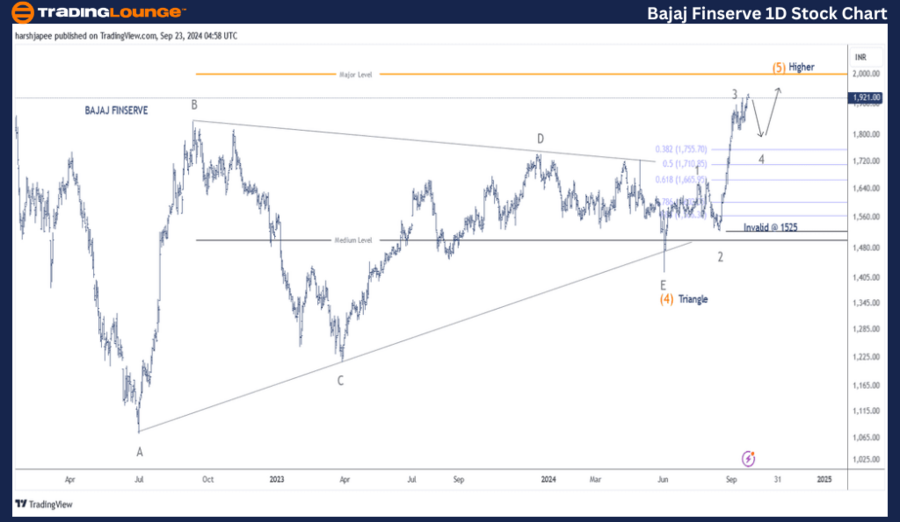

BAJAJ FINSERVE – BAJAJFINSV Stock Analysis (1D Chart)

BAJAJ FINSERVE Elliott Wave Technical Analysis

Function: Larger Trend Higher (Intermediate degree Wave (5), Orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 3 of Intermediate Wave (5)

Details: Intermediate Wave (4) Orange completed as a triangle. Minor Wave 3 Grey of Intermediate Wave (5) is nearing completion around the 1920-1930 level. If this analysis holds, we may see a corrective Wave 4 before prices move higher. Alternatively, if Wave 4 has already completed above 1800, Wave 5 Grey could be progressing now.

Invalidation point: 1523

Bajaj Finserve Daily Chart Technical Analysis and Elliott Wave Projections:

Bajaj Finserve's daily chart points towards a continuation of the uptrend, with the potential for Intermediate Wave (5) Orange to reach the 2100 mark. The nearest support level is around 1525, which coincides with the termination of Minor Wave 2 Grey.

Since July 2022, Bajaj Finserve has been forming a triangle pattern for Intermediate Wave (4) Orange, following lows around the 1075 mark. This triangle, subdivided into Minor Waves A through E, concluded near the 1420 level on June 4, 2024.

Intermediate Wave (5) Orange began unfolding after that, with Minor Waves 1, 2, and 3 reaching completion around 1660, 1525, and the 1920-1930 range, respectively. If the wave count is accurate, a sharp corrective Wave 4 could unfold before the final upward move.

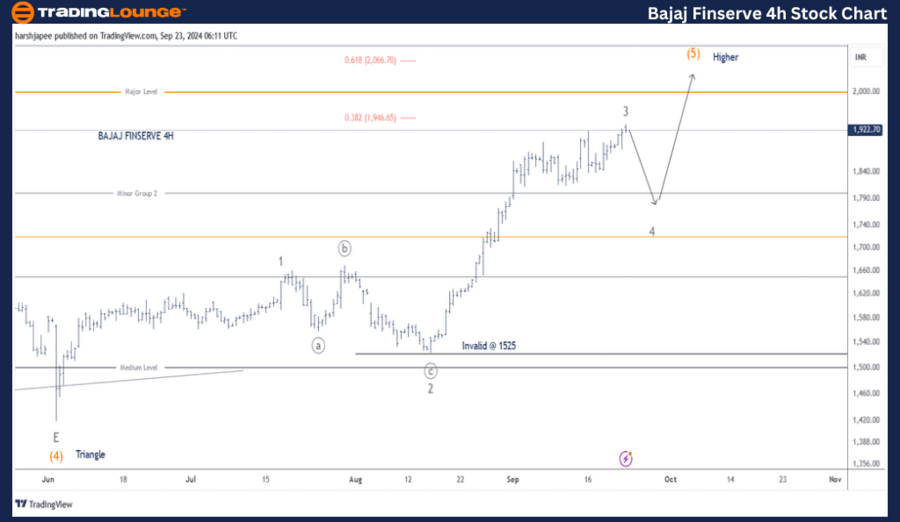

BAJAJ FINSERVE – BAJAJFINSV Elliott Wave Analysis (4H Chart)

Function: Larger Trend Higher (Intermediate degree Wave (5), Orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 3 of Intermediate Wave (5)

Details: Intermediate Wave (4) Orange has completed as a triangle. Minor Wave 3 Grey of Intermediate Wave (5) appears complete near the 1920-1930 level. If this is correct, we may expect a corrective Wave 4, followed by further upward movement. Alternatively, Wave 4 may already be complete above 1800, with Wave 5 Grey advancing. A potential target is around 2090.

Invalidation point: 1523

Bajaj Finserve 4H Chart Technical Analysis and Elliott Wave Projections:

The 4H chart shows the wave progression since the completion of Intermediate Wave (4) Orange near the 1420 level. Notably, Minor Wave 2 Grey unfolded as an expanded flat, ending around 1525, while Minor Wave 3 rallied to highs of 1937.

If the wave count holds, we could see a decline into the 1770-1780 range before prices push higher towards the 2100 level, marking the completion of Wave 5 Grey. Moving forward, prices should remain above 1525.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: DR REDDY'S LABORATORIES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Bajaj Finserve is in the process of unfolding Minor Wave 4 Grey, potentially finding support around the 1770-1780 range before resuming its upward movement.