Elliott Wave Analysis TradingLounge Daily Chart, 20 October 23,

NEO/U.S. dollar(NEOUSD)

NEOUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Double Corrective

Position: Wave (Y)

Direction Next higher Degrees: Wave ((B)) of Flat

Wave Cancel invalid Level: 5.96

Details: The corrective of wave (Y) Likely move down to 5.94.

NEO/U.S. dollar(NEOUSD)Trading Strategy: A decline below 7.08 makes the triangle complete at 7.68, also the price below the MA200 Line, Overview still is a downtrend, and the price move to wave ((5)) which a last wave before change a trend

NEO/U.S. dollar(NEOUSD)Technical Indicators: The price is below the MA200 indicating a downtrend, RSI is a Bearish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

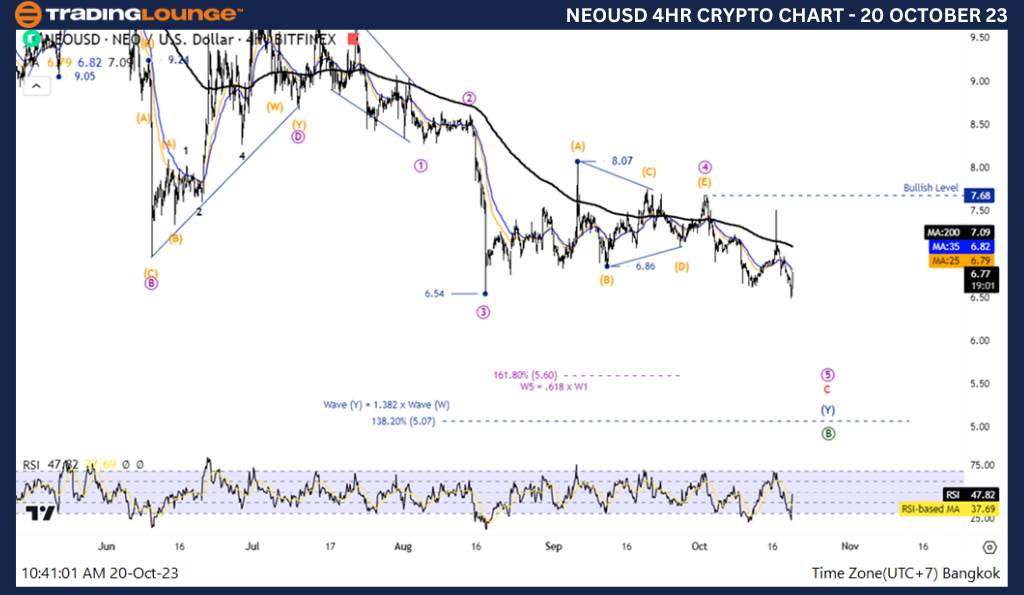

Elliott Wave Analysis TradingLounge 4H Chart, 20 October 23,

NEO/U.S. dollar(NEOUSD)

NEOUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Triangle

Position: Wave (E)

Direction Next higher Degrees: Wave (4) of Impulse

Wave Cancel invalid Level:

Details: Weve 4 may be complete and the ptice decline again in wave 5

NEO/U.S. dollar(NEOUSD)Trading Strategy: A decline below 7.08 makes the triangle complete at 7.68, also the price below the MA200 Line, Overview still is a downtrend, and the price move to wave ((5)) which a last wave before change a trend

NEO/U.S. dollar(NEOUSD)Technical Indicators: The price is below the MA200 indicating a downtrend, RSI is a Bearish Momentum.