NEWS CORPORATION – NWS Elliott Wave Technical Analysis

Greetings,

Today’s Elliott Wave forecast offers a comprehensive breakdown of NEWS CORPORATION – NWS, traded on the Australian Stock Exchange (ASX) under ticker ASX:NWS. Based on our wave analysis, ASX:NWS is currently undergoing a corrective wave pattern. Typically, such corrective movements set the stage for new Motive waves, which may create upcoming bullish trading opportunities. This report provides a technical deep dive into that evolving scenario.

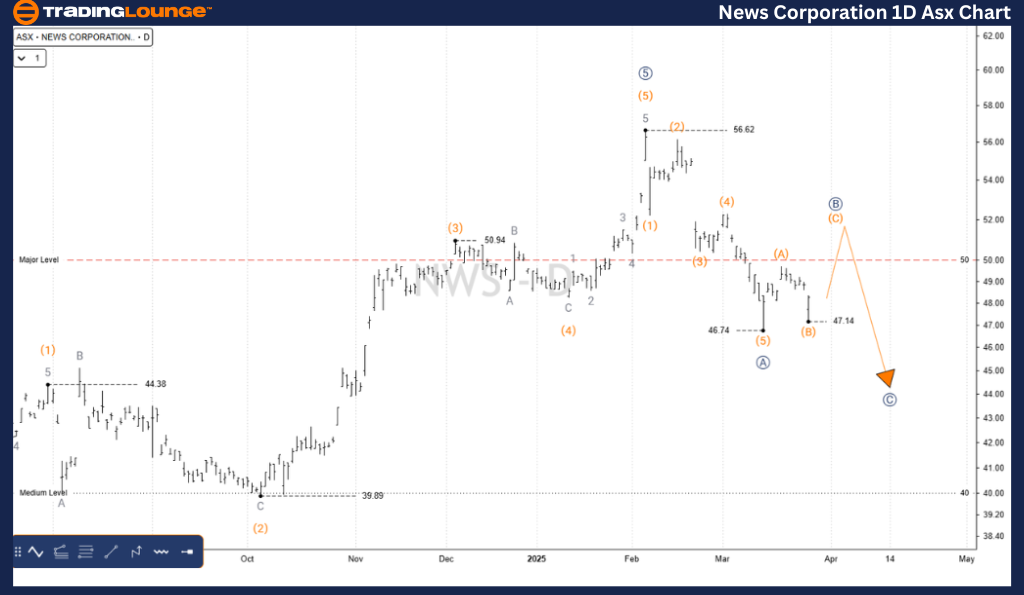

NEWS CORPORATION – NWS 1D Chart (Semilog Scale) Analysis

Function: Major trend (Primary degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave (C) - orange of Wave ((B)) - navy

Details:

ASX:NWS recently completed a strong five-wave impulse rally, peaking around 56.62 AUD. Following this top, the stock entered a corrective ABC pattern (navy), which may drive prices downward in the near term. Our projection estimates a target support zone near 39.89 AUD.

Invalidation point: 47.14 AUD

NEWS CORPORATION – NWS Elliott Wave Technical Analysis | TradingLounge 4-Hour Chart

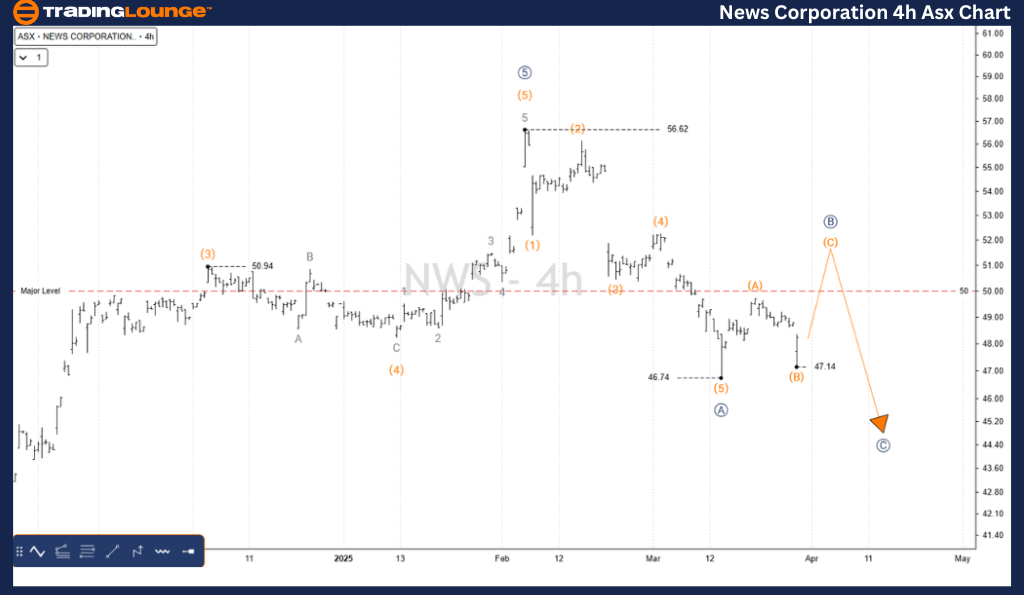

NEWS CORPORATION – NWS 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (A) - orange of Wave ((B)) - navy

Details:

Focusing on recent price action, after the stock hit the high of 56.62 AUD, Wave ((A)) - navy completed around 46.74 AUD. The market is currently tracing Wave ((B)) - navy in a Zigzag correction pattern (A)(B)(C) - orange. Short-term gains are possible during this bounce before a downward Wave ((C)) resumes the corrective move.

Invalidation point: 47.14 AUD

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: ASX: BLOCK, INC – XYZ Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This updated Elliott Wave analysis for NEWS CORPORATION – ASX:NWS outlines key market trends and short-term price dynamics. By identifying key support and resistance zones, along with invalidation points, traders can better manage risk and align strategies with current wave formations. Our goal is to provide precise and actionable Elliott Wave trading signals tailored for today’s market.