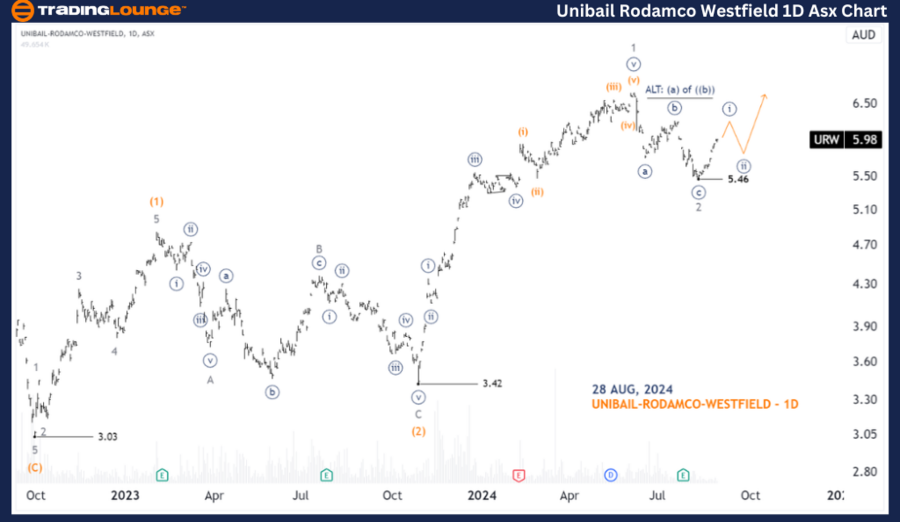

ASX: URW Elliott Wave Analysis TradingLounge (1D Chart)

Greetings, today's Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) with UNIBAIL-RODAMCO-WESTFIELD (URW). It appears that URW may have completed wave 2-grey, and wave 3-grey is beginning to unfold, pushing the price higher.

ASX: UNIBAIL RODAMCO WESTFIELD URW Elliott Wave Technical Analysis

ASX: UNIBAIL RODAMCO WESTFIELD (URW) 1D Chart (Semilog Scale) Analysis

-

Function: Major trend (Minor degree, grey)

-

Mode: Motive

-

Structure: Impulse

-

Position: Wave ((i))-navy of Wave 3-grey

-

Details: Wave 3-grey is currently unfolding with an upward trajectory. This wave is subdividing into wave ((i))-grey, which is expected to complete soon. Afterward, wave ((ii))-grey may unfold, leading to a minor pullback. Subsequently, wave ((iii))-navy is likely to push higher. A Long Trade Setup will be considered once wave ((ii))-navy concludes.

-

Invalidation point: 5.46

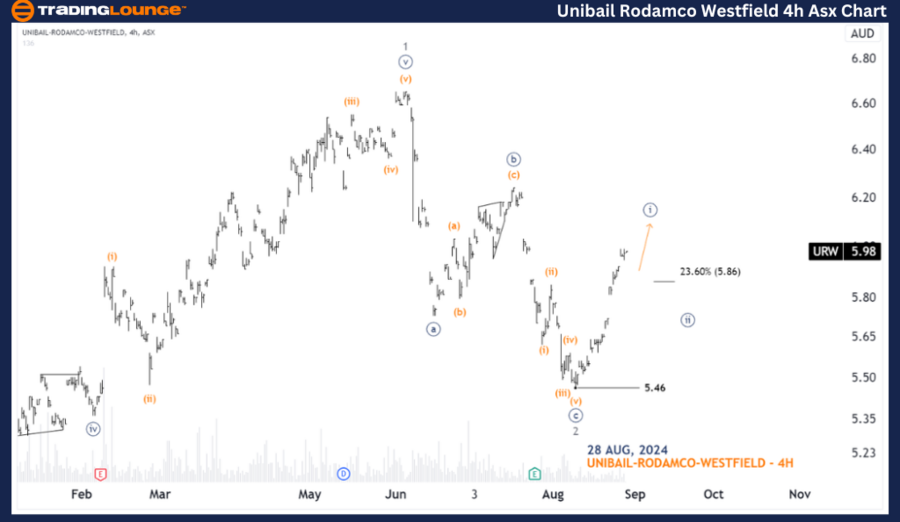

ASX: URW Elliott Wave Analysis TradingLounge (4-Hour Chart)

ASX: UNIBAIL-RODAMCO-WESTFIELD (URW) Elliott Wave Technical Analysis

ASX: UNIBAIL-RODAMCO-WESTFIELD (URW) 4-Hour Chart Analysis

-

Function: Major trend (Minute degree, navy)

-

Mode: Motive

-

Structure: Impulse

-

Position: Wave ((i))-navy

-

Details: Following the low at 5.46, wave 2-grey has concluded, and wave 3-grey is actively pushing the price higher. This wave is subdividing into wave ((i))-navy, which has already moved significantly upward and is expected to complete soon. The dip below 5.86 indicates that wave ((ii))-navy is unfolding, potentially causing a brief decline. Eventually, wave ((iii))-navy is anticipated to push higher. To maintain this outlook, the price must stay above 5.46. A Long Trade Setup will be targeted once wave ((ii))-navy concludes.

-

Invalidation point: 5.46

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: REA GROUP LTD – REA Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis provides a detailed forecast of current and short-term trends for ASX: UNIBAIL-RODAMCO-WESTFIELD (URW). By offering specific price points as validation or invalidation signals for our wave count, we aim to boost the confidence in our analysis. Combining these insights allows us to deliver an objective and professional view of the market trends, helping readers to capitalize on opportunities effectively.