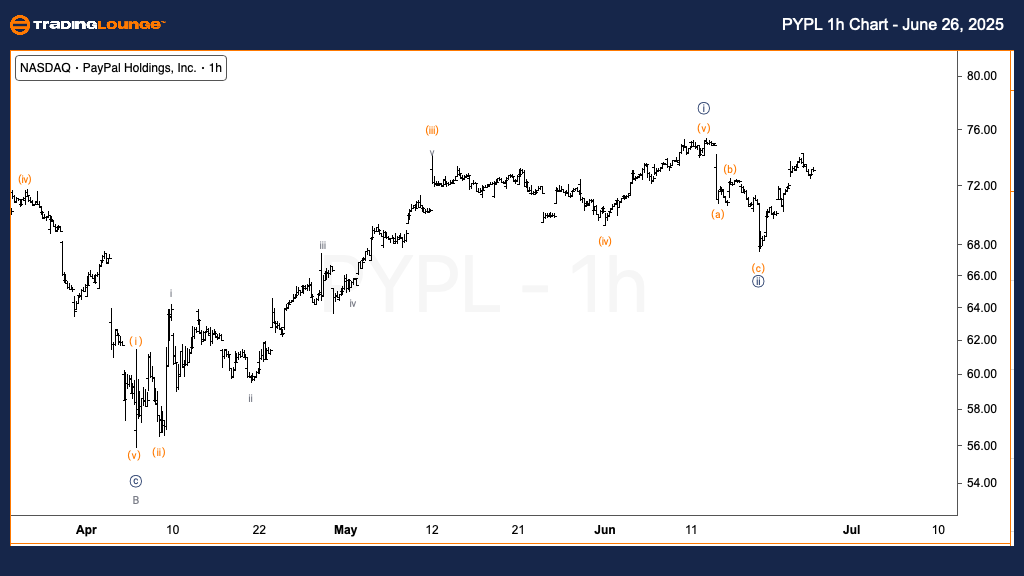

PayPal Holdings Inc. (PYPL) Elliott Wave Forecast – Trading Lounge 1-Hour Chart

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of C

Direction: Upside in Wave {iii}

Details: The 1-hour Elliott Wave chart for PYPL shows that Wave {ii} appears complete, with upward price movement initiating Wave {iii}. An alternative wave count could place this advance within Wave (v) of {i}, implying a minor consolidation before continued upside. Short-term bullish confirmation will rely on how price reacts near key resistance levels and whether momentum remains strong.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Dell Technologies Inc. (DELL) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

This comprehensive Elliott Wave analysis of PayPal Holdings Inc. (PYPL) integrates both daily and intraday timeframes to refine market perspective. The daily chart positions PYPL within Wave C of a larger corrective Wave (B), suggesting bullish potential. The 1-hour chart aligns this by identifying an impulsive move in Wave {iii}, or a possible extension in Wave (v), highlighting ongoing upward strength.