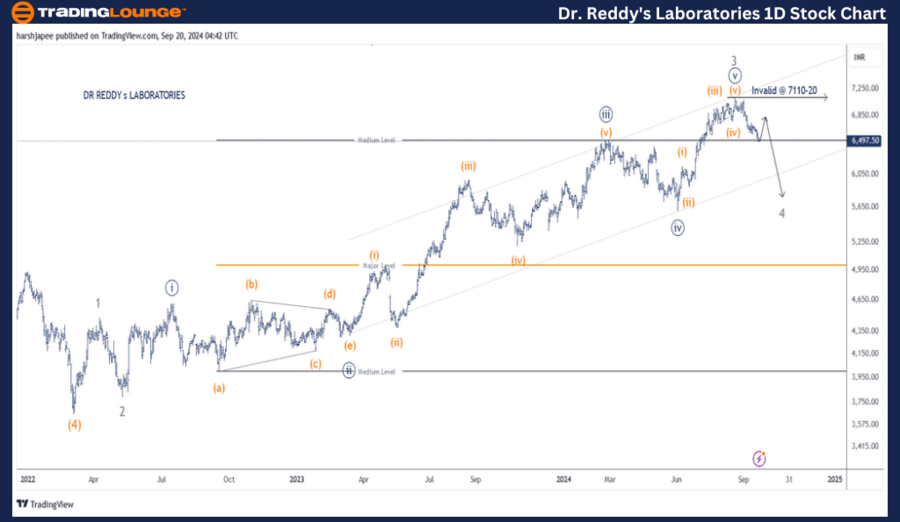

DR REDDY'S LABORATORIES – DRREDDY (1D Chart) Elliott Wave Technical Analysis

DRREDDY Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Zigzag/Flat Unfolding

Position: Impulse drop complete at Minuette Degree (not labelled)

Details: The Minuette impulse wave appears complete within Minor Wave 4 Grey, near the 7110-20 level. If accurate, a slight pullback higher is expected before the price turns lower again.

Invalidation Point: 7110-20

Dr Reddy's Laboratories Daily Chart: Technical Analysis and Elliott Wave Counts

Dr Reddy's Laboratories daily chart suggests a potential correction is underway, likely progressing towards the 5600 level as Minor Wave 4 unfolds. Minor Wave 3 Grey seems to have completed at 7110, which was recorded on August 21, 2024. A zigzag corrective pattern appears to be forming against this high.

In March 2022, Dr Reddy’s registered a low around 2645, marking the termination of Intermediate Wave (4) Orange. From that point, Intermediate Wave (5) has been advancing, with Minor Waves 1 through 3 already completed. Minute Wave ((iii)) has extended, ending around the 6500-10 range.

If this count holds, Minor Wave 4 is likely advancing towards the 5600-10 range, aligning with the previous fourth wave of a lower degree against the 7110 high. Alternatively, if Minute Wave ((v)) is still progressing within Minor Wave 3, the price could push beyond the 7110-20 level.

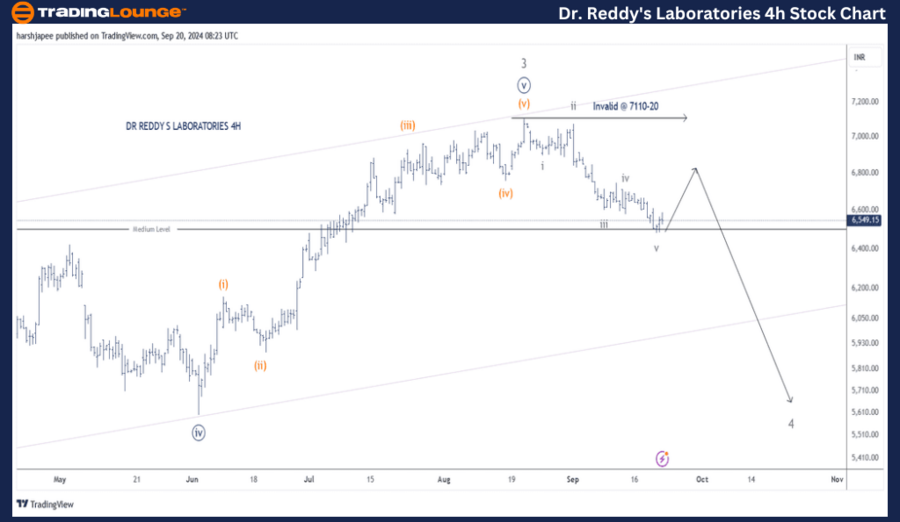

DR REDDY'S LABORATORIES – DRREDDY (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Zigzag/Flat Unfolding

Position: Impulse drop complete at Minuette Degree (not labelled)

Details: The Minuette impulse wave seems to have completed within Minor Wave 4 Grey, around the 7110-20 range. This could represent Wave (a) of a potential Zigzag. If confirmed, expect a slight pullback higher before the price turns lower again.

Invalidation Point: 7110-20

Dr Reddy's Laboratories 4H Chart: Technical Analysis and Elliott Wave Counts

The 4H chart for Dr Reddy's Laboratories highlights sub-waves within Minute Wave ((v)) of Minor Wave 3. The impulse wave may have completed near the 7110-20 level. The subsequent decline towards 6490 appears as an impulse at the Minuette degree.

If this analysis is accurate, prices should see a brief upward move towards 6790 to complete a corrective wave before resuming a downtrend.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TATA STEEL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Dr Reddy's Laboratories is currently moving lower within a counter-trend zigzag pattern, with Minor Wave 4 Grey expected to terminate near the 5600 level. Once this correction completes, the larger degree uptrend is likely to resume, aiming towards the 7110-20 zone.