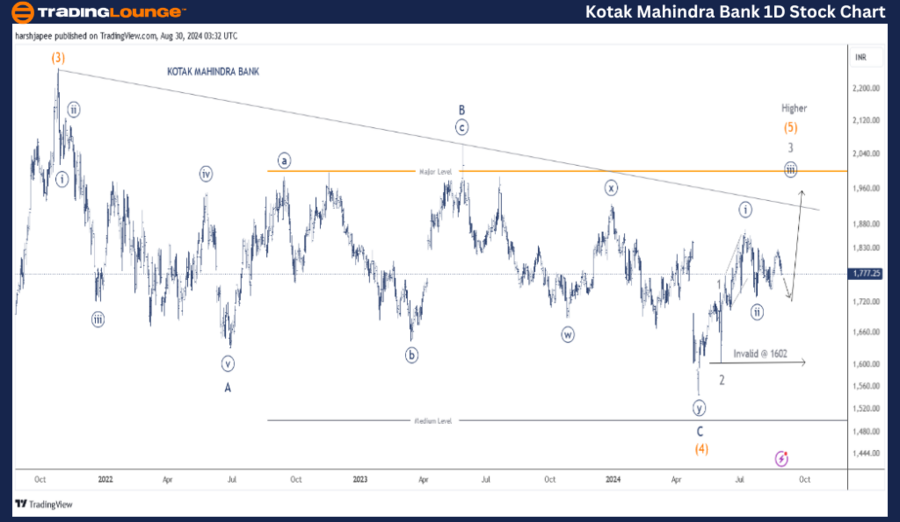

Kotak Mahindra Bank, KOTAKBANK Elliott Wave Analysis 1D Chart

Kotak Mahindra Bank (KOTAKBANK ) Day Chart Analysis

-

Function: Larger Degree Trend Higher (Intermediate degree, orange)

-

Mode: Motive

-

Structure: Impulse

-

Position: Minute Wave ((ii)) Navy

-

Details: Minute Wave ((iii)) is developing within Minor Wave 3 Grey of Intermediate Wave (5) Orange, with 1602 as the critical support level.

- Invalidation point: 1602

Kotak Mahindra Bank Elliott Wave Technical Analysis and Outlook

The Kotak Mahindra Bank daily chart suggests an ongoing uptrend, with Minute Wave ((iii)) Navy potentially advancing towards the 2100 level, provided prices remain above the 1600 support zone. Currently, the stock is consolidating, but a breakout above 1830 could trigger a stronger upward momentum.

The bank's stock has experienced a significant correction since the October 2021 peak around 2250. The Minor Wave A-B-C correction unfolded down to the 1500 lows observed in May 2024. Now, Intermediate Wave (5) is in progress, indicating a possible continuation of the upward trend.

Although Kotak Mahindra Bank has underperformed compared to the Nifty 50 Index, which is at an all-time high, a bullish acceleration could occur as Minor Wave 3 progresses within Intermediate Wave (5) Orange.

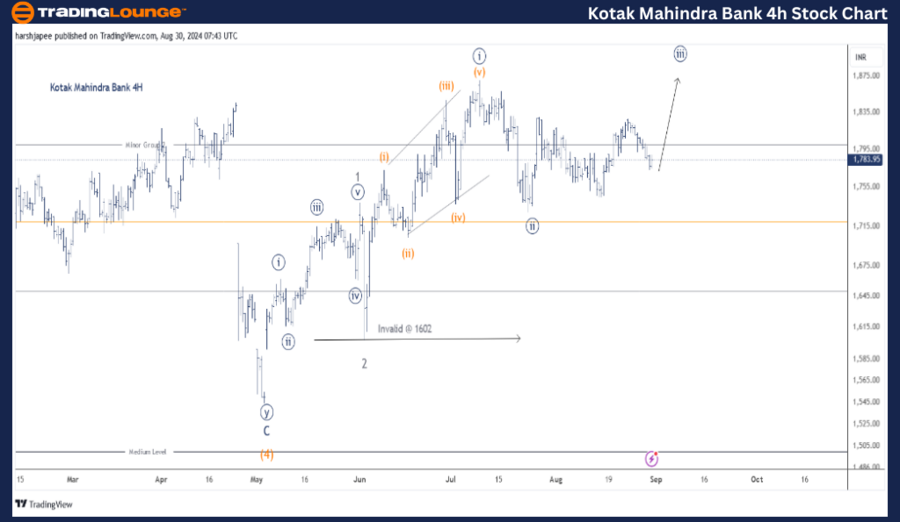

Kotak Mahindra Bank, KOTAKBANK Elliott Wave Analysis 4H Chart

Kotak Mahindra Bank (KOTAKBANK ) 4-Hour Chart Analysis

Kotak Mahindra Bank Stock Technical Analysis

-

Function: Larger Degree Trend Higher (Intermediate degree, orange)

-

Mode: Motive

-

Structure: Impulse

-

Position: Minute Wave ((ii)) Navy

-

Details: Minute Wave ((iii)) is developing within Minor Wave 3 Grey of Intermediate Wave (5) Orange, with 1602 as the key support level. Minute Wave ((ii)) may end as a triangle.

- Invalidation point: 1602

Kotak Mahindra Bank Stock Analysis and Elliott Wave Scenarios

The 4H chart provides a detailed view of the sub-waves since the 1540 low formed in May 2024. An impulse wave completed Minor Wave 1 Grey around 1735, followed by a sharp correction that formed Minor Wave 2.

Minor Wave 3 is likely subdividing into Minute Waves ((i)) and possibly ((ii)), with the latter forming near the 1865 and 1720 levels, respectively. Additionally, there is a possibility that Minute Wave ((ii)) could evolve as a triangle before it concludes.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: State Bank of India Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Kotak Mahindra Bank is trending higher within Minute Wave ((iii)) Navy of Minor Wave 3 Grey as Intermediate Wave (5) Orange unfolds. The bullish outlook remains valid as long as the price stays above the 1602 level.