ASX: BLOCK, INC – XYZ (SQ2) Elliott Wave Technical Analysis

Greetings,

Today’s Elliott Wave analysis provides an updated technical outlook on the Australian Stock Exchange (ASX) stock, BLOCK, INC – XYZ (SQ2).

We observe that ASX:XYZ (SQ2) shows strong potential for an upward move within wave (3) – orange. However, for this bullish Elliott Wave scenario to be confirmed, the share price must stay above the critical invalidation point for approximately 5–7 trading days.

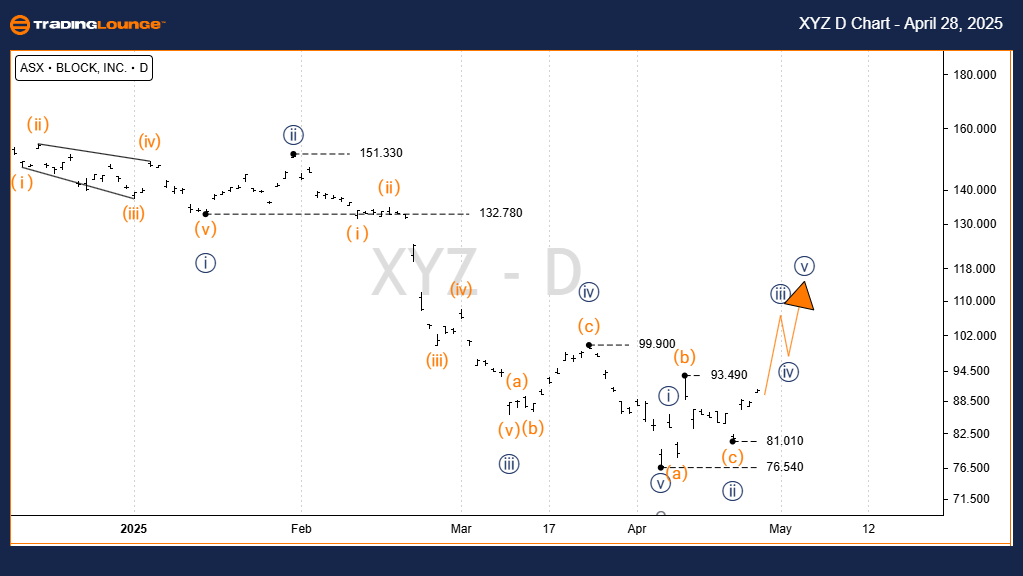

ASX: BLOCK, INC – XYZ (SQ2) Elliott Wave Analysis - TradingLounge 1D Chart

ASX: BLOCK, INC – XYZ (SQ2) 1D Chart (Semilog Scale)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ii)) – Navy of Wave (3) – Orange

Details:

Wave (2) – Orange appears to have completed, suggesting that wave (3) – Orange is now developing higher.

A clear breakout above $93.49 would validate a bullish Elliott Wave setup, with upside price targets extending towards the $110 level.

Invalidation Point: 76.54

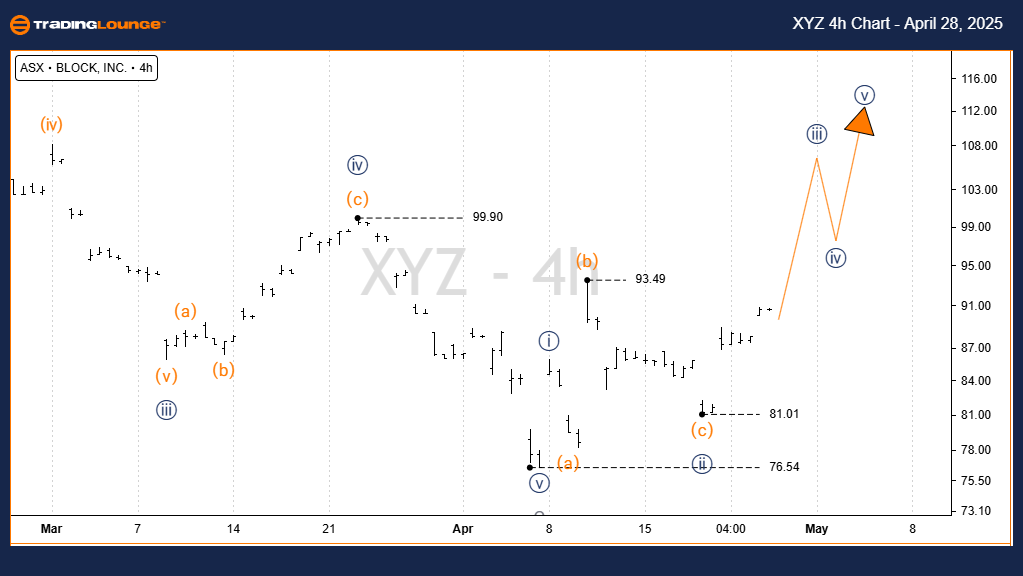

ASX: BLOCK, INC – XYZ (SQ2) 4-Hour Chart Elliott Wave Analysis

Function: Major Trend (Minute Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((I)) – Navy of Wave (3) – Orange

Details:

On the 4-hour chart, from the low at 76.54, wave (3) – Orange is progressing to the upside.

Within this move, a complete navy sequence from ((i)) to ((v)) is unfolding.

The bullish Elliott Wave perspective remains intact as long as the price holds above 76.54.

Invalidation Point: 76.54

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWMONT CORPORATION Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave technical analysis and short-term forecast for ASX: BLOCK, INC – XYZ (SQ2) are designed to offer traders and investors a clear, objective view of the market structure.

We highlight key validation and invalidation points to reinforce confidence in the Elliott Wave count.

By combining technical analysis with real-time market movements, we provide actionable insights to support smarter trading decisions.