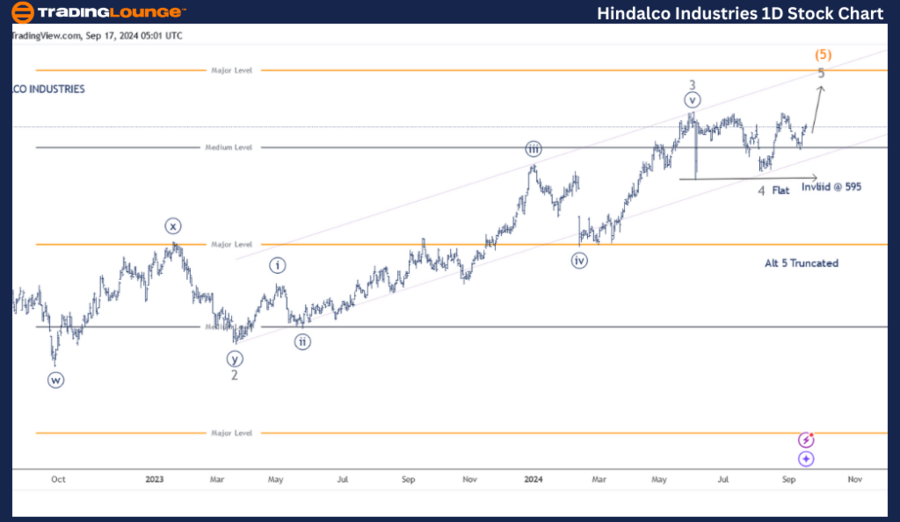

Hindalco Industries – HINDALCO Elliott Wave Analysis (1D Chart)

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 5 (Grey)

Details: Minor Wave 5 Grey is progressing higher within Intermediate Wave (5) against the 595 level. No changes in structure.

Invalidation Point: 595-600

HINDALCO Elliott Wave Technical Analysis

Hindalco Industries Daily Chart Technical Analysis and Elliott Wave Counts

The daily chart of Hindalco Industries suggests the stock is moving higher, aiming to complete Minor Wave 5 Grey and Intermediate Wave (5) Orange beyond the 720 mark. Alternatively, Wave 5 might have completed truncated near 715.

The stock has been rising within Intermediate Wave (5) Orange since June 2022, following a low near 310, which marked the end of Wave (4). Minor Waves 1 through 3 appear complete, with the third wave showing an extended move.

Minor Wave 4 ended as a flat just above the 595 level, and now, the final wave is pushing higher. If the proposed Elliott Wave structure holds, the stock should remain above 595 and continue its upward trend. A break below this level would require a reevaluation of the wave counts.

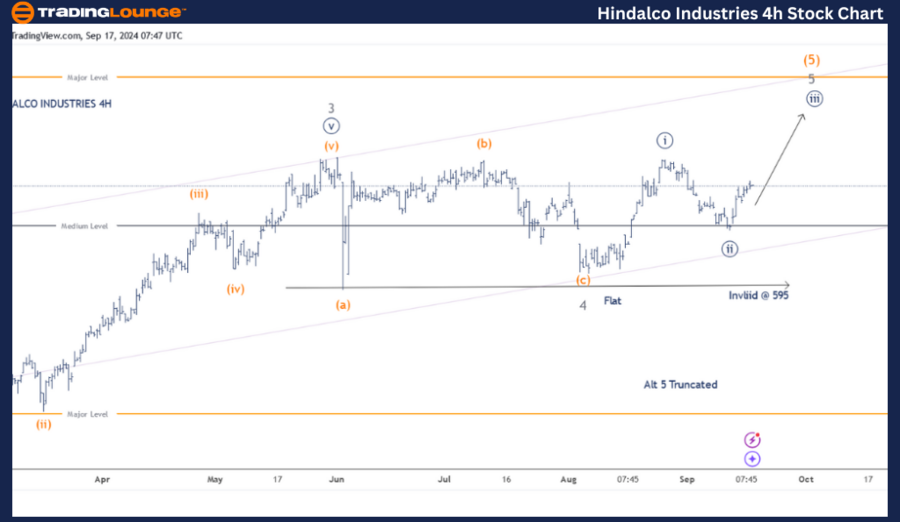

HINDALCO INDUSTRIES – HINDALCO Elliott Wave Analysis (4H Chart)

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 5 (Grey)

Details: Minor Wave 5 Grey is advancing within Intermediate Wave (5) against the 595 level. Alternatively, Wave 5 may have truncated around 715.

Invalidation Point: 595-600

Hindalco Industries 4H Chart Technical Analysis and Elliott Wave Counts

The 4H chart of Hindalco Industries illustrates the development of sub-waves within Minute Wave ((v)) of Minor Wave 3 Grey. Minor Wave 4 Grey might have completed as a running flat above the 600 mark. If accurate, Minor Wave 5 is currently in progress, with Minute Waves ((i)) and ((ii)) likely complete.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Bharti Airtel Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Hindalco Industries is advancing within Minute Wave ((iii)) of Minor Wave 5 Grey, moving higher against the 595 level.